$1.6 Billion in Bitcoin, Ethereum Options Expire—Price Impact?

The crypto market ended today with $1.62 billion in Bitcoin and Ethereum options contracts. This expiring option volume results in short-term price volatility, which can affect traders' profitability.

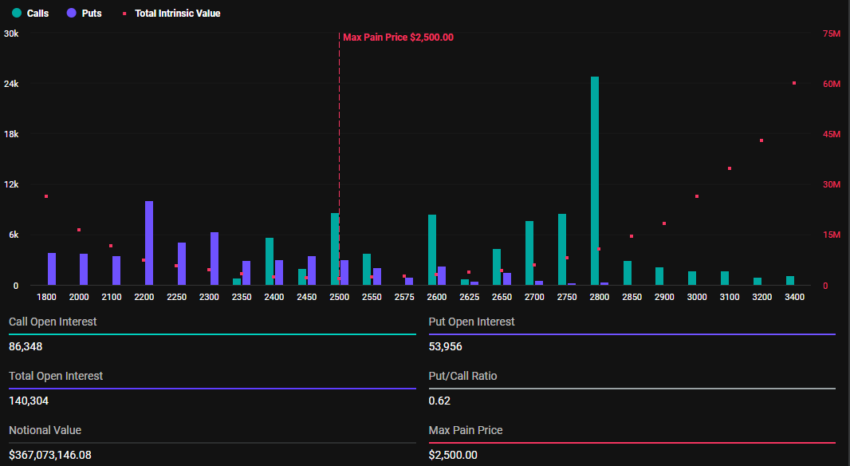

Specifically, expiring Bitcoin (BTC) options are valued at $1.25 billion, while Ethereum (ETH) is valued at $367 million.

Bitcoin and Ethereum holders brace for volatility

According to data from Deribit, 18,583 Bitcoin options will expire today, up slightly from the 18,271 contracts that were liquidated last week. Options contracts expiring today have a call to call ratio of 0.86 and a maximum pain point of $64,000.

Read more: Introduction to Crypto Options Trading.

On the other hand, 140,320 Ethereum options contracts expire today, which is significantly less than last week. It expires at $2,500 with a call ratio of 0.62 and a maximum pain point.

These data indicate a general latent sentiment for both contracts. Bitcoin, currently trading at $67,661; It is above the maximum pain point. Similarly, Ethereum traded hands at $2,617 at the time of writing, well above its strike price.

As the options expire, Bitcoin and Ethereum prices are expected to approach their respective peak pain points. This means that the values of BTC and ETH may fall as the smart money pushes the price to the “extremely painful” level. This is based on Max Payne's theory, which predicts that option prices will converge around strike prices when a large number of contracts – calls and similar – end up being worthless.

The strategy causes option buyers to lose the maximum value, hence the implied bearish feeling. However, the pressure on BTC and ETH prices may ease after Friday 08:00 UTC, when Deribit adjusts its contracts.

Read More: 9 Best Crypto Options Trading Platforms

Meanwhile, analysts say that Bitcoin and the broader market are looking for a strong push that could see the leading cryptocurrency regain its high above $73,777. From a macroeconomic perspective, tailwinds are nowhere near visible. However, CoinShares researchers say US elections remain a key driver of current market sentiment.

“…Investor decisions are likely to be more influenced by the upcoming US election than monetary policy views. “This trend was largely offset by stronger-than-expected economic data slowing outflows, but the recent US vice-presidential debate and a shift in voting against Republicans on expectations that digital assets will further boost earnings and prices,” the latest report said.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.