117 million dollars will flow again into Bitcoin ETFs as the eyes of investors

On Tuesday, Bitcoin exchange-traded funds (ETFs) earned nearly $117 million. Leading this surge was Fidelity's Bitcoin Fund (FBTC) net income of around $63 million.

As a result, FBTC's eight-month total revenue now stands at $9.5 billion.

The BlackRock Bitcoin ETF has yet to record income streams.

On the same day, Greyscale's Bitcoin Mini Trust (BTC) and ARK Invest/21Shares' Bitcoin ETF (ARKB) also posted big gains. They brought in $41.1 million and $12.7 million, respectively.

These figures mark the first time Bitcoin ETFs have crossed the $100 million mark in September. The exodus followed Monday's record $28.6 million, which reversed a grueling eight-day outflow that saw $1.2 billion leave the market.

Read more: How to trade Bitcoin ETF: A step-by-step approach

Meanwhile, BlackRock's iShares Bitcoin Trust did not reflect this positive trend. For the past 10 trading days, since August 27, IBIT has not recorded any inflows, indicating a period of stagnation and occasional outflows. Additionally, on August 29, IBIT reported its second outflow since its inception, losing about $13.5 million.

However, the fund has not challenged IBIT's market leadership as it dominates holdings of more than $20 billion. Also, IBIT now boasts 661 institutional owners, with 20% of its shares held by these entities. Additionally, there are more than 1,000 institutional investors across all ETFs, as evidenced by two 13F filings.

These filings, mandatory quarterly disclosures for institutional investment managers, demonstrate the growing and sustained interest in Bitcoin ETFs.

Bitcoin is showing signs of recovery as these funds gain new capital following a prolonged outage. Since last weekend, the price of Bitcoin has increased by approximately 6.71%, now hovering around $56,600.

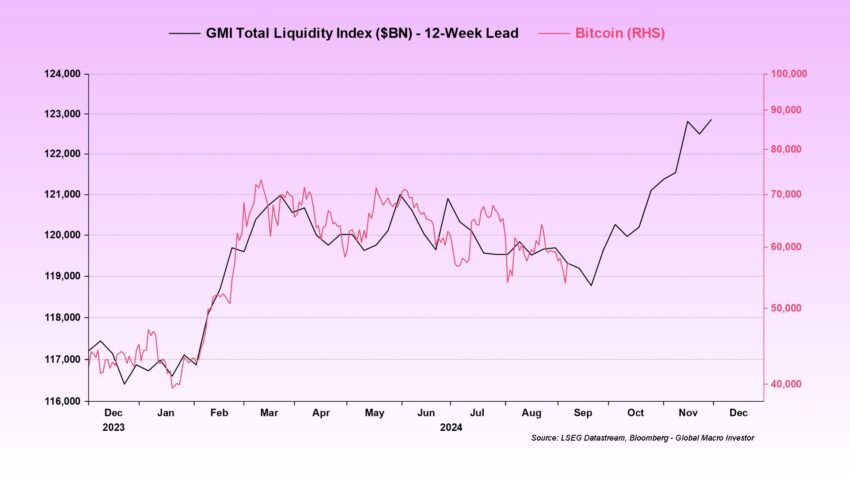

This volatility is closely tied to broader economic indicators that suggest increased liquidity, which often benefits Bitcoin's sensitivity to liquidity changes.

Commenting on the situation is macro researcher Julian Bittel.

“Liquidity is on the rise again, and Bitcoin – being extremely sensitive to changes in liquidity conditions – has the ability to move explosively as fresh liquidity enters the system. The macro environment is changing. A major liquidity wave is now on the horizon, and when it hits, Bitcoin will be higher in Q4.” It looks like there is going to be a strong push,” Bittel said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The Global Money Index (GMI), which measures the amount of money between consumers and banks, is rising. An increase in GMI typically indicates more available funds, which can lead to an increase in Bitcoin purchases.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.