$18 billion in Bitcoin and Ethereum options expire today

The market entered the final days of 2024. Today, a total of $18 billion worth of Bitcoin and Ethereum options contracts will expire.

Exciting and unexpected developments may lie ahead for traders and investors.

What do record-high Crypto options prices show?

According to data from Deribit, this Bitcoin options expiration period included 88,537 contracts – four times more than last week. Similarly, Ethereum options contracts expiring today totaled 796,021, which is 4.5 times more than last week.

The total value of expired Bitcoin options hit a record $14.38 billion, while Ethereum options totaled $3.7 billion. The higher the price of expiring options, the higher the trader's expectation of profit and the higher the need for risk hedging.

For Bitcoin, expiring options have a maximum pain price of $85,000 and a price to call (P/C) ratio of 0.69. In theory, a low P/C ratio (below 1) reflects positive sentiment as more call options (bets on price increases) are being purchased. However, compared to historical data, Bitcoin's P/C ratio has been trending upward in the last quarter of the year, which may indicate an increase in hedging sentiment.

“Gongon protection demand has been on the rise for the past few weeks, possibly fueled in part by players looking to maintain their performance benchmarks for the 2024 calendar year. The call ratio on December 27 has doubled from 0.35 in October and is currently over 0.70,” commented David Launt, head of research at FalconX.

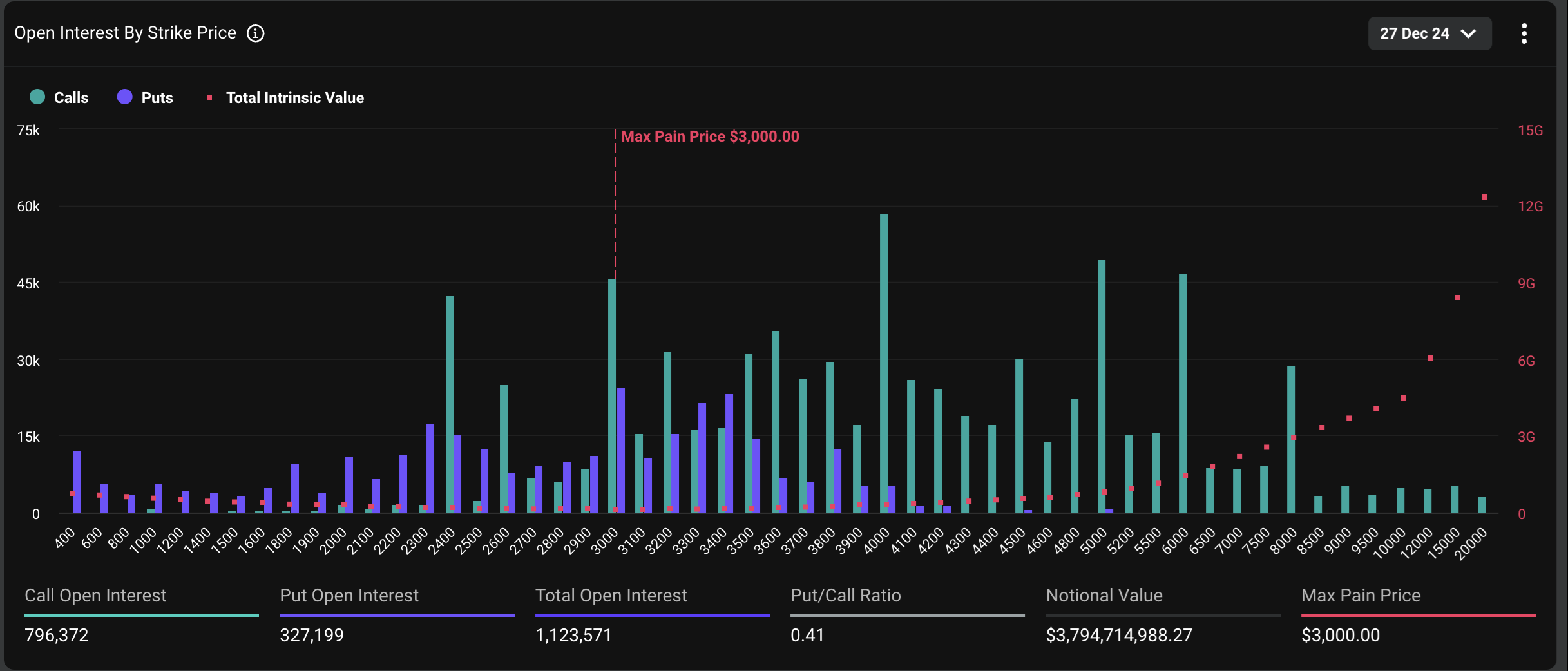

Meanwhile, Ethereum options contracts have a maximum pain price of $3,000 and a P/C ratio of 0.41. This ratio is down from 0.97 at the end of October, indicating growing bullishness for ETH.

At the time of writing, BTC and ETH are trading at $96,300 and $3,300, respectively, higher than the above-mentioned high pain points. The maximum pain price refers to the price level at which all investors holding option contracts (calls and options) will experience a maximum loss (or “pain”) at the end of the period.

Some investors and analysts use peak pain prices as an indicator to predict possible price directions. The rationale is that markets often move toward prices to facilitate profits for option sellers (typically large financial institutions).

“If the market is bullish, any significant negative movement can trigger a quick snowball effect. All eyes are on this end of term to define the narrative going into 2025,” Deribit commented.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.