2.46 billion dollars in Bitcoin sold by holders, miners and ETFs

Significant moves and selling pressures have rocked Bitcoin in recent weeks.

Long-term holders, early miners and ETF managers sold billions in BTC, raising concerns about the cryptocurrency's short-term stability.

Bitcoin selling pressure accelerates.

Bitcoin long-term owners have sold $1.2 billion in the past two weeks. This heavy selling has put pressure on the market.

According to Ki Yang Ju, CEO of blockchain analytics firm CryptoQuant, this amount of capital should be absorbed by sell-side liquidity without payment transactions. Otherwise, brokers will inject bitcoins into the exchange, which can further influence the market.

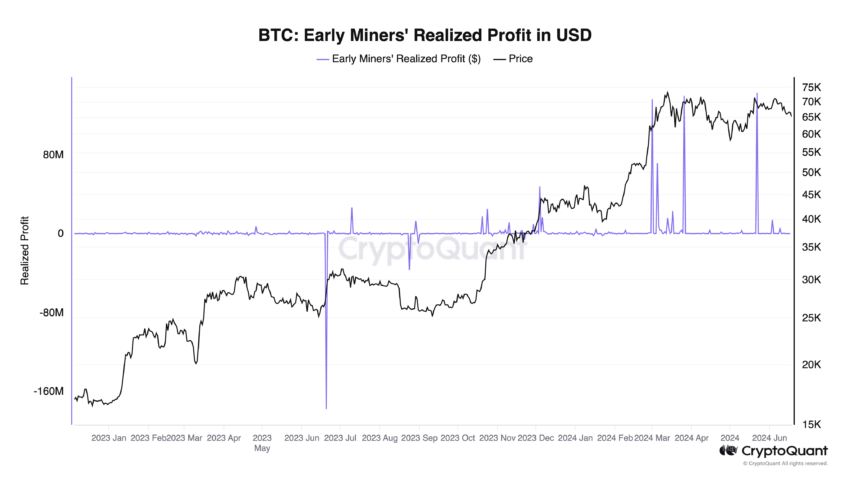

Early Bitcoin miners also contributed to the sale. This year, when bitcoin traded between $62,000 and $70,000, they made about $550 million in profits. This trend has increased the downward pressure on the price of Bitcoin.

Interestingly, on-chain analysis suggests that this “rare” mining capital is linked to the recent Bitcoin halving. This process eliminates weak miners, which leads to a temporary increase in BTC sales. When these miners exit, the market tends to dip before rebounding.

But chain analyst Willie Woo confirmed that this level needs to clear open interest in futures markets before the bullish trend continues.

“We need strong liquidity before we get the all clear for further violent activity,” Woo emphasized.

Read more: What Happened in the Last Half of Bitcoin? Predictions for 2024

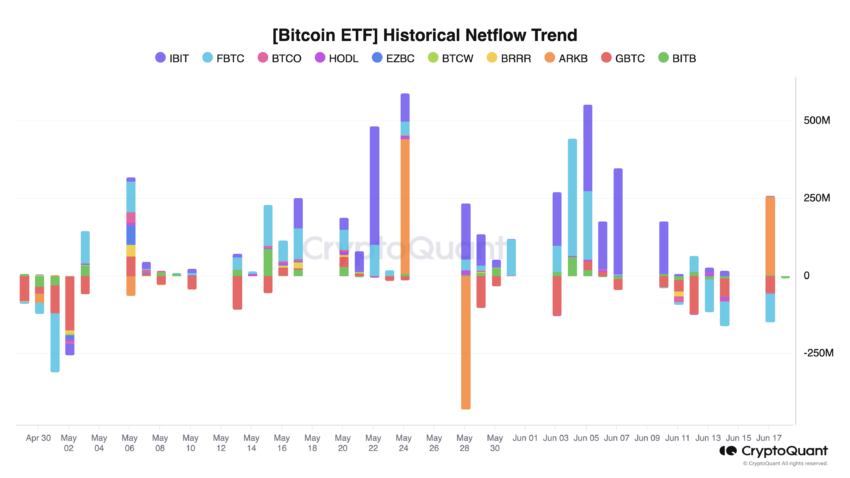

Adding to the market's challenges, analysts at the AI-driven analytics platform have highlighted persistent negative net flows in Bitcoin ETFs.

On June 18, 2024, the net inflow of Bitcoin ETFs reached $152 million. This is the fourth consecutive day of negative net income totaling $714 million. In particular, Grayscale and Fidelity saw significant flows, fueling bearish sentiment.

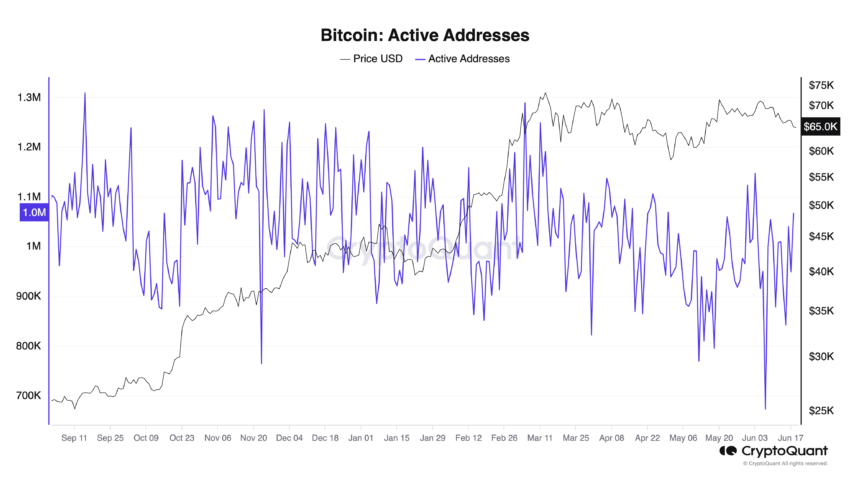

Finally, analysts at data science company IntoTheBlock noted that the number of Bitcoin transactions increased earlier this year due to the excitement surrounding ordinals and runes. However, the increase in use and whaling activity does not increase the number of new participants.

“Typically, crypto bull markets are fueled by Bitcoin enthusiasm. However, despite Bitcoin's early surge, [there’s a] Lack of retail user growth,” IntoTheBlock analysts wrote.

Indeed, the number of new Bitcoin users has fallen to a multi-year low, even below the levels seen during the 2018 bear market. This lack of retail investor growth raises critical questions about the sustainability of the current market dynamics.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

While Ju maintains that media sentiment is bullish, this optimism may not be helpful. With high sell-off offers from long-term holders, early miners and continued negative ETF inflows, Bitcoin may face a longer correction period.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.