$2.5 Billion in Bitcoin, Ethereum Options Expires After Market Crash

Following Monday's crypto market crash, nearly $2.5 billion in Bitcoin (BTC) and Ethereum (ETH) options expired today.

Expiration can affect the market conditions, investors control the potential shifts.

$2.5 Billion in Options Contracts Expires: Will Crypto Markets Continue to Recover?

According to Deribit, $1.94 billion worth of Bitcoin options are about to expire. The maximum pain point of these contracts is $60,000.

These options included 31,615 contracts, slightly less than last week's 36,732. The call-to-call ratio of 0.71 indicates overall bullish sentiment despite recent volatility.

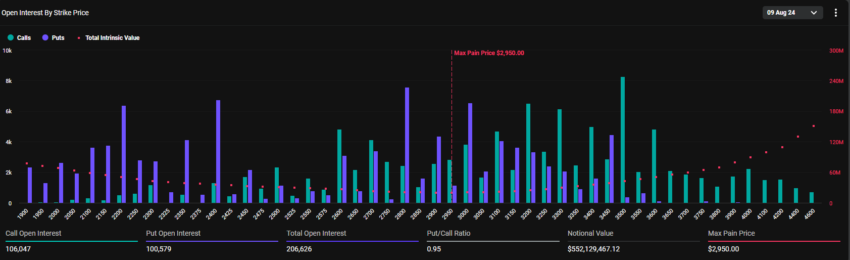

Ethereum has $552.13 million worth of options, which includes 206,626 contracts. This figure represents an increase from the previous week's 183,756 contracts. The maximum pain point for these options is $2,950, and the call ratio is 0.95.

Read more: Introduction to Crypto Options Trading

The highest pain point in the crypto options market represents the price level that causes the greatest financial distress to option holders. Meanwhile, the call ratio shows a higher spread of call options (calls) than put options (puts).

Analysts of crypto options trading tool Greeks.live provided insights on today's contract expiration. They indicated that all major terms remain above 60% of implied volatility (IV). Meanwhile, Bitcoin's current 7-day realized volatility (RV) is at 100%, well above the IV level.

“There is a cumulative effect in volatility, which leads to longer high volatility swings, so IV has strong support, and sellers can gradually build positions,” Greeks.Live analysts commented.

Bitcoin and Ethereum prices fell significantly during Monday's market crash, BeinCrypto reported. According to Coinglass data, the weight is evident in the liquid assets of more than $1 billion.

However, the crypto market started to recover the next day after the crash. At the time of writing, Bitcoin has bounced back above the $60,000 level. It is now trading at $61,494, up nearly 10% in 24 hours.

Similarly, Ethereum is up nearly 12 percent, now trading at $2,671 after briefly reaching $2,700.

Read more: 9 Best Crypto Options Trading Platforms

Historically, options contract expirations result in sharp but temporary price movements. The market will soon stabilize. Finally, traders must effectively manage potential volatility by analyzing technical indicators and market sentiment.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.