2.52 Million Altcoins Are Ruining Crypto’s Future.

A clear case is emerging in the cryptocurrency market. Over 2.52 million created altcoin expansion is suffocating the industry.

This unprecedented new development of tokens, while initially a sign of market growth, now poses major challenges.

2.52 million new tokens were created.

In the year In 2020, the crypto market experienced a frenzy. Liquidity increased as retail investors and venture capitalists (VCs) poured money into the industry. VCs in particular have contributed to the growth of many projects by investing heavily.

Will Clemente, co-founder of Reflexivity Research, reflected on how straightforward the method was back then. Investors should invest capital in high-beta altcoins and enjoy the ride with Bitcoin at its best.

“In 2020, you're going to be at risk, those things are going to have a higher beta for Bitcoin and all the vaporware is going to be long and everything is going to go up,” Clement explained.

This trend continued in 2022 when VC funding reached a record $11.1 billion in the first quarter alone. However, this flood of new capital has led to an unsustainable increase in the number of altcoins.

The number of tokens tripled between 2020 and 2022, but was hit hard by the ensuing bear market. High-profile failures such as the LUNA and FTX failures have caused widespread market turmoil. Projects that have raised the most funds have chosen to delay launch in anticipation of more favorable market conditions.

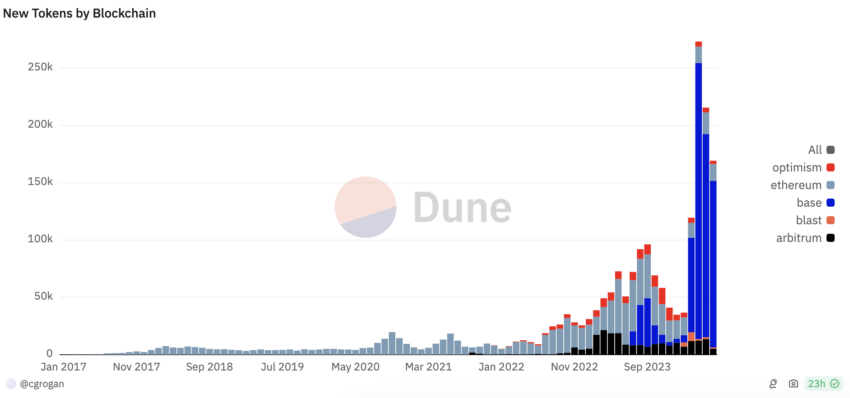

In the year By the end of 2023, market sentiment had improved, leading to a surge in new altcoin launches. This resurgence took place in 2024, with over a million new tokens introduced as of April. As a result, the total number of altcoins in different blockchains has reached 2.52 million.

“There were nearly 1 million new crypto tokens created in the last month, which is 2x the total number created on Ethereum from 2015-2023,” Coinbase Director Conor Grogan said.

Read more: 7 Hot Meme Coins and Altcoins Trending in 2024

Although these numbers may be exaggerated due to the ease of creating meme coins, the number of new tokens is impressive.

How Altcoins Affect Crypto

This flood of new symptoms is problematic. The more altcoins that flood the market, the greater the aggregate supply pressure.

Estimates suggest that $150 to $200 million worth of new supply enters the market every day. This constant sales pressure results in price reductions similar to inflation in a traditional economy. As more altcoins are created, their value will decrease against other currencies.

“Think of token dilution as inflation. If the government prints US dollars, this in turn reduces the purchasing power of the dollar along with the price of goods and services. It's the same in crypto,” explained crypto analyst Miles Deicher.

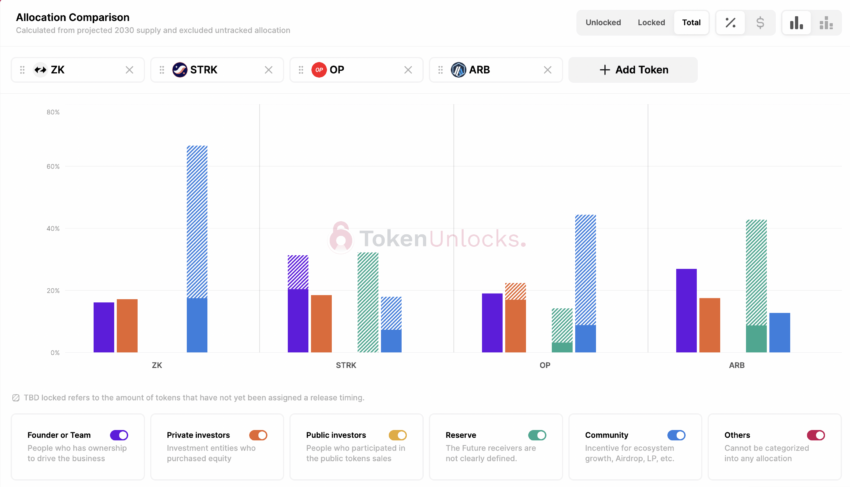

Many of these new tokens will have low fully diluted values (FDV) and high float, exacerbating supply pressure and circulation. This environment would be manageable if new liquidity was entering the market.

However, with insufficient new capital, the market is constantly flooded with new tokens, causing the price to drop.

Read more: Which are the best Altcoins to invest in June 2024?

This may be one reason why retail investors are reluctant to participate, feeling disadvantaged compared to VCs.

In previous cycles, retail investors may have made higher returns. Now, tokens often launch at high valuations, leaving little room for growth, and then bleed off when their launch programs begin.

“The swing to the private market is one of the biggest issues in crypto, especially compared to other markets like stocks and real estate. This volatility is going to be a problem because they feel like they won't win retail,” Deutscher said.

Solving this problem requires a coordinated effort from multiple stakeholders. Exchanges may apply stricter token distribution rules, and project teams may prioritize community allocations. In addition, a high percentage of tokens may be unlocked at launch, which may have mechanisms to avoid waste.

Read more: 10 Best Altcoin Exchanges in 2024

The current state of the market highlights the need for superior functionality. Exchanges should consider canceling defunct projects. The goal should be to create a retail-friendly environment that benefits everyone, including VCs and exchanges.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.