After years of unkind words for the crypto industry, 2023 was the year US regulators brought out the sticks and stones.

followed by fall out of Criminally mismanaged. crypto brand FTX In November 2022, Wall Street's top regulator, the Securities and Exchange Commission, had good reason to regulate an industry full of “fraudsters, swindlers and swindlers.” Quote SEC Chairman Gary Gensler.

But has the move gone too far?

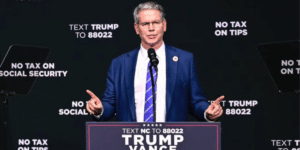

Some US lawmakers, including crypto-friendly Majority Whip Tom Emmer, criticized the regulator. “Fun invention” In the world's largest economy.

Republican Patrick McHenry (R-NC) Accused Gensler of wanting to “blow up” the crypto industry. Even the courts have them He was beaten The SEC has “arbitrarily and capriciously” denied digital asset fund manager Greyscale turned its crypto fund into an ETF.

“The SEC's crusade against many crypto exchanges appears to be a deliberate plan to push a political agenda through regulatory enforcement,” said Remo Associate Anthony Glukov. Law PC, they were told Decrypt.

But the SEC wasn't the only one going after the major crypto brands: the Commodity Futures Trading Commission (CFTC) and the Justice Department were aggressive in their pursuit of alleged losers in the digital asset space.

Gensler had he said. In 2021, consumers will need protection in the crypto industry. But FTX suddenly Loss occurred In November, and in it Now sentenced Crime boss Sam Bankman-Fried caught up A month later, regulators quickly upped their game.

The first 2023 enforcement action was filed against Genesis and Gemini in January. In late November, Changpeng Zhao (CZ), the founder of the world's largest crypto exchange, resigned as CEO of Binance and pleaded guilty to money laundering.Here's how we got there:

Table of Contents

ToggleJanuary: The SEC fires its first shots of the year

The SEC has moved quickly – since the year hit Crypto lender Genesis and digital asset exchange Gemini are accused of collecting billions of dollars worth of crypto from investors in an unregistered collateral offering.

Gemini CEO Tyler Winklevoss responded by calling the SEC's actions “absolutely counterproductive.”

Genesis, a subsidiary of Digital Currency Group (DCG), followed that month presented It shows exposure to loss He fell crypto venture fund Three Arrows Capital. The lender was a provider of the Gemini Income program Frozen exits Following the collapse of FTX in 2022.

Later that month, the stablecoin giant announced it was scrapping plans to go public with a $9 billion SPAC merger, a sign that the regulatory environment is starting to tighten for digital asset companies. Spokesperson of the club They spoke DecryptHowever, the company did not file charges against the SEC for the failure of the agreement, saying that the circle never expected the process to be “quick and easy”.

Closing out the month was crypto lender Nexo – one of the last digital asset lenders to stand firm after the bankruptcy of Celsius and BlockFi. (Disclosure: Nexo is one of 22 investors. Decrypt.) SEC Solved the charges against Nexo On January 19, the crypto lender agreed to pay a $45 million fine over allegations that its loan product was an unregistered security.

February: Release of the Kraken

Kraken was next.

On February 9, SEC Accused A major US crypto exchange has violated securities laws by failing to register the offering and sale of a crypto asset staking-as-service program. Kraken paid a $30 million fine without admitting or denying the allegations in the SEC complaint.

In an interview with Decrypt A few months later, the chief legal officer of the exchange, Marco Santori he said. Targeting by regulators was expected when working in the digital asset industry. “If the SEC or a federal regulator never gets involved, you're probably not going hard enough,” he said. 2023 won't be the last time the SEC knocks on the Kraken's door.

That same month, the SEC also where given Wells' notice is to warn fintech company Paxos that it will take legal action over the New York company's involvement in the creation of Binance USD (BUSD). A stable coin. The commission alleged that the digital token was a security—something Paxos vehemently denied. Well then It stopped It said it will end its relationship with Binance to prepare for legislation by issuing the token.

March: CFTC files first case against Binance

The CFTC was the first US agency. File a lawsuit against Binance, the largest exchange of digital assets. The lawsuit alleges in federal court that CEO Changpeng Zhao and his company violated trading and derivatives laws by allowing Americans to trade crypto options since at least July 2019. It was the first of many times during the year that Zhao used the now-famous “4” to dismiss the claims in the lawsuit as FUD. The crypto mogul tweeting his number is short: “Ignore the FUD [fear, uncertainty, doubt]He said.

He used it repeatedly throughout the year, including when newspapers liked it. Wall Street Journal he said. In March – citing text messages – the exchange had deliberately alienated US officials.

The CFTC action marks a critical moment in the regulatory crackdown on crypto's biggest players, as it follows federal criminal charges against Binance and its founder.

April: Bittrex came next

In April, SEC hit Crypto exchange Bittrex is accused of failing to register as a broker-dealer, exchange and clearing agency, and allegedly embezzled at least $1.3 billion between 2017 and 2022.

The action was significant, as the regulator released some well-known names in the crypto space as unregistered securities for the first time: OMG Network (OMG), Dash (DASH), Monolith (TKN), Naga (NGC), Real Estate Protocol (IHT), and Algorand (ALGO) are all listed in the complaint.

In a statement, Bittrex previously asked the SEC to clarify what coins and tokens are securities – to no avail. In March, he It is closed American activities. The exchange agreed to settle later in August, but that would be just the beginning of the fallout. In November, exchange It is closed globally.

June: The SEC brings out the big guns

Things really started to heat up in the summer. Following the CFTC's indictment against Binance in March, the SEC followed up with its own crackdown on two of the biggest brands in crypto in June. Binance And Coinbase.

Although the facts alleged in each case are different, the regulator charged Binance with fraud but not Coinbase – likely a coincidence that they were charged in the same week.

Another key difference: CZ is named as the main defendant in the Binance lawsuit; Coinbase CEO Brian Armstrong was mentioned only once in the exchange's complaint.

In its lawsuit against Coinbase, the SEC alleged that the exchange was an unregistered national securities exchange, brokerage and clearing agency — and offered and sold unregistered securities through its stocking service. The company responded by saying that “the company has demonstrated its commitment to compliance,” and that the SEC's “enforcement-only approach” “harms America's economic competitiveness.”

Like the Bittrex case, the SEC again Target individual's digital assets In his complaint against Coinbase—only this time for the first time—he called out some of the biggest cryptocurrencies in the space. That list of tokens that are considered illegal is included. Polygon (MATIC), Solana (Sun), Filecoin (FIL)And Cardano (ADA).

The SEC is also named Cosmos Hub (ATOM), The sandbox (SAND), Decentralized (MANA), ALGO, Axie Infinity (AXS)And elbow As unregistered securities in the lawsuits.

As a result, the Solana Foundation came out on the defensive. Strongly deny Solana's behavior as security. Polygon Labs also released a statement. he said. MATIC was “available to a wide range of people, but only in non-U.S.-targeted actions at any given time.”

The Solana Foundation disagrees with describing SOL as security. We welcome the continued involvement of policymakers as constructive partners in building legal clarity on these issues for the thousands of entrepreneurs in the United States.

— Solana Foundation (@SolanaFndn) June 10, 2023

The allegations have caused uproar in the crypto industry—especially the attack on Coinbase. A group of blockchain advocacy groups He wrote a letter He asked the judge handling the case to dismiss the case, saying the regulator was trying to usurp the power of Congress.

Wall Street Star Cathy Wood he said. At the time, the SEC was trying to “put [Coinbase and Binance in the same bucket—and they’re not in the same bucket,” claiming that the Coinbase lawsuit was less damning.

This was because Binance had been in the crosshairs of the authorities for some time. And the SEC made that clear with its severe allegations in its lawsuit: it alleged fraud and the comingling of funds.

Most alarmingly, the SEC also alleged that billions of dollars of customer funds went to a bank account for an entity controlled by Zhao.

Binance and Zhao would later go on to settle with the CFTC and more severe criminal charges.

July: Celsius and LBRY catch heat—but Ripple catches a break

Just about every regulator went after crypto lender Celsius in July—one year after it collapsed. Its disgraced ex-CEO Alex Mashinsky was arrested and released on a $40 million bail.

The DOJ, SEC, Federal Trade Commission, and CTFC all hit Mashinksy with lawsuits. In short, Mashinksy allegedly lied and repeatedly misled investors about how well his crypto company was doing and lined his pockets in the process, according to lawsuits. He was arrested but released after agreeing to pay a $40 million personal recognizance bond. His assets have since been frozen as he awaits his trial next year.

Elsewhere, LBRY, Inc., the company behind the eponymous blockchain publishing platform, had to shutter following a long battle with the SEC. The regulator had a problem with the company selling its tokens to fund its project—which it deemed violating securities laws.

The final judgement in SEC vs LBRY is out.

In accordance with the court's order and our promises, we expect to spend the next several months winding LBRY Inc. down entirely.

As to what happens to LBRY from here, well, that's up to you. pic.twitter.com/cU8O3nATT6

— LBRY 🚀 (@LBRYcom) July 11, 2023

But the “war on crypto” wasn’t completely one-sided, and July marked the first time that the SEC suffered a significant setback in its attempts to “regulate through enforcement.”

Ripple, the crypto payments startup whose founders also created the XRP cryptocurrency—still to this day one of the biggest digital assets around by market cap—scored a significant win against the SEC on July 13.

Following a massive 2020 $1.3 billion lawsuit alleging that the fintech firm had misled investors and sold unregistered securities in the form of XRP back in 2020, a judge sided with the company. Federal district judge Analisa Torres ruled that programmatic sales of XRP to retail investors—that is, Ripple’s sales of XRP on cryptocurrency exchanges to the average crypto user—did not qualify as securities transactions.

The judge also ruled, however, that the $728 million-worth of contracts for institutional sales did constitute unregistered securities sales, so Ripple isn’t completely off the hook. Nevertheless, the company and XRP holders around the world celebrated the win just the same. Major cryptocurrency that had previously halted trading for XRP relisted the asset, and the coin exploded in value.

Ripple’s General Counsel Stu Alderoty said at the time that he expected U.S. banks to go back to using the fintech firm’s On-Demand Liquidity (ODL) product.

August: Grayscale scores against the SEC

A month later, the SEC once again was defeated in court when faced up against a crypto firm—an unfamiliar posture for the regulator.

Grayscale scored a win against the SEC in a shocking development of its long and drawn out battle with the regulator.

The crypto fund manager had applied to the SEC to turn its Bitcoin Trust into an exchange-traded fund (ETF) but was denied. Grayscale then sued the SEC in 2022.

The court took Grayscale’s side in late August when a U.S. Court of Appeals for the D.C. Circuit judge overturned the SEC’s decision to block its ETF ambitions. The judge said that the denial of Grayscale’s proposal was “arbitrary and capricious” because the regulator had already approved similar products—crypto futures ETFs.

Crypto markets interpreted the ruling as positive and the price of Bitcoin shot up. Analysts told Decrypt that the move would help approval of a long-awaited Bitcoin ETF in the long-run.

Meanwhile, Bittrex agreed to pay $24 million in fines to settle its case with the SEC for allegedly selling unregistered securities. It neither admitted nor denied the charges.

September: Binance bites back

Binance and its boss CZ bit back at the SEC in September, asking for June’s lawsuit to be dismissed. The short of it, Binance’s legal representatives argued, was that the SEC never gave clear guidelines for the crypto sector and as a result, was overstepping its regulatory authority.

The exchange also argued that the regulator had sought to “enlarge its jurisdiction globally.” The SEC’s lawsuit argued that American customers were using Binance’s global service—despite not being allowed to.

Wall Street’s top regulator “often argues that such companies, regardless of their location, must comply with U.S. securities laws if they are serving U.S. residents or their activities have significant effects on U.S. markets,” former CFTC trial attorney Braden Perry told Decrypt.

October: Genesis saga continues

The New York Attorney General’s office in October filed a lawsuit against Genesis Global Capital, Gemini Trust, and Digital Currency Group (DCG), alleging that the three companies “lied to investors and tried to hide more than a billion dollars in losses.”

New York Attorney General Letitia James said in a statement that “middle-class investors who suffered as a result” due to the three companies allegedly defrauding 232,000 customers for over $1 billion.

A DCG spokesperson told Decrypt that they would fight the claims.

November: Bye-bye, Zhao

The war on crypto reached its climax last month when the U.S. government at last convicted two of crypto’s biggest personalities: FTX founder Sam Bankman-Fried, and Binance founder Changpeng Zhao.

On November 3, a jury convicted Bankman-Fried of seven fraud and conspiracy charges. This concluded the criminal saga connected to colossal collapse of the FTX mega brand—though Bankman-Fried’s lawyers have vowed to appeal the verdict and continue to fight the charges.

Then, only weeks later, Binance CEO Zhao agreed to step down from his role at his crypto company as part of a settlement with the U.S. Department of Justice, following a years-long investigation. He agreed to pay $4.3 billion in fines and pleaded guilty to money laundering charges.

Right around the same time, the SEC went after Kraken for the second time this year, alleging that the San Francisco-based crypto exchange commingled customer assets with company funds—even paying some bills from an account meant for clients.

The regulator also said Kraken sold unregistered securities—something the exchange vehemently denied—and put investors’ funds at risk. Kraken said it would “defend its position.”

December:

After a hard year for Binance’s now ex-boss Zhao, a U.S. judge banned the disgraced crypto mogul from leaving the country, saying that he posed “too great a flight risk” due to his “enormous wealth and property abroad.” His sentencing will take place next year.

But what happens next? Not all are saying that 2024 will continue to be difficult. Blockchain Association CEO Kristin Smith said that it was likely the crypto sphere was “turning the corner on core regulatory issues.”

“The FTX verdict and the conclusion of the DOJ’s case against Binance should clear some of the air in Washington,” she said.

“2024 will be a turnaround year for the industry,” she added.

Stay on top of crypto news, get daily updates in your inbox.