$287 million sent by Chainlink (LINK) to Binance: price impact

Recent network activity surrounding Chainlink (LINK) tokens has attracted attention. Market observers have raised concerns about the cryptocurrency's stability and future price direction.

The token network, which recently hit a 22-month high, released significant digital assets the other day.

Chainlink unlocks 19 million tokens.

In the year

Specifically, 15.95 million LINK tokens, worth $287 million, were transferred to Binance. Meanwhile, the remaining 3.05 million LINK, worth $54.3 million, found their way to the multi-sig wallet, 0xD50f.

It should be noted that these activities on the chain are not new events. SpotOnChain These designated wallets have continuously transferred LINK tokens to Binance since August 2022. During this period, Chainlink unlocked 106 million LINK, transferring 88.95 million LINK to Binance at an average price of $9.06, for a total of $805 million.

The blockchain oracle provider still holds a massive inventory of 412.5 million LINK in 24 contracts, worth $7.35 billion.

What's next for LINK value?

BeInCrypto's pricing data indicates that the increased LINK circulation has not had a significant impact on the token's price. In the past 24 hours, LINK experienced a modest gain of 0.83%, reaching $18.01, continuing its positive trend of gaining over 26% last week.

This price movement is in line with the observations of on-chain analyst LookOnChain, who pointed out that the price of LINK generally increased after the deposit. Similarly, BeenCrypto's global head of news, Ali Martinez, suggested that ChainLink may face resistance at the $20 level, with 5,330 addresses holding 8.59 million LINK.

“Chainlink seems destined for more profits! On-chain analysis shows a significant resistance level at $20, where 5,330 addresses hold a total of approximately 8.59 million LINKs, Martinez said.

Read more: How to buy Chainlink (LINK) and everything you need to know

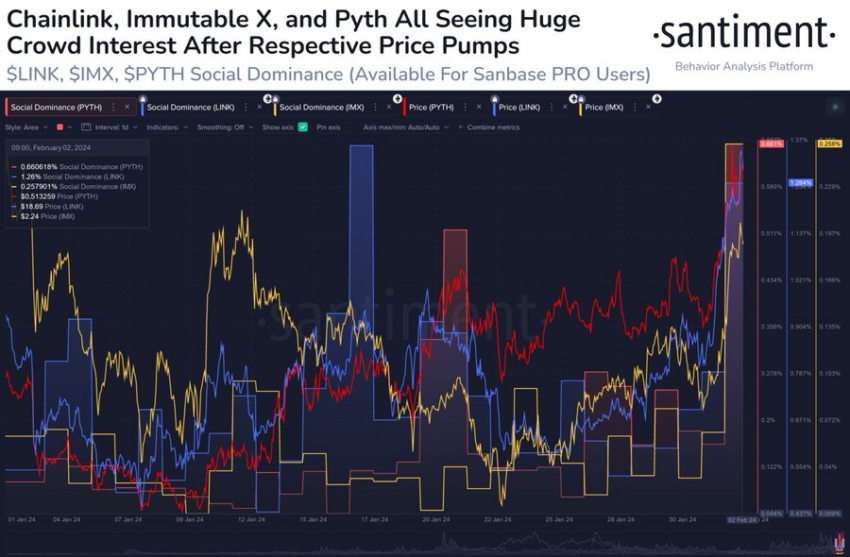

However, leading analyst firm Santiment has urged market participants to exercise caution. The firm noted that speculation surrounding LINK could create fear of missing out (FOMO), which could attract major crowds and create high volatility in the asset.

“Chainlink (+34%), ImmutableX (+23%), and Pyth (+26%) all experienced impressive market cap growth last week. The mainstream public is discussing them at high prices, which means FOMO should drive high volatility for these assets, Santiment said.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.