$3 billion in BTC, ETH options expire when Bitcoin reaches $100,000

Today, approximately $3 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire, sparking speculation in the crypto market.

These expired crypto options come ahead of President-elect Donald Trump's inauguration week. Bitcoin is running ahead of its ascent, reclaiming the $100,000 mark.

More than $2.8 billion in bitcoin and ethereum options will expire

According to Deribit data, 21,664 bitcoin contracts worth nearly $2.2 billion are set to expire today. Bitcoin's call to call ratio is 0.94.

The maximum pain point – the price at which the property will cause financial loss to the largest number of owners – is $96,000. Here, most contracts become void.

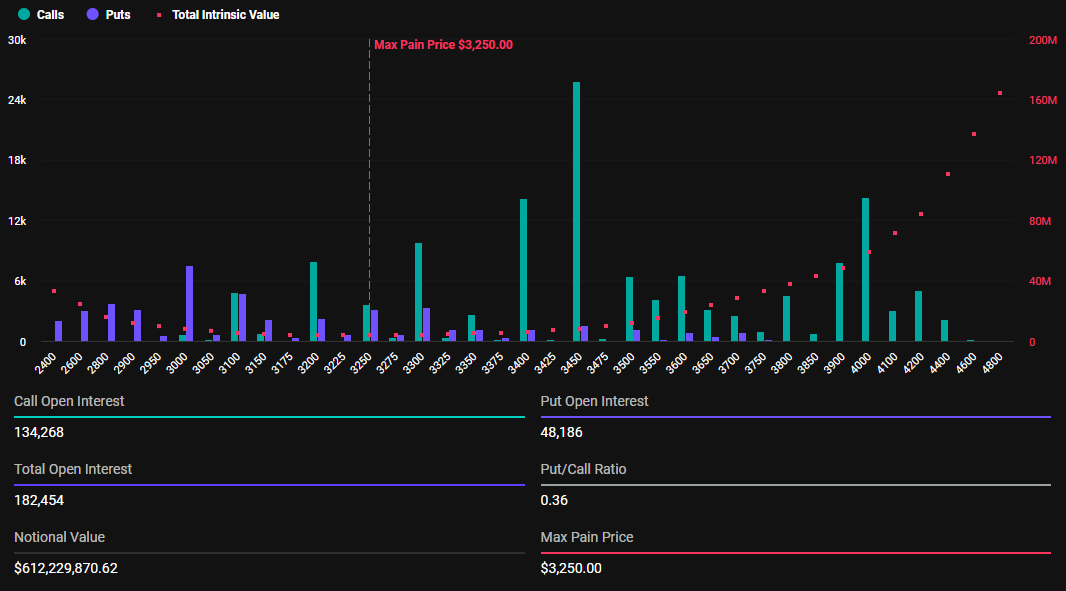

Similarly, crypto markets witness the expiration of 182,454 Ethereum contracts worth $612.2 million. The call ratio for these expired Ethereum options is 0.36 and the maximum pain is $3,250.

Options expiration leads to notable price volatility, making it important for traders and investors to closely monitor today's developments. Call ratios below 1 for both Bitcoin and Ethereum indicate bullishness in the market. This indicates that many traders are betting on a rise in prices, reflecting positive market sentiment.

Bitcoin's move to reclaim $100,000 is consistent with this market optimism. Meanwhile, Grix.Live analysts describe the prospect of Donald Trump's presidency as he promised to be the “Crypto President”, which could well affect industrial policies. Analysts also cite expectations that there will be no devaluation, which could affect market sentiment towards cryptocurrencies.

“Bitcoin rallied above $100,000 again, erasing the overbought market sentiment of the weekend… Trump will officially take office as the new US president next week, and it's worth watching to see if he approves policies in favor of cryptocurrencies this month. US stocks have rallied in recent days, and the price rally at the end of the month will basically be waiting for any price reduction,” Grix.Live shared on X (Twitter).

However, the analysts noted that short-term option implied volatility (IV) increased, indicating a significant increase in long-term strength. Thus, investors are advised to partially buy short-term options by focusing on the expected policy changes in the government and the flow of ETFs.

Greeks.live also highlights how the trading behavior of different regions affects the price of Bitcoin. Asia and Europe sold Bitcoin causing the price to fall, which was bought back by the Americans, making the market trend positive. This reflects the international interaction in the cryptocurrency markets.

“Asia and EU sold BTC today and then Americans bought it all at low prices? Turning a red day into a green day for BTC,” he wrote.

Although this is a sly commentary on price action, this interaction, ahead of the expected volatility due to Trump's inauguration, points to the underlying context of political events affecting market sentiment.

At the time of writing, Bitcoin was trading at $101,187, according to BeinCrypto data. This represents a modest gain of 1.62% since the open of Friday's session.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.