3 US Economic Events to Watch for Crypto Market Impact

Crypto Markets You're in for the most volatile week of 2024. Three US macroeconomic data events are on the calendar and could have a significant impact on investors' portfolios.

Meanwhile, Bitcoin (BTC) is trading below $70,000, with hopes of a fourth quarter (Q4) positive return for the historically pioneering crypto.

US election: Donald Trump vs Kamala Harris

The US market reached the peak of the political showdown between Donald Trump and Kamala Harris from the Republican and Democratic parties on Tuesday, November 5. According to the data on Polymarket, the US elections are only a few hours away from Trump. in leadership.

Read more: How to Vote Blockchain in 2024?

However, industry peer Polymarket shows nearly the same margin in the forecast market, with Trump leading at 52 percent to Harris' 48 percent. This comparison reflects the differences in the user base of these platforms. Nevertheless, analysts expect a volatile day for Bitcoin.

The results of the US election could have significant implications for economic policy, regulatory environments and investor sentiment. Depending on the winner, policies regarding the cryptocurrency may change, which may affect the price of Bitcoin, with sentiment spilling over to other crypto tokens.

“I expect it to be a real firecracker with a lot of flexibility this week. The key day for the US election is Tuesday. According to Mark Cullen, an analyst at Alphabetic, it could be very scary for Bitcoin if there is no clear winner as the day progresses.

Initial unemployment claims: A measure of the labor market

Beyond the US elections, crypto markets will be dominated by initial jobless claims on Thursday, November 7. Although the labor market is softening, the unemployment rate is at an all-time low.

Last week, US citizens filing new applications for unemployment insurance rose by 216,000 since the week ending Oct. 25, down from 228,000 the previous week. However, there is a consensus forecast of 220,000.

Higher initial jobless claims in Thursday's report signaled increased economic distress and a weakening labor market. This could lead to lower consumer spending and investment in traditional assets such as stocks and bonds. Therefore, some investors may turn to alternative assets such as cryptocurrencies as a hedge against economic uncertainty.

The FOMC's interest rate decision and Jerome Powell's speech

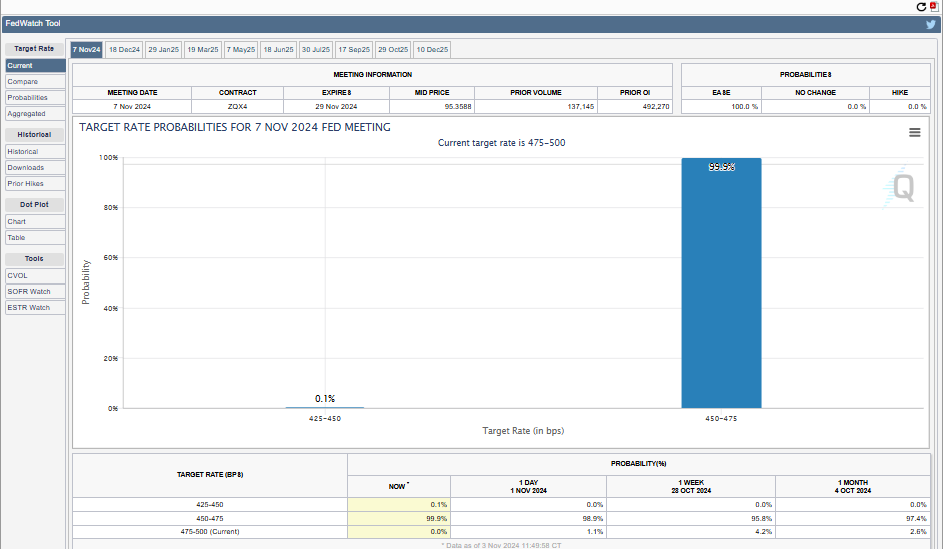

On Thursday, the Federal Open Market Committee (FOMC) will release the minutes from the last meeting, followed by comments from Federal Reserve (Fed) Chairman Jerome Powell. The Fed operates under two mandates: to maintain inflation as measured by the Consumer Price Index (CPI) at 2 percent annually and to maintain full employment.

The FOMC's November meeting is scheduled for next Wednesday and Thursday, and economists expect another rate cut. The Fed cut interest rates by 50 basis points (0.5%) at the previous meeting, when the US CPI fell to 2.4%.

Another rate cut is likely as inflation nears the Fed's 2 percent target, with the unemployment rate rising to 4.1% from 3.7% this year, signaling softness in the labor market.

Read more: How to protect yourself from inflation using cryptocurrency

Recently, Powell has indicated that further slowdowns to support economic growth before the situation worsens have increased the negative risks to employment. Moreover, the FOMC forecast in September suggested that the federal funds rate could be cut by another 50 basis points before the end of 2024.

With only the November and December meetings left, perhaps, two 25-point cuts are underway. Against this backdrop, the CME Fed Watchtool shows a 99.9% chance of a 25 bps rate cut on Thursday's US economic data release.

Meanwhile, Spotonchain expects further growth for Bitcoin after the US elections and the FOMC meeting, with the price of BTC reaching $100,000 in 2024. The rally, according to Spotonchain, will come regardless of who wins the election.

“The market is entering a very volatile week with the US election and the FOMC meeting, but this rally may be here to stay. Historically, the real bull run starts after an election, and we believe BTC will continue its upward march this year if Trump or Harris become the next president.” It could reach 100,000, Spotonchain said.

At the time of writing, BTC is trading at $68,698, representing a modest increase of 0.34% since the opening of Monday's session.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.