4.6 billion Bitcoin, Ethereum options expire as US markets shift

Almost $4.6 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire today, fueling volatility in the crypto market.

This event came after the US election and the Federal Open Market Committee (FOMC) meeting. These two US macro developments were the driving force behind Bitcoin sentiment this week.

US Elections, FOMC Drive Crypto Market Sentiment Before Major Options End

According to data from DariBit, there were 48,794 Bitcoin options contracts worth $3.7 billion in 2018. Expires November 8th. These contracts have a call to call ratio of 0.72 and a maximum pain point of $69,000.

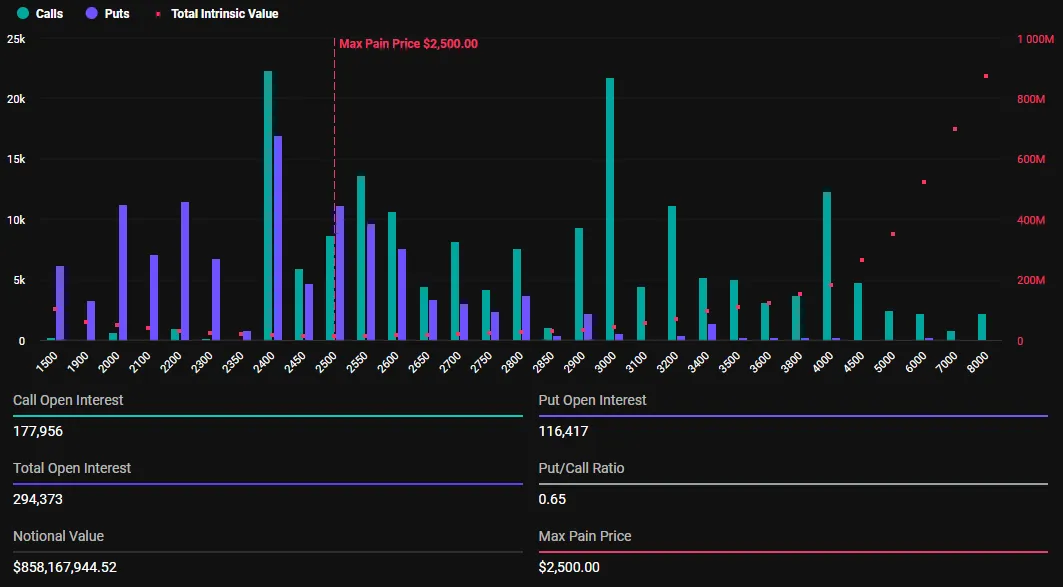

Similarly, the Ethereum options market is about to close at $854.88 million with 294,380 contracts. Ethereum contracts expiring today have a call ratio of 0.65, with a maximum pain point of $2,500.

Read more: Introduction to Crypto Options Trading.

In options trading, the maximum pain point is the level at which option holders experience significant losses. Basically, it is the price at which the maximum number of options (both calls and puts) expire worthless, causing the greatest financial “pain” to traders.

Meanwhile, the put-to-call ratio measures market sentiment by comparing the number of put options (bets on price declines) to put options (bets on price increases).

According to Deribit, the bullish trading surrounding the elections in 2010 On November 6, trading volumes rose to $10.8 billion on a daily basis. This was expected to peak for Donald Trump's victory. This coincided with BTC re-ordering its all-time high at $75,100.

Grix.Live's latest analysis details the impact of the recent US election on crypto options contracts expiring today. Analysts say the options market is closing in on gains to end the election season as the buzz around Donald Trump's victory fades.

“The electoral market is cooling down fast. Despite the strong gains in Bitcoin and Ether and the optimism in the crypto market, the options market is closing in on gains to end the options game,” he said.

In addition, Greeks.live Bitcoin doomsday options fell below 50%. An expiration date option is added to a contract so that the issuer or investor can redeem the contract early.

Similarly, the analysts say implied volatility (IV) is falling sharply in all major terms, with ETH benefiting from today's big gains and falling behind BTC less. Meanwhile, big owners are already planning.

The analysts added: “Large investors are already starting to prepare for the end of the year or the spring market of next year.”

Read more: How to protect yourself from inflation using cryptocurrency

Elsewhere, the FOMC decided to cut interest rates by 25 basis points (0.25%). Federal Reserve (Fed) Chairman Jerome Powell said, “Raising rates is not our plan.” The comments are based on the belief that people are still feeling inflation.

Interestingly, Fed Chairman Trump said he would not step down if he was asked to take over the SEC (Securities and Exchange Commission) over his plans to reform US cryptocurrency laws.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.