$4 Billion Bitcoin, Ethereum Options Expiring

The crypto market closes today with $3.98 billion in Bitcoin (BTC) and Ethereum (ETH) options contracts. This large time lag could impact short-term price action, especially since both assets have recently declined.

With Bitcoin options valued at $3.4 billion and Ethereum at $581.57 million, traders are scrambling for a possible exchange.

Top Crypto Options Expiration: What Traders Should Watch Today

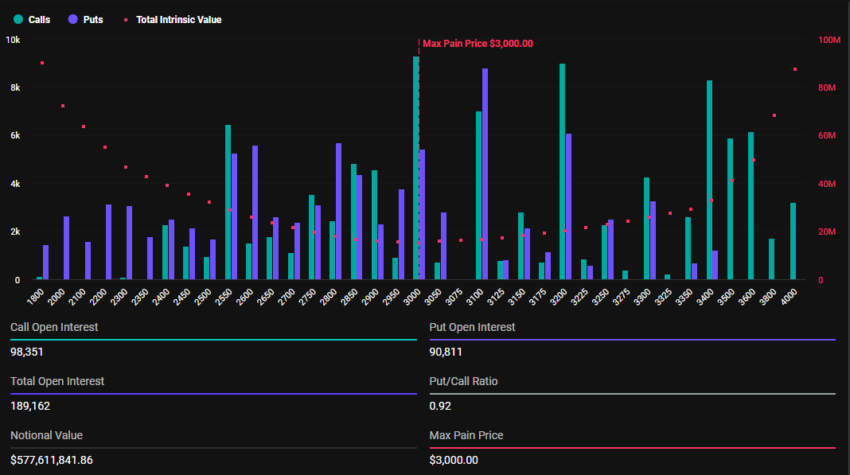

According to Deribit data, Bitcoin options expiration included 38,566 contracts, compared to 48,794 contracts last week. Similarly, Ethereum expiring options totaled 189,018 contracts, down from 294,380 contracts last week.

For Bitcoin, the expiring options have a maximum strike price of $79,500 and a call to call ratio of 0.85. Although this asset has recently pulled back, it shows a generally bullish sentiment. In comparison, their Ethereum counterparts have a maximum pain price of $3,000 and a price to call ratio of 0.92, indicating a similar market outlook.

The peak pain point is often a critical metric that drives market behavior. It represents the price level at which most options are worthless, causing the greatest financial “suffering” to traders.

Meanwhile, call ratios below 1 for both Bitcoin and Ethereum suggest optimism in the market, with many traders betting on a price rise. While put options represent bets on a price decline, call options represent bets on a price rise. Taken together, this ratio (call-to-call ratio) measures market sentiment.

Traders and investors should be looking for volatilityAs option expirations often result in short-term price fluctuations, which Creating market volatility.

“The market can be very volatile, so trade carefully,” warned a wise counsel from a top Asian crypto influencer.

However, markets usually stabilize as traders adjust to the new price environment. With today's high volume of expirations, traders and investors can expect similar results, which may affect future crypto market trends. As Bitcoin and Ethereum options near expiration, both assets may be offered their respective strike prices.

This is a result of Max Payne's theory, which predicts that option prices will converge around strike prices and expire when the largest number of contracts – both calls and puts – are worthless.

More Headwinds From Year-End Crypto Options Expiration

While markets are still optimistic, the general view is that Bitcoin's upside potential remains viable, potentially reaching $100,000 before the end of the year. However, big problems lie ahead, with many crypto options expiring at the end of the month and possibly even more (about $11.8 billion for BTC) on December 27.

These dates are important because Bitcoin bull runs tend to end right at the end of the year, between November and December. However, considering that they only start between October and November, they usually extend into the first months of the new year.

The expiration of these Bitcoin options at the end of the year could be the main trigger. It can immediately affect the price action as well as the journey in the new year 2025. The bulls see the end of the year as a unique opportunity to enter the barrier above $100,000, and the bears have vowed to limit the price gains to defend their position.

“When we look at the options market, the market is clearly polarized and trading is very fragmented, some big traders are going to the sky, many traders are currently on the short side of the market,” Greeks.live shared. .

If the positioning battle intensifies towards the end of the year, the collapse of these expiring options could roll over to December, setting new benchmarks for Bitcoin and Ethereum.

According to the latest data, the trading price of Bitcoin fell by 2.46% to $87,813. Similarly, Ethereum fell by 5.43%, now trading at $3,053.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.