4 Signs of the Beginning of a Bitcoin Bull Market

It's been almost two years since Bitcoin (BTC) reached its current all-time high. Experts point to four reasons that indicate the beginning of a new Bitcoin bull market. Let's look at them in a little more detail.

The period of bearish trend and market stagnation is coming to an end. But what are the signs that a Bitcoin bull market is approaching?

The situation on the Bitcoin chart

The price of Bitcoin moves in cycles. The digital asset industry as a whole has a strong opinion on this topic, as cryptocurrency trades in a cycle that lasts about four years. This means that in each cycle, the digital asset industry goes through bull market phases and then crashes.

Read more: Bitcoin Half Cycles and Investment Strategies: What You Need to Know

The halving happens every 210,000 blocks and the rate of issuing new BTCs is halved. For this reason, in such a situation with stable demand, the value of the property should increase. And of course it's growing – at least this pattern has never been broken after the previous three halves.

The next half will take place in spring 2024. The exact date of this event cannot be known at this time, because the process depends on the number of blocks produced.

Under ideal conditions, each block takes 10 minutes to mine. However, in reality, the blocks come out quickly and slowly. The shorter the time remaining before the decline, the more accurate the predictions will be.

However, according to NiceHash, the next Bitcoin halving is 157 days away.

More recently, however, there has been a growing consensus that global geopolitical tensions will play a major role in the halving. This forces people to lose faith in the traditional economy and look for alternative means of storing value.

Who is saving Bitcoins?

Whalers are big investors with more than a thousand BTC in their wallets. This means that we are talking about experienced market players with large capital who can influence trends.

Whales are still actively hoarding cryptocurrencies, according to new research by Glassnode analysts. Now they do not sell coins, which affects the situation in the digital asset market very well.

Read more: A comprehensive guide to tracking smart money in the Crypto market.

Investors with small amounts of money in their accounts do the same. For example, “crab” wallets with less than 10 BTC have accumulated 191,600 BTC in the last thirty days for a total of more than 3.1 billion dollars.

This is the record number of coins used by this category of investors. This means that different capital owners have an interest in the digital asset.

Spot ETF Approval on the Horizon?

Major financial institutions have been struggling for years to launch their own Bitcoin exchange-traded funds. However, the debate only took place in the summer of 2023, thanks to the world's largest investment firm BlackRock, which joined the race and submitted an application.

Previously, the US Securities and Exchange Commission (SEC) refused to approve ETFs. However, in the past four months, the SEC has lost two major lawsuits against cryptocurrency companies and has come under intense pressure from the US Congress. With this in mind, the regulator is still expected to approve the launch of a Bitcoin spot ETF, which would be a serious source of capital for the entire crypto industry.

The potential impact of the approval of the Bitcoin-ETF in the US has been seen in the past. In October, Cointelegraph incorrectly published news from BlackRock about an ETF approval. Despite being fake news, the price of Bitcoin rose from $28,000 to $30,000 in a matter of minutes. With the real adoption of ETFs, the development of the cryptocurrency market will become more dynamic.

Read more: How to prepare for a Bitcoin ETF: A step-by-step approach

Cryptocurrency investors are preparing for a bull market.

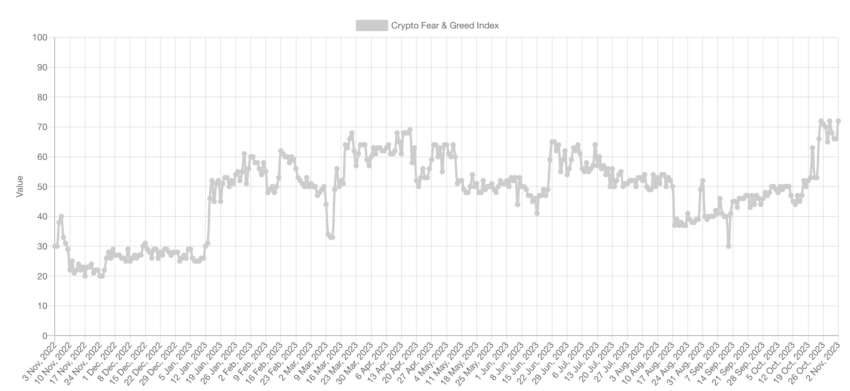

Alternatively, on November 6, the Bitcoin Fear and Greed index rose to 74 points out of 100, its highest level in more than a year, a clear sign of optimism among investors and traders.

Read more: What is the Crypto Fear and Greed Index?

Many investors believe that assets should be sold when the market is favorable. However, in this case, the market is still far from this situation, and the indicators are simply optimistic about the end of the downward trend.

The possibility of a new bull market in the digital asset market doesn't seem too far away anymore. Digital assets now seem very attractive to capital owners. Enthusiasts of cryptocurrency, therefore, should probably prepare for the influx of money in the market.

It is also worth mentioning that the crypto market is subject to high volatility. Therefore, readers should do their own research before making any investment decisions.

Do you have anything to say about the Bitcoin bull market or something else? Write to us on our Telegram channel or join the conversation. You can also find us on TikTok, Facebook or X (Twitter). Click here for BeenCrypto's latest Bitcoin (BTC) analysis.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content.