$5.55 Billion Crypto Liquidations in April: Lessons to Learn

In an unusual display of market volatility, the cryptocurrency market declined $5.55 billion in long and short positions this April. This was mainly fueled by the speculation surrounding the Bitcoin halving event.

This period of chaos serves as fertile ground for critical insights and strategic adaptation of investment practices.

Volatility Hits Pre-Bitcoin Decline

Rosemary Dávila, an experienced crypto financial advisor, provides insights to BeInCrypto on best practices for navigating these turbulent times.

When building an investment portfolio, she suggests having a clear purpose for each asset, both short- and long-term. Davila highlights the importance of a well-defined strategy, as Bitcoin's inherent volatility requires a more nuanced approach.

Indeed, this year's halving has had a huge impact on the Bitcoin market, with prices hitting an all-time high of $73,737 in March. However, the following weeks brought volatility, with Bitcoin experiencing a 20% price correction and some altcoins dropping more than 70%.

Given the high volatility, Davila strongly advises newcomers to the cryptocurrency market to proceed with caution.

“The best thing is not to panic and rush to buy like crazy, because Bitcoin is volatile. I think the best advice is to set aside a certain amount every month and buy at an average price, and until then, see how you feel about these highly volatile investments. With a clear strategy, market noise shouldn't bother me. Davila told BeinCrypto.

Read more: Crypto Portfolio Management: A Beginner's Guide

She also understands the psychological dynamics in the game, especially the half-time postseason. The reduced supply of bitcoins causes price increases due to demand – classic supply and demand volatility. If the investment portfolio is in line with expectations, it is recommended to stay the course.

Otherwise, Davila suggests that investors should consider relocating or adding to holdings after price corrections, but never during periods of high prices. It is important to remember that the crypto market is influenced by many external factors and is difficult to predict with certainty. Still, following previous Bitcoin halvings, the price stabilized after the initial spike as capital flowed into altcoins.

Managing emotions and expectations

Addressing the impact on investors, especially startups, Davila emphasized the potential psychological pressure. Frequent and sensationalist news coverage of a dwindling Bitcoin supply creates anxiety among investors. This fear of missing out can lead to unexpected decisions.

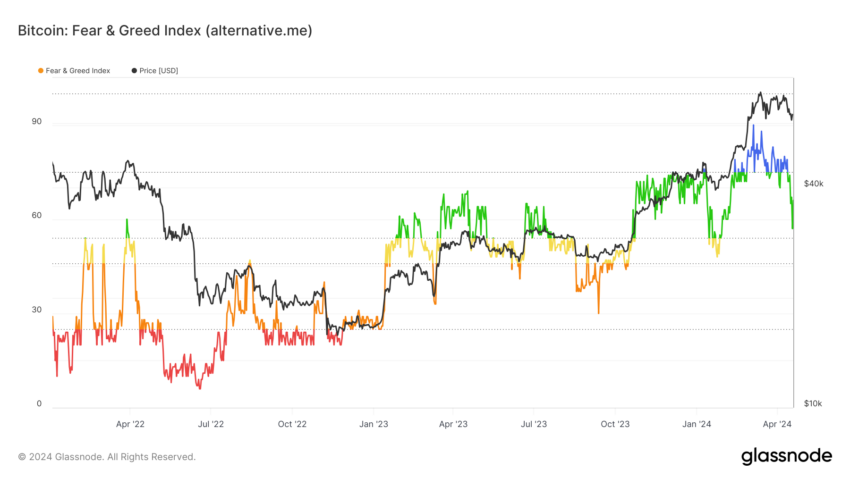

She pointed out that market sentiment, which is estimated by the fear and greed index, currently indicates “greed”, which indicates an overestimation and a possible correction. Even if bitcoin exchange-traded funds (ETFs) are halved and in their early stages, “the analysis method should remain the same,” advises Davila.

Finally, she discusses operational strategies for different investment horizons. For short-term speculative holdings, for example, she believes it's critical to use popular platforms with daily trading volumes and user engagement. For long-term containers, safe storage in cool bags is good.

Read More: Top 11 Platforms to Trade the Cheapest Cryptocurrencies

As the discussion about cryptocurrencies evolves, Dávila sees Bitcoin's utility in transactions and its acceptance as a legitimate financial asset increasing, especially as the regulatory landscape adapts.

Disclaimer

Following Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is committed to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its employees. Readers should independently verify information and consult with a professional before making decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.