5 key events to watch this week

This week is full of key economic events that have a huge impact on the crypto market. These macroeconomic data come as market participants prepare for the year-end holiday rush.

Meanwhile, Bitcoin (BTC) continues to hold above the $100,000 mark, with traders and investors expecting more on the expected Christmas rally.

US macroeconomic data that may affect Bitcoin sentiment this week

Crypto market participants, traders and investors will be watching the following US economic data this week for price implications.

S&P flash services and production of PMI data

The week begins with Monday's release of S&P flash services and manufacturing purchasing managers' indices (PMI). PMI data derived from monthly business surveys serve as key indicators of economic health, often used to forecast market trends and assess business conditions.

November services PMI stood at 56.1, while the December consensus forecast was slightly lower at 55.3. Meanwhile, the manufacturing PMI, which was 49.7 in November, is expected to decrease slightly to 49.6 in December. A PMI above 50 indicates economic expansion, while a reading below 50 indicates contraction.

If the data shows strength in the services and manufacturing sectors, it could strengthen overall economic confidence. This optimism may increase investors' appetite for risky assets, including cryptocurrencies. However, economists are cautious about concerns about the broader economic outlook.

“The US economy is now in total SHAMBLES. We've had an inverted yield curve and an ISM manufacturing PMI below 50 for almost a year now. The inversion in the yield curves has successfully predicted the last 7 crashes. Before Covid and 2008, the crash ISM manufacturing PMI was below 50,” shared a popular user on X.

Retail sales data

Another US economic data that will interest crypto market participants this week is retail sales data. After the 0.4% reading in October, economists forecast a 0.6% reading for November. The retail sales data provides insights into consumer spending patterns and overall consumer confidence.

If retail sales are strong, it can be seen as a positive sign for the economy, indicating that consumers are spending more. This may lead to increased investor confidence in traditional financial markets, which may also seep into the crypto market.

Retail sales data can also affect inflation. If retail sales are strong, it could indicate rising demand and higher inflation. Cryptocurrencies like Bitcoin are often considered a hedge against inflation, so any signs of inflation could drive investors into cryptocurrencies.

Famous analyst Mark Cullen said, “Strong sales = huge markets, weak = vulnerable.”

Federal Reserve Interest Rate Decision (FOMC)

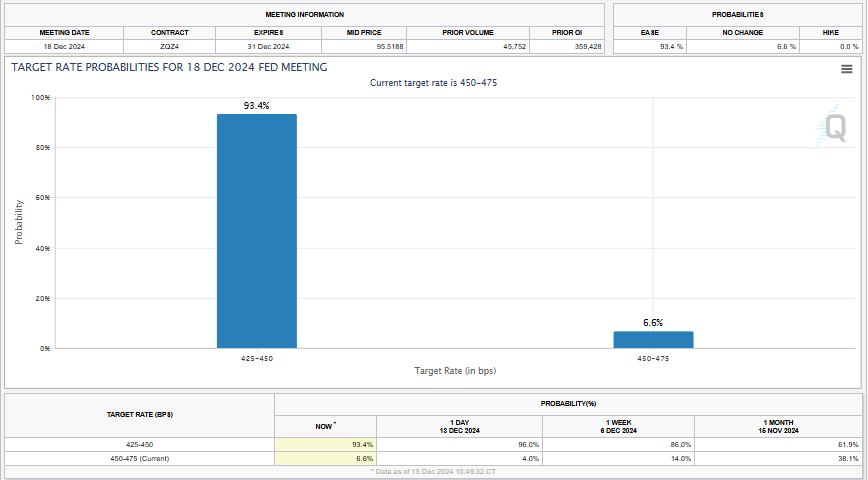

However, the highlight of this week's US macroeconomic data will be the Federal Reserve's (Fed) interest rate decision on Wednesday. Crypto markets support market swings in anticipation of whether the Fed will hike or lower.

According to the CME FedWatch Tool, markets are expecting a rate hike of 25 basis points (0.25% bps) on Wednesday. This is 50 basis points (0.5%) against the Fed's cut rates of 6.6%.

This reflects expectations that the Fed will take a more cautious stance in cutting interest rates next year. This comes amid signs that progress in bringing inflation down to the 2% target has stalled. Against this backdrop, if intermediate interest rate forecasts show a hawkish shift in the Fed's outlook, investors will tune in to gauge the Fed's point plan.

Shortly after the FOMC, Fed Chairman Jerome Powell will hold a press conference, marking another exciting time for crypto market participants.

“Markets will be closely watching for signs of bullishness or ambivalence ahead. A surprise here could cause significant moves across the board, especially in interest rate sectors,” said a popular user on X (Twitter).

Last week's US Consumer Price Index (CPI) and Producer Price Index (PPI) boosted expectations that the Fed will slow its pace of rate-cutting next year. Specifically, the CPI increased again, while the Core CPI refused to decrease. Meanwhile, the unemployment rate is gradually increasing.

Given this scenario, the FED may continue to cut interest rates by another 0.25%. However, this position may be based on the hope that this is only a temporary situation and that inflation and unemployment will decrease in the future.

Q3 2024 GDP data

On Thursday, the US Bureau of Economic Analysis (BEA) will release a second update of third quarter (Q3) GDP data. This data provides insight into the health of the economy as we approach the end of the year.

Note: This is one of the main indicators of the health of the US economy with an average forecast of 2.9% after the previous 2.8%. This means US GDP grew by an annualized 2.8% in Q3 2024, and markets will be watching to see if the trend continues.

PCE inflation data

To close out the week, November's personal consumption expenditure (PCE) inflation data will be released on Friday. It is a measure of consumer spending that includes all goods and services purchased by American households. This makes it a critical benchmark for the Fed, meaning any surprises could have a direct impact on the Fed's future policy decisions and market sentiment.

According to The Kobeissi Letter, a leading commentary on global capital markets, one-month annualized core PCE inflation hit 3.5%+ as traders awaited November data over the weekend. Meanwhile, the one-month, three-month and six-month annualized core PCE inflation rates are all rising here.

Similarly, one-month annual supercore PCE inflation is now nearing a record high of 5 percent. On the other hand, supercore PCE inflation is above 3.5% and rising. Taken together, these data show that consumers in many categories are under high inflation pressure.

Based on the above, the week could be wild, with high volatility around these events. At the time of writing, BTC was trading at $104,991, a modest 2% increase since the opening of Monday's session.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.