97% of Arbitrage Holders in Bankruptcy: Is Arbitrage’s Future Gloomy?

The L2 ecosystem of the Ethereum blockchain is growing every day. But Arbitrum, who gathered so many people, could not support him. Among Ethereum layer 2 solutions, Arbitrum was found to be the lowest performing L2.

ARB token is downloading.

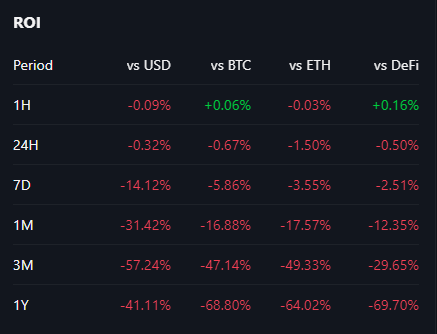

According to Messari, the arbitrage proved to be a loss-making settlement for investors. Since its token launch in January 2023, it has been steadily declining. From October 23rd to January 24th, there were only three months where the ARB token saw a slight increase. For the rest of the time, the ARB token only disappointed the investors.

The scary information

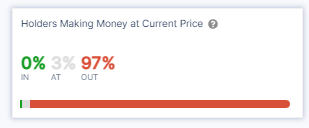

Data from IntoTheBlock shows that only 0.02% of holders are profitable, 3% have neither profit nor loss, and 97% are in significant losses. More than 1.15 million addresses have borne the brunt of this loss.

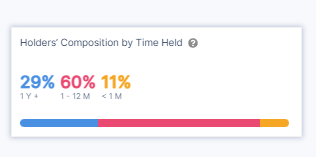

Additionally, only 29% had been on ARB for more than a year, 60% had been on it for more than a month, and 11% had been on it for less than a month. Mesari data confirms that 97% of holders are facing losses.

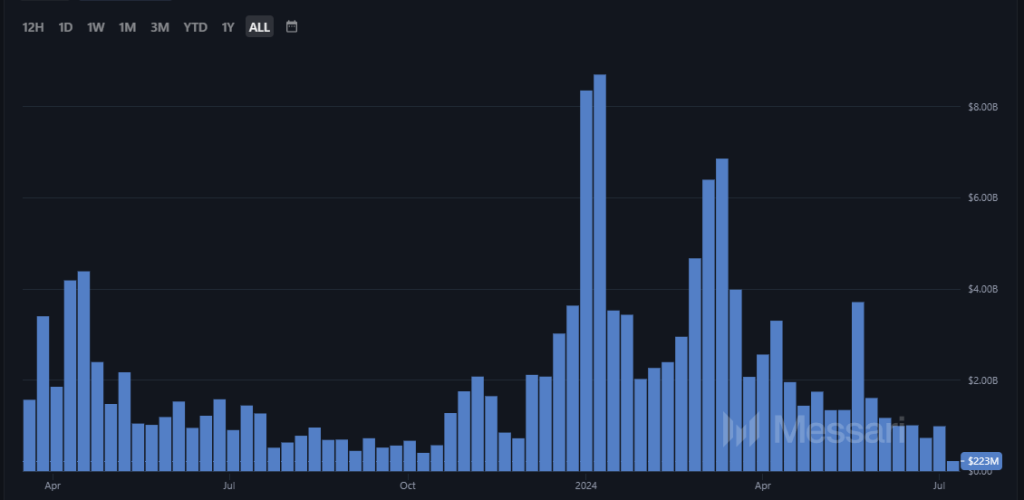

While the Ethereum L2 ecosystem has seen better days compared to arbitrage, it has never been so lucky. And the total amount of arbitrage is decreasing significantly.

When the token was launched in 2023, there was a lot of activity around it. Arbitrum's airdrop attracted investor interest. Additionally, several DApps have been launched on Arbitrum. In January 2024, arbitrage hit an all-time high of $2.39. Since then, the ARB token has fallen 76 percent.

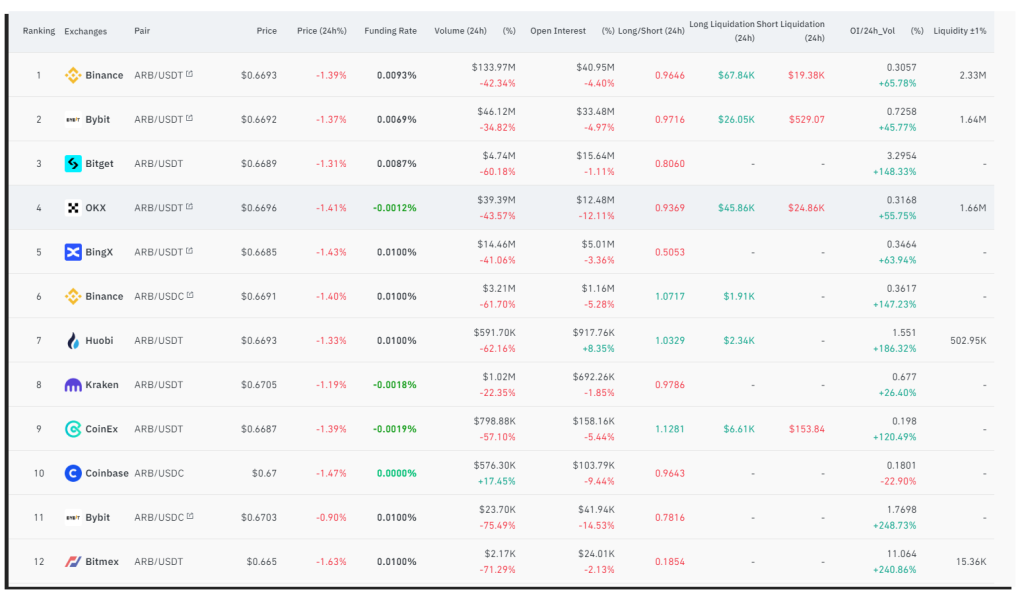

Looking at Glassnode's data, it's clear that there has been a general decrease in ARB token trading volume over the past 24 hours.

The most significant decline was seen in the ARB/USDC pair on Baybit, which fell by 75.49%. However, an increase in OI was also observed. Looking at this, it seems that traders are sure that the price of ARB will increase.