A path to Bitcoin as a reserve asset?

The growing space of bitcoin ETFs (exchange-traded funds) is shaping the crypto market. CryptoQuant Analyst MAC_D notes that these funds control 5.33% of the total mining BTC supply – a significant increase from the 3.15% recorded in January.

This represents an increase of 425,000 BTC in ten months, indicating a growing demand for physically backed Bitcoin ETFs.

Bitcoin ETF stock drives BTC price growth

The analyst highlights the strong correlation between Bitcoin spot ETFs stocks and price movements. This trend was particularly evident during the March and November price spikes of Bitcoin, which were fueled by significant ETF inflows and positive market sentiment.

“Spot ETF volume increased by +425,000 BTC in January to 629,900 BTC → 1.0545 million BTC when sales began. This is an increase of 2.18% in 10 months or 3.15% → 5.33% of the total mining supply of 19.78 million BTC. March has seen impressive price increases. And looking at November, we see a strong correlation between stockpiling and inflation, the analyst explained in a post on X.

Indeed, in March, U.S.-listed Bitcoin ETFs reported net inflows of nearly $4 billion, driving trading volume to $111 billion—nearly three times as much as in February. During the same period, the price of Bitcoin on Coinbase rose to a then-record high of more than $73,777.

Similarly, in November, amid heightened expectations of Donald Trump's re-election and regulatory support for crypto, Bitcoin soared above $93,265 on Binance, marking an all-time high.

“The more bitcoins are accumulated in spot ETFs, the stronger the value,” added Mc_D.

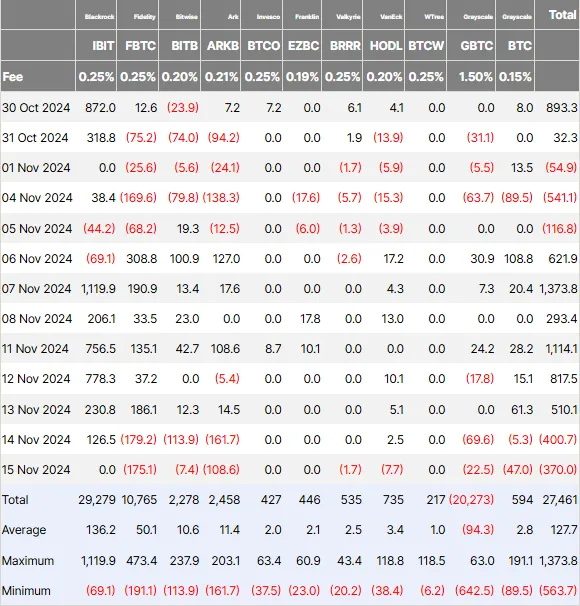

BlackRock's iShares Bitcoin Trust (IBIT) continues to dominate the spot ETF market. Recent data shows the fund has more than $40 billion in assets, with net inflows of more than $3 billion as of Nov. 6.

While the broader US Bitcoin ETF market had a mixed performance this week, IBIT strengthened its lead by adding $2 billion in net income.

Overall, US Bitcoin ETFs recorded $2.4 billion in inflows in the first half of last week. However, redemptions on Thursday and Friday brought the week's net income down to $1.6 billion, as shown above.

Regulatory Tailwinds Bolster ETF Adoption

The rise in Bitcoin ETF adoption is closely tied to changing regulatory frameworks. Recently, the US Securities and Exchange Commission (SEC) approved Bitcoin ETF options. This chapter coincides with the recent progress of the Commodity Futures Trading Commission (CFTC), which has cleared the way for Bitcoin options trading.

Recently, the SEC and CFTC approved the listing of the eco-conscious 7RCC Bitcoin and Carbon Credit Futures ETF. Together, these developments will legitimize Bitcoin ETFs and increase their appeal to institutional investors. This regulatory support played a vital role in building confidence and bringing capital to the market.

Optimism surrounding the favorable regulatory environment under the new US administration has led to further inflows into Bitcoin ETFs. In turn, policies that support the digital asset industry have heightened expectations, further accelerating Bitcoin adoption through ETFs. BeinCrypto recently reported that Bitcoin ETFs are now in 60% of our top hard fund portfolios.

The role of macroeconomic factors such as Federal Reserve policy and US elections cannot be overlooked. As the Fed eases monetary tightening, riskier assets like Bitcoin are gaining favor.

Looking ahead, analysts predict that the increasing adoption of Bitcoin ETFs could pave the way for Bitcoin to be recognized as a reserve asset. If the US government catches on to this trend, inflows into ETFs are expected to rise even further, strengthening Bitcoin's place in global finance.

Meanwhile, the growing share of Bitcoin held by spot ETFs has broader implications for the crypto market. By controlling more than 5% of the Bitcoin supply, these funds can stabilize liquidity and reduce market volatility.

However, there are concerns about institutional control over Bitcoin, as this would be contrary to the original decentralized ethos of the pioneering cryptocurrency.

“Doesn't this defeat the whole purpose of “decentralization”? Blackrock will be the biggest hodler, it doesn't get more centralized than that,” said one X user.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.