A spiraling decline among American investors

According to a comprehensive survey of American investors after they wait for new investments in the US, whether they enter the US ownership level or enter the US ownership level.

The findings show that risk-taking investment behaviors such as earnings conditions and investor vestries move from investment behaviors that result in surprising results.

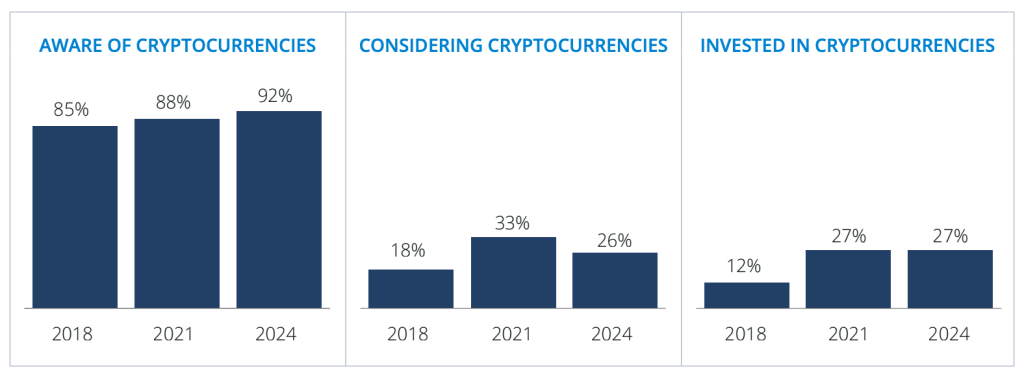

According to the survey investment (investment) investors with pension investment accounts, in relation to 20,861 investments, 27% of digital assets have changed with 2021, but now it is only buying more than 33%, compared to 20% three years ago.

New investors as market enthusiasts

The American investment market has been in an amazing state since the introduction of the investment market.

Only 8% of current investors started in the two years before the 2021 survey, compared to 21% of them.

The rider points to the tide of the ship – participation in the local development market is particularly affected by active adults.

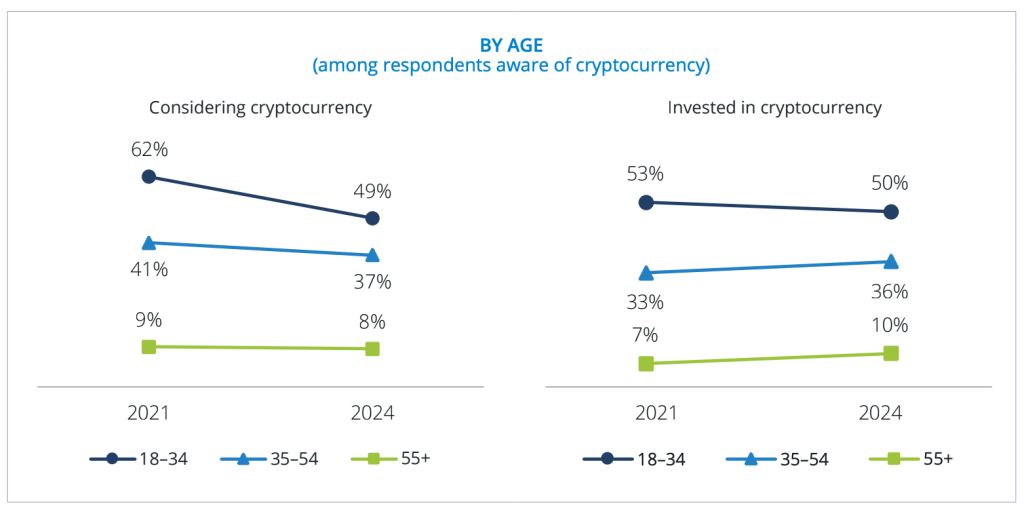

The rate of participation of young investors under 35 years in 2024 in 2024.

Similarly, the investment rates between people of color and men have changed the increase observed three years ago.

In the year 292-2021 through investors who entered the market, many of the younger participants left the market completely, from 30 to 38, from 31 to 38.

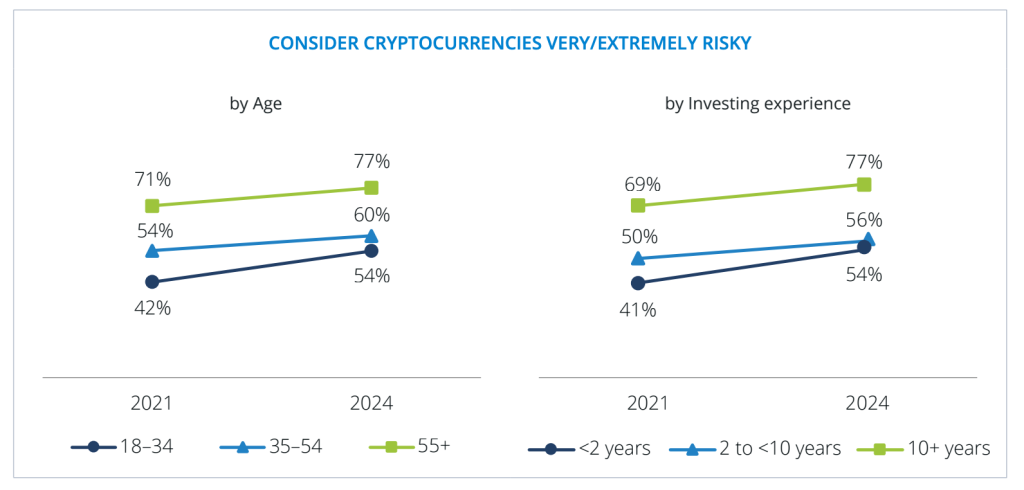

In addition to frozen entry rates, investors returned from various risk positions. 56% of those who know that digital assets are more dangerous than 58% of those who know.

Percentages of penny stocks, private placements, and structured notes all returned to 2018 levels after a short period.

Demographics of wrong appetite complaints

Investors willing to accept significant portfolio risk will increase from 1224 in 2021 to 1224 in 2024. From 1224 From 1224 to 821 From 1224

Among investors under the age of 25, those willing to take high risks fell from 24% to 15%; 62 percent of this age group believe that they need to take big risks to achieve their financial goals.

“The latest Feynman Foundation research provides insights into market conditions,” said Jonathan Sokobin, the Economist Foundation's Chief Investing and Investing Economist.

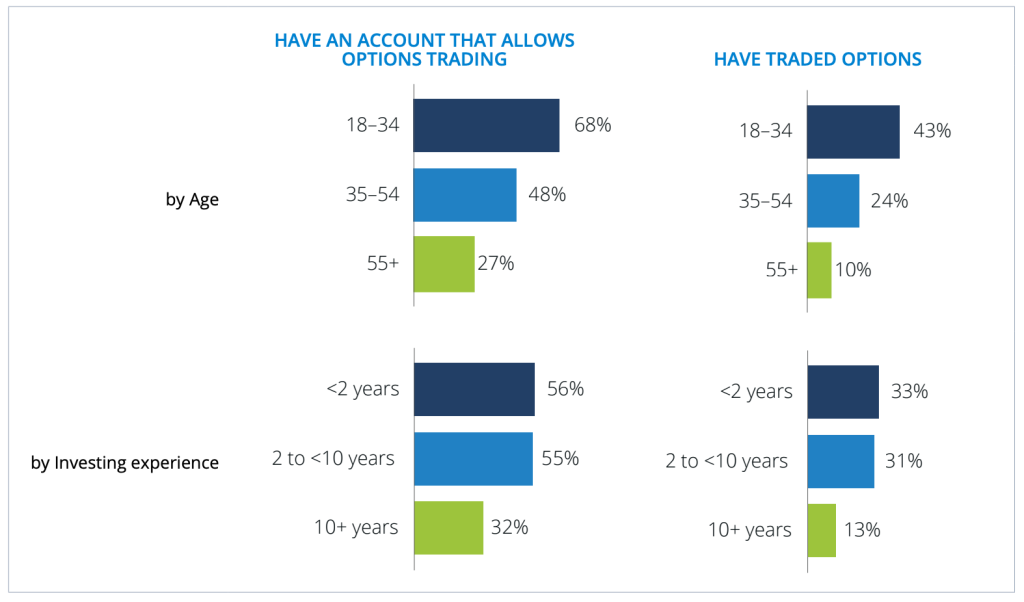

Despite their appetite for risk, young investors continue to engage in behaviors that hold more potential.

Of the 35, 10% of investors are below 10% and above and below 10% and above and above, 22% are marginal investors, 44% are only older participants.

Meanwhile, 13% of all investors, including 29% of those under 35%, are buying MEES shares or viral investments.

The rejection of Cresspto seems to be very surprising among these investors. In 2024, digital resources were concentrated from 621 to 48% of those with experience under the age of 62, from 2 points to 1 to 48%.

Among investors under the age of 35, the share of older investors rose from 62% to 49% compared to younger investors.

The study found that social media's “proactive communication skills” now guide investment decisions for up to 61 percent of investors under the age of 35.

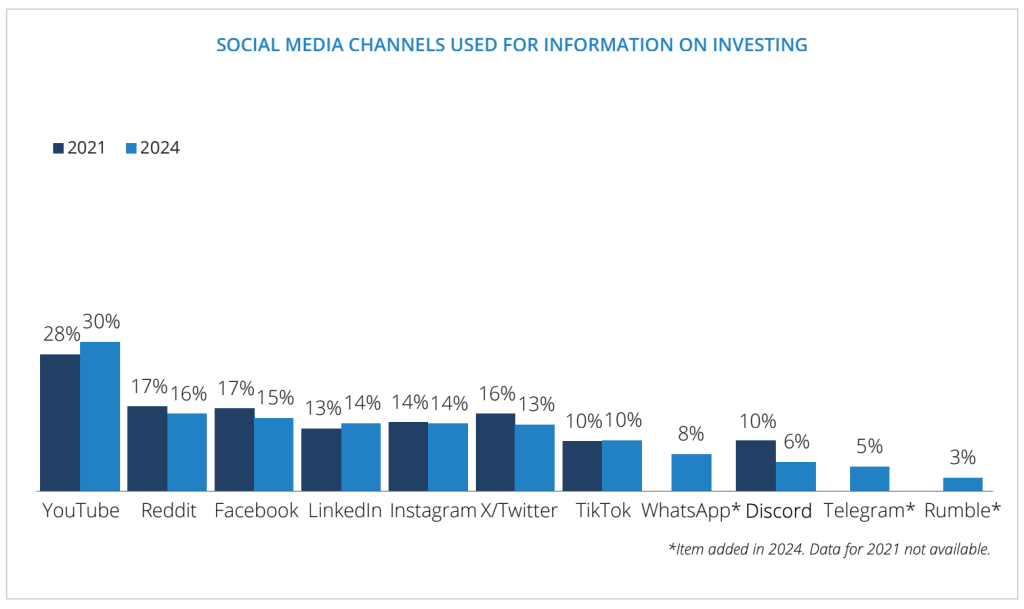

YouTube for King-in investment information, more than 30% use, more than 30% use, 61% of the exiting investors out of 30%.

More than 85 percent of investors from friends and family have emerged as the top source of information for more than 85 percent of investors.

Concerns about investment fraud have been raised, with 37% of respondents worried about fraud, up from 1321 and 30% worried about losing money.

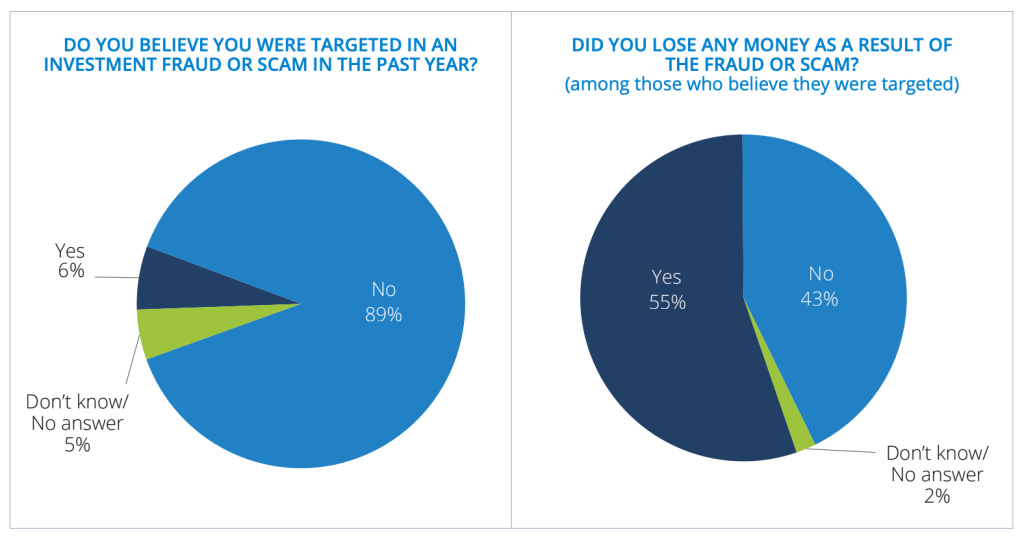

However, the vast majority, 89%, do not believe that they are targeted in investment fraud.

In relation to fraud, “guaranteed, when the risk is presented with 25 annual returns” investors are investing, they said that they buy large gaps in the awareness of fraud.

Finfer Foundation President Prestri Wall O emphasizes the importance of foreign investor education.

They are knowledgeable and risk assessments in cooperation with the capitals can still easily leave the attractiveness of the value, “he said. “The investment education efforts remain very important.”

In particular, the findings defy broader market trends, with specific studies indicating that more than 50 million American adults now own digital assets.

In addition, among the younger generation of people looking for alternative wealth building strategies to increase home values, home ownership is being prioritized.

Closing news news analysed, cryptographic predictions