A survey shows that Bitcoin will drop to $20,000 in January 2025

A Deutsche Bank research report shows gloomy investor sentiment. More than a third of individuals surveyed believe Bitcoin will drop below $20,000 by January 2025.

Recent trends show a significant change in the cryptocurrency market. Leading digital currency Bitcoin fell below $39,000 yesterday, down 20 percent from its regional high.

Will Bitcoin Fall to $20,000?

This survey involved 2,000 people from the US, UK and Eurozone. It was held from January 15 to 19. Despite the pessimistic view, 15% of participants see the possibility of returning. By the end of the year, they expect the price of Bitcoin to rise from $40,000 to $75,000.

On January 11, the price of Bitcoin rose to $49,000. This increase is due to the excitement in the new space Bitcoin ETFs. It was the highest point since March 2022.

However, the sales that followed resulted in a sharp decline. As of writing, the value of Bitcoin is around $40,000.

Read more: What is a Bitcoin ETF?

Deutsche Bank analysts Marion Labore and Cassidy Ainsworth-Grace highlighted expectations from the new position Bitcoin ETF in expanding the institutionalization of this classic digital asset. Despite this, most of the ETF's revenue came from retail investors, the report said.

The investment landscape has changed, with nearly $4 billion pouring into the new space Bitcoin ETFs, mainly those managed by BlackRock and Fidelity. This migration, however, was balanced by a $2.8 billion move from funds to ETFs out of grayscale.

“Despite only ~1 week since launch, the first net entry into Bitcoin ETFs appears to be much smaller than the crypto community was in the financial media, and less than what we saw in the first week of entry into the gold ETF when it launched in 2004.”

We think most of the crypto-industry will set the bar high for ETF launches, and while it makes sense, we think the expectations are too high and unrealistic,” said a JPMorgan analyst.

Pre-half correction?

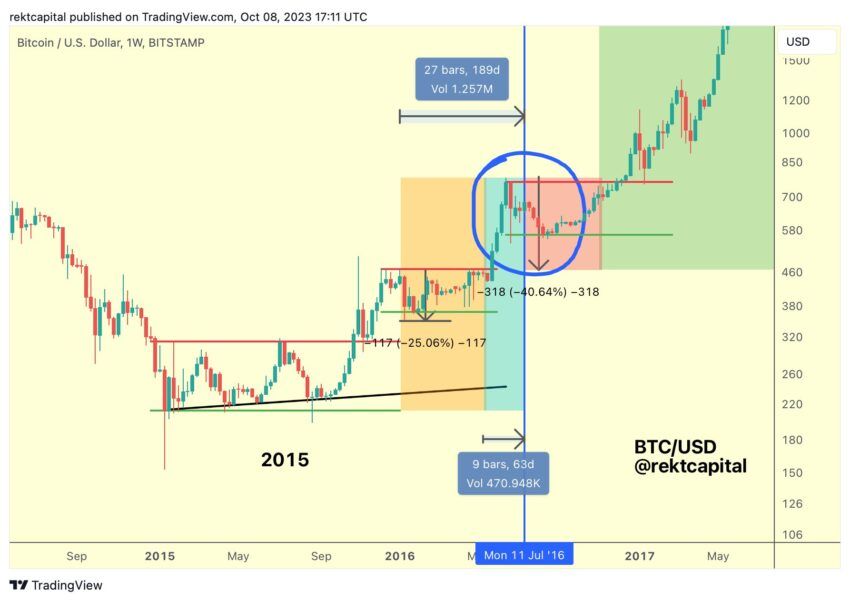

However, there is a historical pattern that offers a glimmer of hope. Bitcoin markets are known for their cyclical nature, often echoing past trends. A study of the 189-day lead-up to the 2016 Bitcoin halving showed a 25% retracement in Bitcoin's price, indicating a pre-halving rally that lasted up to two months before the event.

In each previous cycle, the peak of the Bitcoin bull market occurred during the year following a halving, suggesting a potential peak in 2025. The current market direction also closely mirrors the 2019 fractal.

Read more: Bitcoin half-cycles and investment strategies: What you need to know

If this pattern holds true, the first quarter of 2024 may witness a crash in the cryptocurrency market. This scenario seems even more plausible amid the pre-halving hype and excitement surrounding the approval of the Spot Bitcoin ETF.

In conclusion, while Bitcoin's recent future appears to be full of uncertainty, its history of cyclical patterns provides a road map for possible future trends.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.