AAVE Price Open, Next New Annual High?

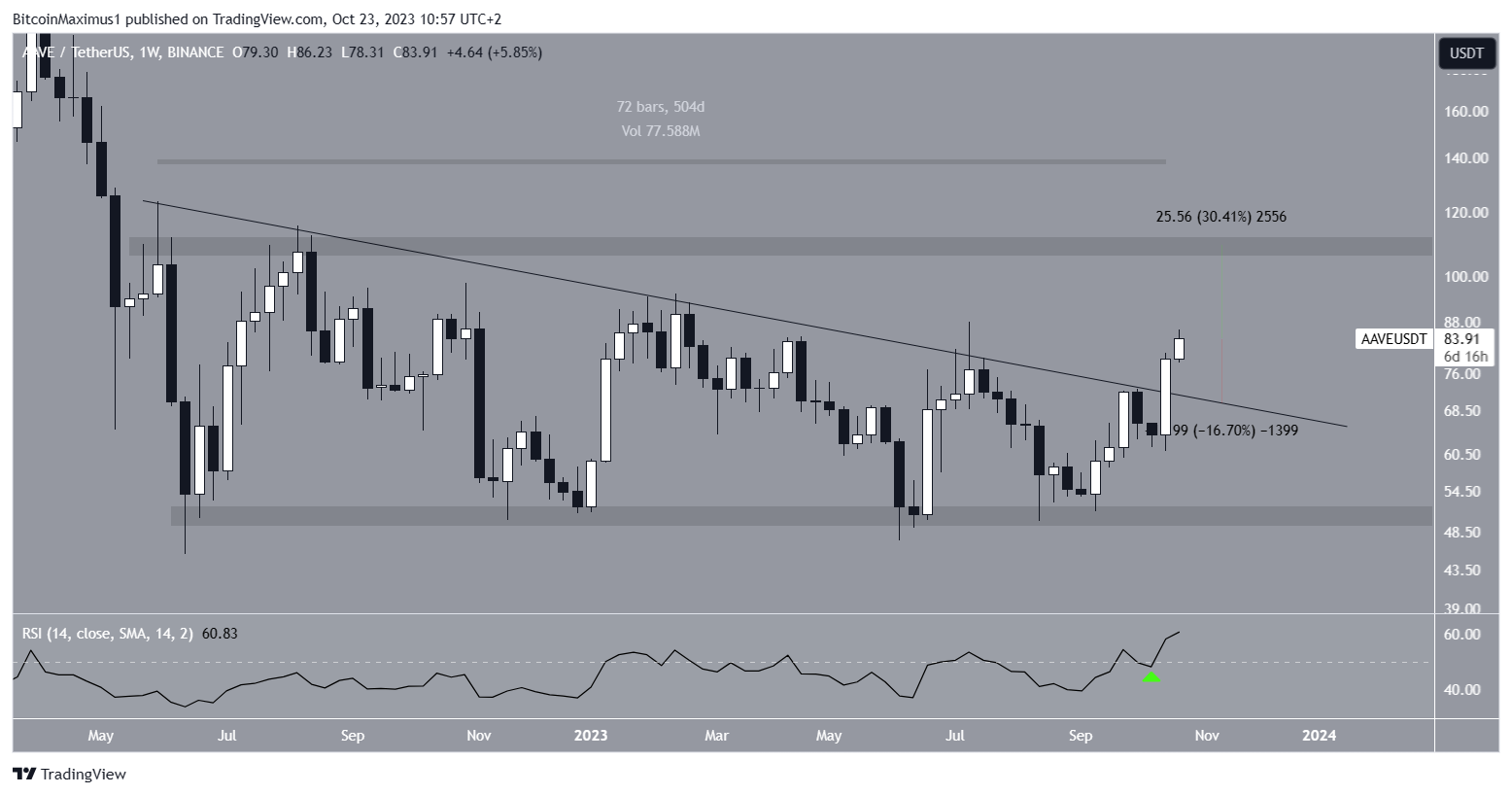

AAVE price breakout from last week's 500-day downtrend trend line rose above $86 today.

The price is approaching the $110 resistance area from May 2022. Will it happen?

AAVE breaks out of the 500-day resistance trend line

The weekly time-frame technical analysis shows that AAVE has declined at the descending resistance trend line from May 2022. The decline led to a June 2022 low to $47.30, confirming the $50 horizontal area as support (green icon).

AAVE has increased since its inception, forming a higher low (white icon) in August.

Read more: 9 Best AI Crypto Trading Bots to Maximize Your Profits

After four failed AAVE price rejection attempts (red icons), the altcoin finally broke out of the resistance trend last week, reaching a high of $86.23 today.

At the time of the loss, the line lasted more than 500 days.

Cryptocurrency analysts at X are mostly bullish. Crypto Tony and Eliz883 both outlined a long-term downtrend resistance, noting that the breakout is a strong sign of an upcoming bull run.

WolrdOfCharts revealed a long-term bearish resistance trend, which was from an all-time high.

He believes a similar bull run has begun.

Read more: 9 Best Crypto Indicator Accounts for Trading

AAVE Price Prediction: How Long Will the Increase Continue?

With RSI as a momentum indicator, traders can determine whether the market is overbought or oversold and decide whether to accumulate or sell an asset.

Bulls have the advantage if the RSI reading is above 50 and the trend is up, but if the reading is below 50, the opposite is true.

The weekly RSI legitimizes a breakout. This is because the RSI has moved above 50 (green icon) and reached a high of 60.

This is the highest price since April 2021, when prices are nearing their all-time high. Long-term downtrend resistance combined with recent trends is a sign that the trend has turned bullish.

If the price of AAVE continues to go up, it can increase by another 30% and reach the next closest resistance at $110.

Despite the high AAVE price forecast, failure to sustain the increase would result in a 17% decline to confirm trend resistance at $68. This can be caused by a weekly closing of the depression.

Read more: Best 9 Telegram Channels for Crypto Signals in 2023

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.