After BTC and ETH, Solana ETF is finally launching!

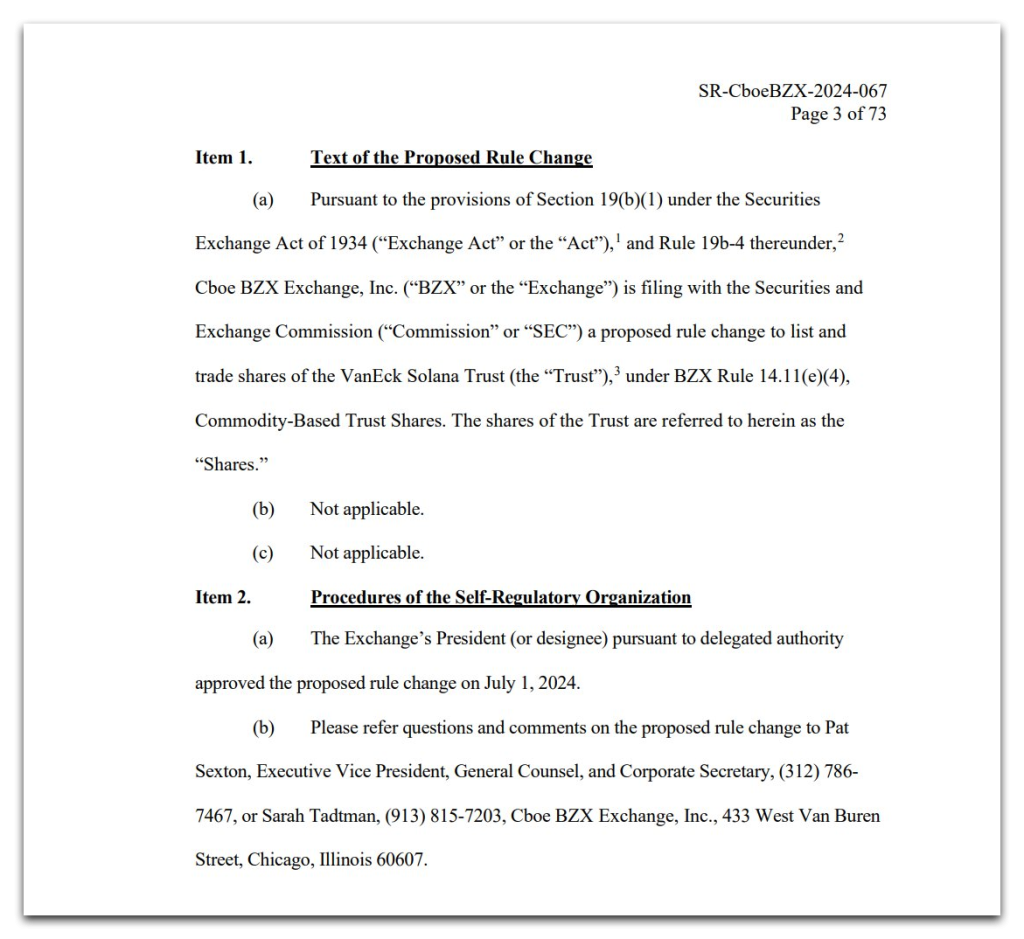

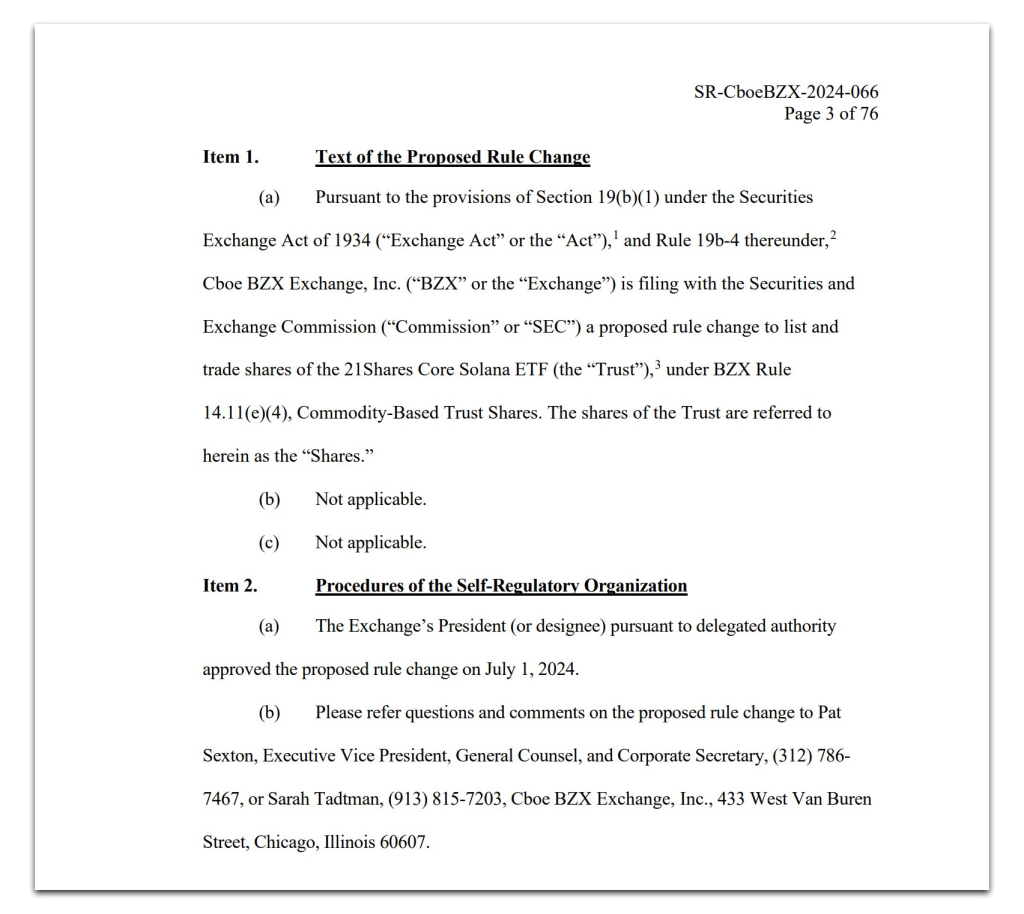

Two hours ago, Matthew Siegel, head of digital assets research at VanEck, tweeted that the CBOE had filed their 19b-4 form for the Solana ETF.

Things are getting pretty serious about the Solana ETF this week. Investment giants VanEck and 21Shares are making a big move to launch Solana (SOL) spot exchange traded funds (ETFs), filing 19b-4 forms with the US Securities and Exchange Commission (SEC). This step is critical to the regulatory process and aims to obtain approval to list these ETFs on the Cboe BZX exchange.

It all started a few days ago, when VanEyck filed an S-1 form on June 27, 2024, followed closely by 21Shares on June 28, 2024. These ETFs are designed to give investors direct exposure to Solana by tracking the spot price. A decision likely due to the current regulatory uncertainty surrounding crypto staking.

Background and previous tests

This isn't the first time VanEck and 21Shares have tried to introduce Solana ETFs. They have been pushing for this for months, emphasizing their commitment to expanding cryptocurrency investment options. Their previous attempts have met with regulatory hurdles, but they show no signs of letting up.

VanEck and 21Shares aren't just focusing on Solana, they're also making significant progress with Ethereum (ETH) ETFs. In May 2024, the SEC approved their 19b-4 filings for Ethereum ETFs, which are set to begin trading soon. This is an important moment as this approval is a major victory and hopes for Solana's EFF approval.

Market responses and expert insights

This investment giant step by the two is a big step in favor of crypto. When news of the first filing hit the air, Solana's price soared. Experts are expecting a similar response from the market about the 19b record.

Experts believe that if these ETFs are approved, Solana's volume and trading volume will increase significantly. But there are still some problems. The SEC still views SOL as a security and there is no regulated futures market for Solana yet, which the SEC thinks is critical to ETF approval.

look forward

VanEck and 21Shares are both trying to get their crypto ETFs approved at the same time, which shows how much interest and competition there is in this market. It may take a while for this to happen, but the benefits can be huge. As the rules and regulations change, approval for the Solana Spot ETF could lead to greater acceptance of cryptocurrencies in the formal financial markets. Investors and people in the industry are eagerly waiting to see what the SEC decides, because it could really affect the future of crypto investments.