After moving above $300, could BNB price hit a yearly high?

BNB's price is up nearly 20% this week, nearing annual highs. This is the biggest weekly increase since 2021.

The upward move took the price above $300 for the first time since May. Will BNB hit a new annual high above $350 this week?

BNB will break from long-term resistance

The price of BNB has fallen below the long-term downtrend resistance line from the November 2021 high. The cut will drop to $184 in June 2022. After that, the price rose but made a failed breakout attempt (red icon) in April 2023 (red icon).

After making a higher low in October, the price of BNB broke out of the trend line last week and has risen sharply this one, although it has yet to reach a yearly high. At the time of the loss, the trend line was for 770 days.

Cryptophobic A cryptophobic trader believes that this crash will start a new long-term uptrend.

RSI is a momentum indicator that traders use to determine whether the market is overbought or oversold.

A reading above 50 and an upward trend indicates that the bulls are still in advantage, while a reading below 50 indicates the opposite. The weekly RSI is rising and above 50 (green icon), both of which are signs of a bearish trend.

Read more: How to buy BNB and everything you need to know

BNB Price Prediction: Is $400 On The Cards?

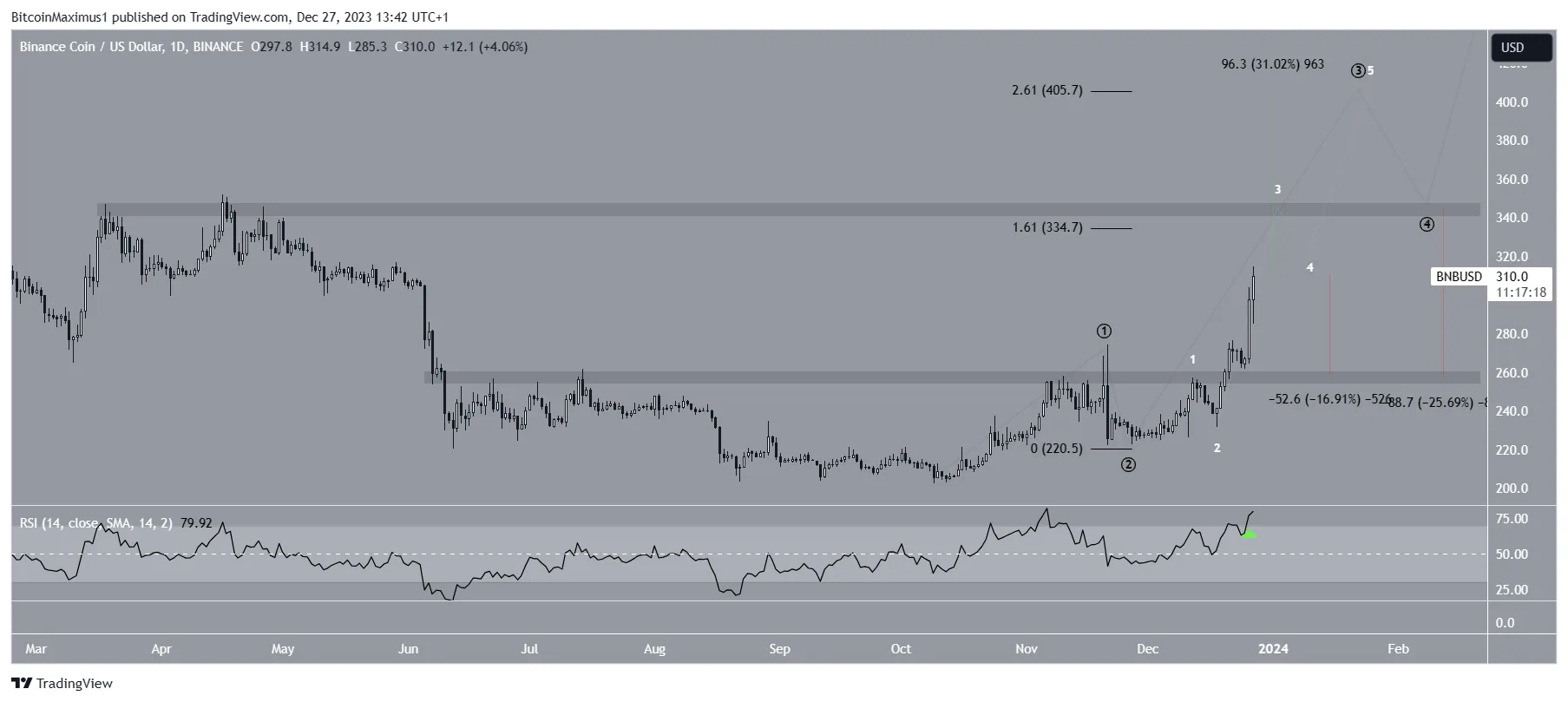

Daily time frame technical analysis supports the next increase. This is due to the number of waves, price action and RSI readings.

Technical analysts use the Elliott Wave theory to determine the direction of the trend by studying recurring long-term price patterns and the psychology of investors.

The most predictable wave count indicates that BNB price is in wave three of a five-wave uptrend (black). The sub-wave count is given in white, with an extended wave showing three.

Read more: What is BNB and how does it work?

The daily RSI is above 50 and rising, and recently moved above 70 (green icon), which is a sign of consolidation strength.

Additionally, the price action shows movement above an important horizontal area.

If the price of BNB continues to rise and rises above $345, it may increase by 30% to the next resistance at $405, which will be the annual high. This wave gives one wave length of 2.61 times three times.

Despite this bullish BNB price forecast, failure to break above $345 will threaten the bullish momentum and lead to a return to the $260 support area. This would be a 17% discount from the current price and a 25% discount from around $344.

Click here for BeInCrypto's latest crypto market analysis.

youtube.com/watch?v=Q_CUjMjtvnI

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action taken by the reader on the information found on our website is at their own risk.