Altcoins in Bitcoin? Analyzing the potential of the Altcoin phase

In the last few months, the price of altcoin has fallen from 30% to 70%, which has led analysts to write off the possibility of the altcoin season. But when armed with new information, BeInCrypto realizes that things can change.

This analysis provides insight into the rationale and rationale behind the proposal.

But the first days, the symptoms appeared

The Altcoin era is a market stage where non-Bitcoin (BTC) cryptocurrencies are outperforming the number one coin and recording consistent price increases.

One of the indicators confirming this period is TOTAL2, which is the total market value of the crypto excluding BTC. When this market value increases, it gives confidence in the altcoin's value increase.

However, a decline means that Bitcoin is dominating the market. At press time, the total altcoin market cap is at $940.37 billion – an increase of 4.87% in the last 24 hours. The same market volume between June 6 and July 8 was initially down 23.26 percent.

Read more: Which are the best Altcoins to invest in July 2024

If the price of the indicator continues to rise, the season of altcoin will be close. The last time such a situation happened between February and March. During that time, the value of TOTAL2 increased from $753.83 billion to $1.24 trillion in one month.

Following the latest change, analysts at X seem to be changing their stance in favor of the dominance of altcoins. One of them is Michael van de Pop, founder of MN Trading.

“Altcoin market capitalization has reached a critical upper timeframe support level and found support here. It's still early in the week, but if this week continues this upward trend, the signs will start to improve,” Van de Pop commented on X.

Bitcoin's Dominance Backwards, May Open Doors For Altcoins.

Opinions aside, another factor that determines whether altcoins' boom is here is Bitcoin's dominance. For the cycle to be confirmed, BTC.D must decrease.

Employing the weekly chart, we note that BTC.D fell from 62.69% in March 2021 to 40.89% in May. As history shows, this was around the same time that many altcoins peaked in the last bull market.

This week, the dominance fell from 55.04% to 54.68%, which indicates that some altcoins have started to increase BTC.

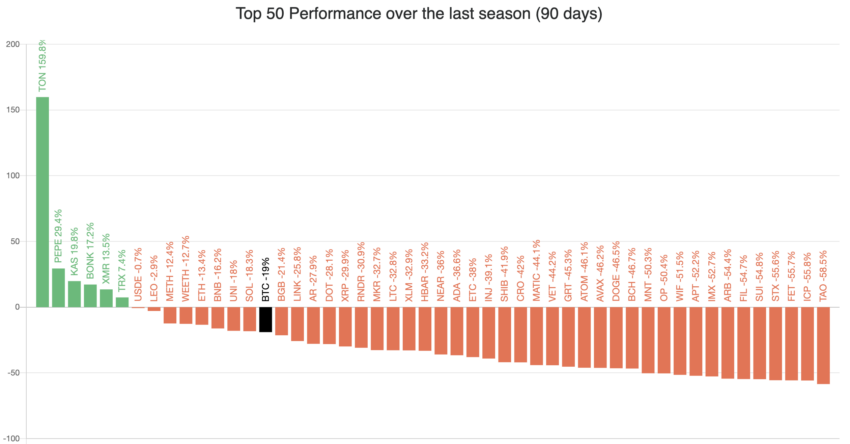

This means that at least 75% of the 50 altcoins must outperform Bitcoin in 2021.

According to data from Blockchain, only a few cryptocurrencies have done that, including a few MM coins. Some of them include TONCOIN, PEPE, CASPA and BONK.

As a result, the Altcoin Season Index remains at 29 in the last 90 days. But this is an improvement from the reading when it was 25 a few days ago.

If the index continues to hit highs, altcoins will be close to retesting their all-time highs, putting BTC on the back foot in the process.

Read more: What are Altcoins? A guide to alternative cryptocurrencies

Ethereum, Solana's role is critical

Additionally, it is important to mention that Ethereum (ETH) has always been acting as a catalyst to develop altcoin dominance.

Over the past few months, ETH has underperformed against BTC. However, the position's approval could cause Ethereum ETFs to see a significant increase in the price of ETH.

If this is the case, other altcoins could potentially join the rally. In the case of Capo of Crypto, the update on the ETH ETF, as well as the official applications of the Solana ETF by VanEck and 21Shares, is why the analyst worries about altcoins.

“The pressure to sell by the German government is sinking. All Spot Ethereum ETF Applicants have officially filed updated S-1s.VanEck and 21Shares 19b-4s for Spot Solana ETFs. I am especially bullish on altcoins over the next few weeks. Capo of Crypto wrote.

Based on the above analysis and market sentiment, altcoins seem poised for a big pump. However, traders should be vigilant.

If selling pressure resurfaces in the market, the hike could be worth it. Also, if Ethereum doesn't receive impressive returns to ETFs, cryptocurrencies may struggle to bounce back.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.