Altcoins may soon experience a “mania phase”: Bitfinex

Share this article

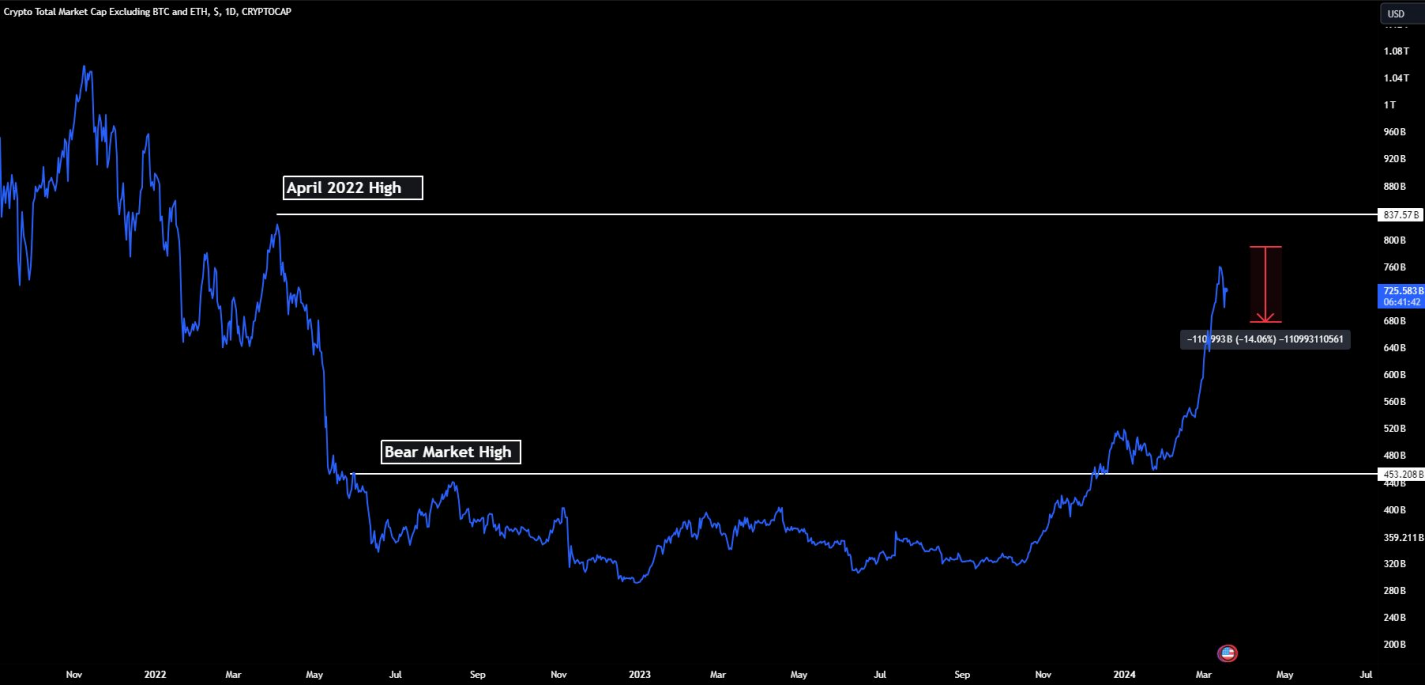

Altcoins have shown significant stability against Bitcoin's recent volatility, according to the latest Bitfinex Alpha report. The Total3 Index, which excludes Bitcoin and Ethereum to measure the rest of the crypto market, hit a new high on March 14 with a market capitalization of $788 billion.

The Total3 index's new cycle high represents a more than 74% increase from its peak during the bear market, indicating strong growth in altcoin investments. This trend highlights the crypto landscape where altcoins are not only gaining traction but also attracting significant capital inflows. The index is now 6.5% shy of its April 2022 peak of $837.5 billion. Exceeding this threshold could send the altcoin into a “mania phase,” characterized by high investor enthusiasm and high revenue in the sector.

While Ethereum's Total Value Locked (TVL) is a key indicator of capital flows into Ethereum Virtual Machine (EVM) compatible chains and projects, the performance of other Layer-1 blockchains is beginning to eclipse Ethereum's historical role for altcoins. Nevertheless, the influence of Ethereum in predicting altcoin market movements is still high.

Despite this improved landscape, Ethereum's performance against Bitcoin has been poor. Denkun's reform did not provide a strong narrative to increase the price significantly, although other altcoins are doing well. The ETH/BTC ratio is approaching bear market lows, a level previously tested before the launch of the exchange traded fund (ETF).

However, there is a silver lining: Ethereum-based altcoin projects are performing strongly, and on-chain metrics point to an optimistic outlook for the ecosystem. Notably, 2024's largest Ether net exchange was recorded last week with 154,000 Ether leaving centralized trading platforms, indicating a short-term upward movement in price. This activity may be due to traders switching their ethereum exchanges to ERC-20 protocols or Layer-2 platforms such as Base mainnet, which has seen TVL double in the past two weeks.

The rise in the base currency of major Layer-1 blockchains for on-chain transactions is a big sign for Ethereum and its peers. This trend not only increases the demand for utility and demand, but also contributes to their resilience during the fall of Bitcoin.

Moreover, the weekly performance of large-cap altcoins shows that Layer-1 ecosystems such as Tron, Near, Solana, Avalanche, Aptos and Binance Chain are outperforming the overall market. Near, in particular, has garnered a lot of investor attention ahead of NVIDIA'S Transforming AI conference, where Protocol co-founder and CEO Ilya Polosukin is scheduled to speak.

Share this article

The information contained or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of information obtained through this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing articles can be supplemented with AI-generated content by HAL, our proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.