Are CBDCS now ‘useless’? He said the market is over

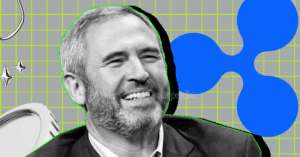

Ripp's chief technology development officer has raised a new debate on central bank digital currencies (CBDCs) and how to re-establish financial freedom.

Schwartz's article “Cash in X” is shared quickly when “cash” takes place, especially after a user asks for a risk to freedom – after asking for a war on foreign currencies or CBDCs.

Here is what he said.

“It depends on when you use it.”

Schwartz answered with an interesting look.

“If CBDC creates more options for people who want to use it, that's good. If it compromises people's options to beat other options, that's bad.”

He added that while some people push for private institutions, giving people the option of government to limit their mining options actually supports freedom in some cases.

But they admit that the market is mostly moved, because it is difficult for the governments to learn from the financial institutions again.

In short, Schwartz believes that “the technology is not the problem, but how it is used does.

Also Read: CBDS “Beneficial CBDCs Raised as Stopcociins”

A growing role in CBDC pressure

RIPRER has already worked with digital currency pilots like Pala, Bhutan, Montene, George, George, and JackAgit. These efforts are not only to organize CBDCs, but also to ensure that not only CBDCCs, but also careful and structured deposits.

That evolution was initiated by both XPL and XRM, a sophisticated, Ripple dollar token. The organized market cap is close to $790 million, backed by DBS Bank and Franklin Temple.

The war on cash: Why is Schwertke careless?

In the article, Schwarzz “” In cash “quietly raised people's financial freedom. Current laws, push individuals to trust individuals to terminate accounts without clear reasons.

He compared it to being forced to eat only in approved restaurants – no choice to cook at home.

He wrote: “That is, how much we are forced to be forced today.

Public pressure on CBDCs in public

Not everyone believes that CBD is the champion of international regulators.

On Reddit, there are frequent discussions about growing public distrust. One user wrote that the experiments in Finland, Kenya and Nigeria could be a “financial disaster”.

Consumers fear loss of privacy, government surveillance and banks losing their due importance. Others have warned of the risk of economic instability and job losses in traditional banking.

Will CBDCs bring efficiency and inclusion or not in a financial era where every transaction is monitored and limited by the government? This is a control trend.

Trust with the agreement

In the year From 2017 To ensure accuracy, transparency and reliability, each article is known in fact. Our review guidelines ensure unedited reviews when indicated by exchanges, platforms or tools. We strive to provide up-to-date information on everything Crypto and Countchant, from origins to industries.

Investment responsibility

All opinions and insights shared represent the market conditions of the author. Please do your own research before making any investment decisions. However, the author or publication is not responsible for your financial choices.

Sponsored and advertisements

Sponsored content and affiliate links may appear on our site. Ads are clearly marked, and our editorial content is completely independent from our advertising partners.