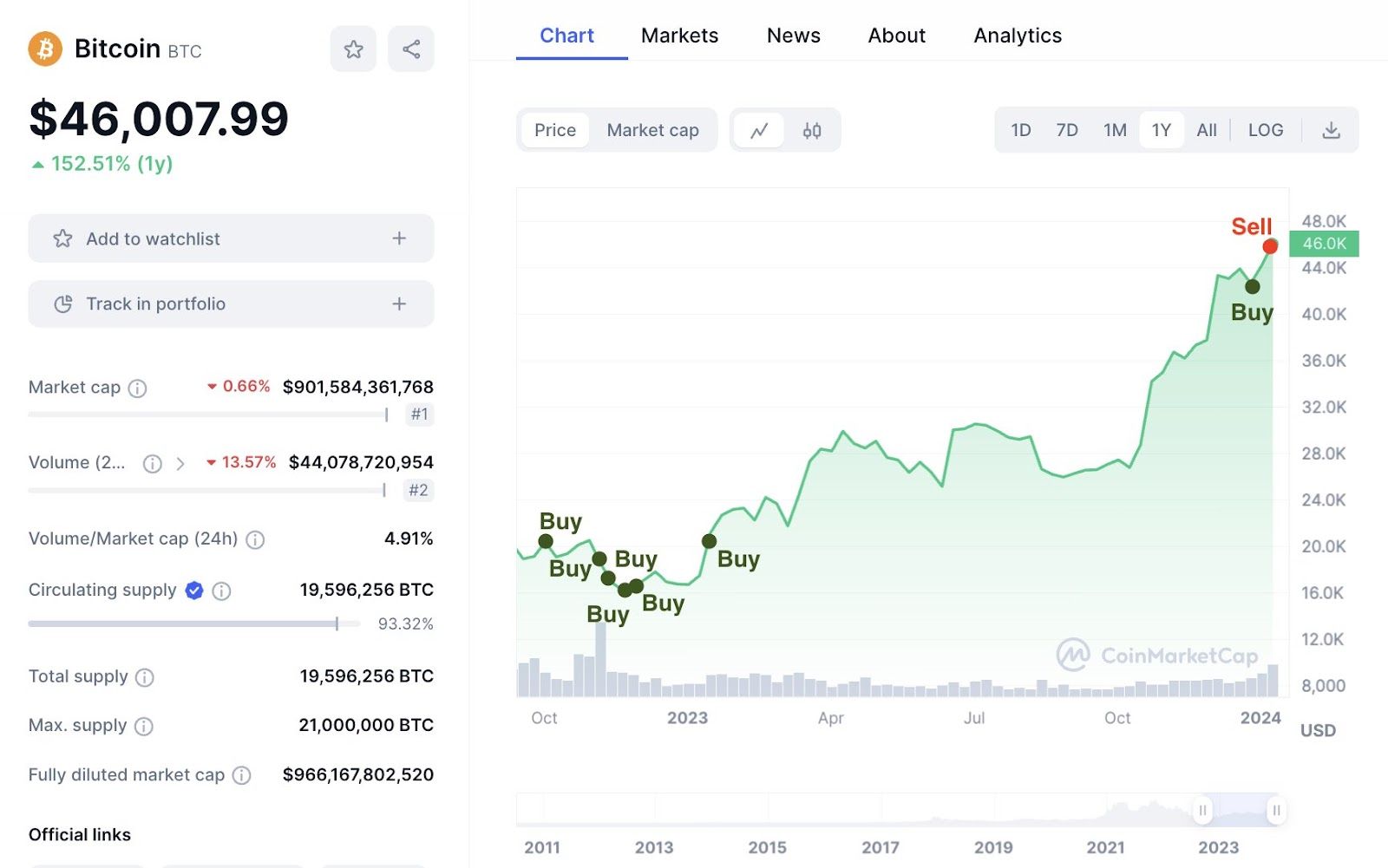

Are Crypto Wells Preparing for the Bitcoin Market?

A smart Bitcoin well has made huge gains, raising questions about the current state of the cryptocurrency market. This move also matches the scale on the chain, which is a strong indication of changing sentiment.

Analysts believe that whales may enter a non-vulnerable environment, pre-determining the level of depletion.

Is Bitcoin about to reach a market peak?

The Inter-Exchange Flow Pulse (IFP) developed by CryptoQuant tracks the flow of Bitcoin between destination and source exchanges. It serves as a barometer for market sentiment. Technically, increasing Bitcoin flows into native exchanges indicate a bull run, and decreasing flows indicate bearish trends.

Recently, the IFP trend made an interesting reversal as it declined below the 90-day moving average. Historically, such shifts have been the precursors to bearish markets, suggesting that Bitcoin's price may decline.

Read more: How to evaluate cryptocurrencies with chain and fundamental analysis

In the midst of these market ups and downs, strategic trading by the popular Bitcoin Well has become a focal point. This whale sold 2,742 BTC worth approximately $127.7 million, making a huge profit of over $75 million, a 41.5% increase.

The timing of this selloff, which occurred shortly after the launch of the Spot Bitcoin ETF, is particularly significant. In fact, some experts believe that Bitcoin ETF, from a long-term perspective, may be “selling the news event” in the short term.

“Approve [of spot Bitcoin ETFs] It should be very bullish in the medium and long term, but it should be seen in the short term. The market was (almost) fully priced in on the permit (which is partly being confirmed by the lack of a super rally) and whether we get a typical “buy the rumor – sell the news” type action remains to be seen. Short term, said Jaime Baeza, founder of Anbi Investments.

Read more: A comprehensive guide to tracking smart money in the Crypto market

Still, whale trading is not just an independent phenomenon, but part of a broader trend observed by CryptoQuant CEO Ki Young Ju.

According to Ju, bitcoin whales are moving away from the primary exchanges and using risk-off mode. Therefore, this feature clearly indicates the level of subsidy in the cryptocurrency market.

“Bitcoin whales are shifting into risk-averse mode by avoiding sending BTC to exchanges. Red up. Time wasting,” said Ju.

The change in whaling behavior and IFP's recent plunge have important implications for investors. When the Bitcoin market is at its peak, it is time to increase vigilance and re-evaluate investment strategies.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.