ARK Invest predicts how Bitcoin will increase to 2.3 million dollars

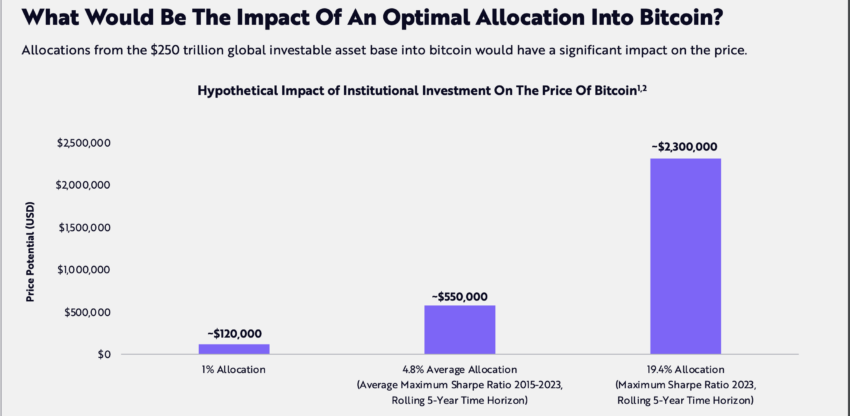

In a research report by ARK Invest, Bitcoin's (BTC) price is analyzed in depth and shows a huge increase of around $2.3 million. This projection is based on a 19.4% allocation from the $250 trillion global investable asset base.

Given the growing interest in digital currency among institutions and high-net-worth investors, this is a bold yet increasingly compelling scenario.

Can Bitcoin Reach $2.3 Million?

Bitcoin's ascension is not just a speculative frenzy, but a testament to its intrinsic value and utility. Indeed, it fundamentally disrupted the traditional financial ecosystem, offering a decentralized alternative without the associated risk.

Bitcoin's rise in value is due in part to a variety of investors, including nation-states and corporations, and its role as an asset of choice in times of uncertainty. It has a 40% market share over traditional securities such as gold.

Moreover, BTC's performance metrics are impressive, averaging 44% annualized returns over the past seven years. This weakens the return of other major assets. The impressive track record highlights the wisdom of long-term Bitcoin investing. Despite the volatility, regardless of the initial purchase period, a commitment of at least five years has historically yielded profits.

“Bitcoin Volatility May Obscure Long-Term Returns. While significant appreciation or depreciation may occur in the short term, a long-term investment horizon remains the key to investing in Bitcoin,” writes ARK Invest.

Read more: Bitcoin price prediction for 2024/2025/2030

ARK Invest's analysis extends to portfolio management, showing that the best risk-adjusted return strategy in 2023 includes a 19.4% Bitcoin allocation. This systematic approach has been validated over the past nine years and supports the inclusion of Bitcoin in a 5-year analysis to maximize risk-adjusted returns.

The implications of ARK Invest's findings are profound. Just moving 1% of your global investment assets into Bitcoin can bring its value to $120,000. A more aggressive 4.8% change would raise prices to $550,000. However, the 19.4% allocation scenario captures the imagination, indicating a Bitcoin zenith of $2.3 million.

Read more: How to buy Bitcoin (BTC) and everything you need to know

This ambitious forecast is not without its problems and uncertainties. The road to such valuation levels will be fraught with regulatory, technological and market dynamics.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.