Arthur Hayes and Peter Brandt announced their Bitcoin targets

This week has proven to be a difficult one for Bitcoin and the broader crypto market. After hitting the $60,000 mark, Bitcoin's price has dropped about 5%, currently trading at around $56,400.

Massive outflows from the space have impacted Bitcoin Exchange Traded Funds (ETFs) in particular.

The crypto market went into a panic when Bitcoin struggled

Although US markets were closed on Monday, heavy withdrawals continued afterwards. On Tuesday, spot Bitcoin ETFs saw a net inflow of $287.78 million.

Next, on Wednesday, ETFs recorded an additional $37.29 million in inflows, followed by $211.15 million on Thursday. Thus, the spot Bitcoin ETF recorded a total inflow of $536.22 million this week.

Read more: How to trade Bitcoin ETF: A step-by-step approach

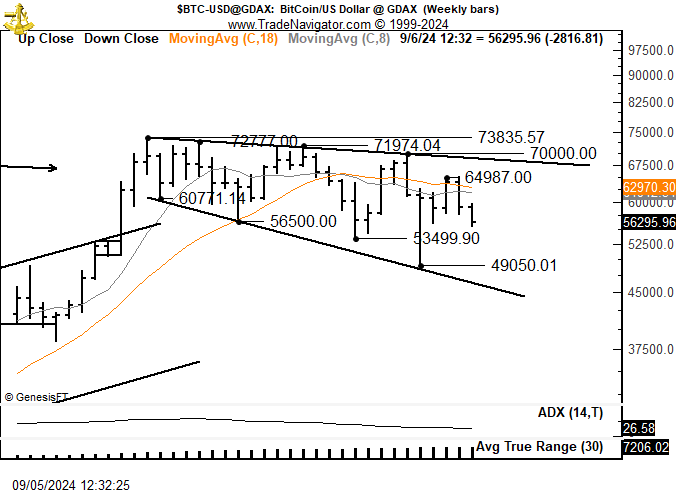

In light of these flows, several industry leaders have expressed a bearish outlook on Bitcoin. BitMEX crypto exchange co-founder Arthur Hayes has made his short position on Bitcoin clear, targeting a break below $50,000.

“BTC is tough, I'm shooting for sub $50,000 this weekend. I took a cheeky short. Pray for my soul, for I am saved,” Hayes shared on X (formerly Twitter).

Similarly, veteran trader Peter Brandt has suggested that Bitcoin may decline to the $46,000 level.

“This is called an inverted amplification triangle or megaphone. The lower limit test will be up to $46,000 or more. A push to new all-time highs is needed to get this bull market back on track for Bitcoin. Selling is stronger than buying in this pattern,” Brandt elaborated.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Moreover, the US Jobs non-farm payrolls report was released today. This information is critical because it can influence the Federal Reserve's rate decisions. A particularly weak jobs report sparked global market volatility last month, affecting cryptocurrencies.

“Upcoming US payroll data will be eagerly awaited by investors as it could influence the Federal Reserve's decision on whether to cut rates this month.” The market volatility reflects the uncertainty surrounding this key economic indicator, Avinash Shekhar, CEO of P42 crypto derivatives exchange, told BEncrypto.

As a result, the crypto market has fallen into the “high fear” zone, according to the Crypto Fear & Grade Index, which measures market sentiment. On September 6, the index dropped to 22, indicating “extreme fear”—a stark contrast to the previous day's 29 points labeled “fear.” This marks the lowest point since August 8, when the index hit 20.

Read more: What is the Crypto Fear and Greed Index?

Despite the widespread negative sentiment, some traders see potential opportunities. Prominent crypto investor Quintin Francois has highlighted that Bitcoin is reflecting sentiment towards a low of $16,000 at the end of November 2022. Therefore, he advised the investors to act accordingly.

However, it is important to acknowledge that high levels of fear may persist, leading to prolonged market volatility.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.