Arthur Hayes says Solana is the highest-beta bitcoin among US picks.

Key receivers

Hayes suggests that Solana could be a strong play amid electoral volatility. The Federal Reserve's monetary policy is expected to have a greater impact on digital assets than the results of the US election.

Share this article

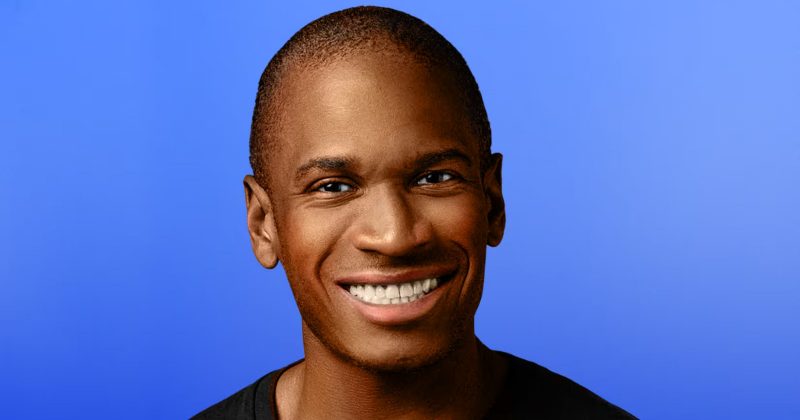

Arthur Hayes, co-founder of BitMEX and CIO at Maelstrom, endorsed Solana before the US election, describing it as “high beta bitcoin” during an appearance on the Unchained podcast.

With the election just days away, Hayes said Solana is a good bet because it is highly liquid and could jump if bitcoin performs well.

Hayes also said that in the long run it doesn't matter who wins the US election because the biggest impact on digital assets will be the Fed's decision to cut rates on November 7.

“The bigger picture is more focused on the Federal Reserve's monetary policy than the immediate results of the election,” he explained.

Hayes also said that he supports Solana on ETH, saying that Ethereum is now ‘very slow' and that a change in narrative is needed to change people's thinking about its poor performance in recent months.

Solana stated that he currently has a ‘share of mind' and that it will move quickly and that when the market picks up, Bitcoin will be higher, while Ethereum will be at ‘equal beta' to Bitcoin, or perhaps a little lower.

During the podcast, Hayes highlighted Solana's incredible rise from around $7 to $180, especially after the FTX crash, highlighting her ability to find and sustain value.

Hayes touched on the regulatory aspects of a significant reform of crypto regulations, regardless of political changes.

His advice to investors and traders is to focus on market fundamentals rather than political developments, which often have a temporary effect on market volatility.

The session concluded with Hayes emphasizing the strategic importance of selecting high-beta assets such as Solana in times of anticipated financial easing.

Share this article