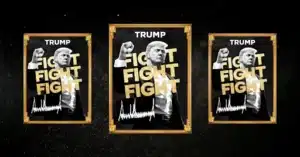

Arthur Hayes’s Bitcoin Reserve Is Unlikely; Trump warns of BTC sell-off

Arthur Hayes, the former CEO of BitMEX, recently warned that Bitcoin could face a “brutal selloff” when Donald Trump takes office. In a detailed blog post, Hayes expressed doubts that Trump would follow through on his big promises about cryptocurrencies, including making the US the “crypto capital of the world” and establishing a bitcoin reserve.

Hayes is skeptical about the implementation of Trump's policy

Hayes says the administration will have just 12 months to enact its ambitious policies. Trump believes he will face significant political challenges in the 2026 midterm elections, with most of his term in office being bogged down and making meaningful change difficult.

“To prevent the Democrats from retaking both houses of the legislature in 2026, it is almost impossible for Trump to please the base enough. The public is desperate and impatient,” he wrote. As this realization permeates the markets, he says there is a “trash” stockpile for Bitcoin and other so-called “Trump trades.”

Bitcoin Reserve is unlikely?

Hayes dismissed the idea of a US bitcoin reserve as unreal, and emphasized that the mere threat of such a reserve could create buying pressure.

Arthur Hayes If the U.S. government were to print more money and devalue the dollar and use some of it to buy bitcoins, the price of bitcoin would rise. This in turn prompts other countries to follow suit and buy Bitcoin, causing the price to skyrocket.

While Hayes believes that long-term bitcoin holders may eventually sell at higher fiat prices, the US Bitcoin Reserve (BSR) is unlikely to do so. Politicians argue that it is a priority to use the newly created dollars for populist measures to secure votes in the upcoming elections.

Quick US dollar discount

Hayes believes Trump will begin a rapid devaluation of the U.S. dollar in the first half of 2025, according to economic adviser Mark Besant, possibly leading to a devaluation of the dollar against gold in the first half of 2025. In the US environment, it will increase GDP, and win support for the Republican agenda.

Hayes predicts that “another pillar for the crypto bull market” could arise if mainland Chinese investors are eventually allowed exposure to Bitcoin ETFs in Hong Kong. Furthermore, he predicted that EU leaders would secretly rule while ordinary citizens suffered from inflation.

Hayes believes that Trump's economic policies will lead to global changes in currency values and financial systems, with Bitcoin and crypto acting as key beneficiaries in the medium to long term.

However, while Hayes remains bullish on the long-term prospects of Bitcoin and predicts an increase of $ 1 million, he will also be consistent in his path towards this goal, with significant price corrections along the way.