As 2025 begins, XRP jumps 10% to $2.3

Key receivers

On the first trading day of 2025, XRP rose 10% to $2.3. XRP has taken over Bitcoin and Ethereum trading in South Korea.

Share this article

XRP started the new year with a strong performance, increasing by 10% in the last 24 hours and regaining the $2.3 mark seen on December 26, according to CoinGecko data.

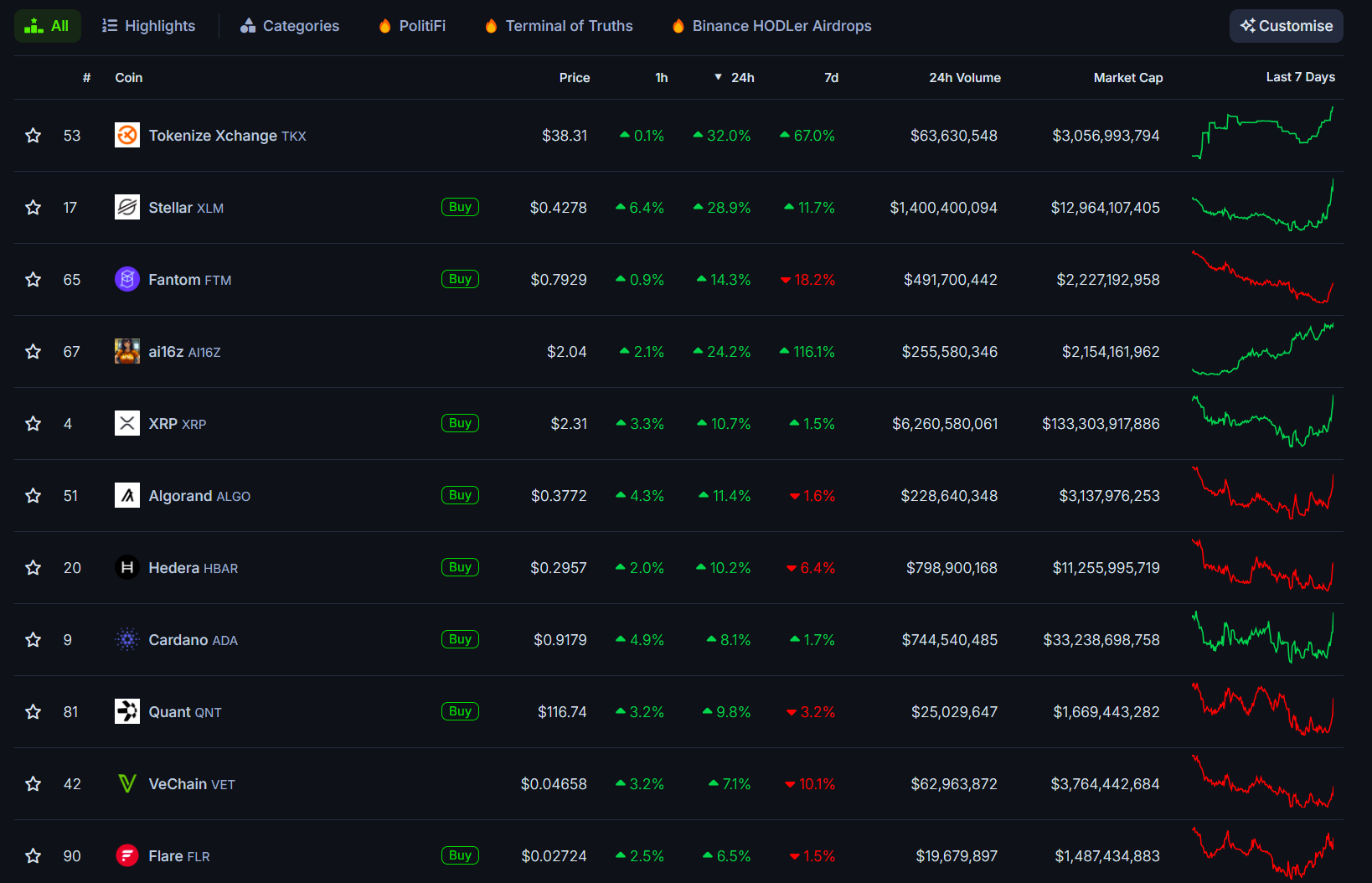

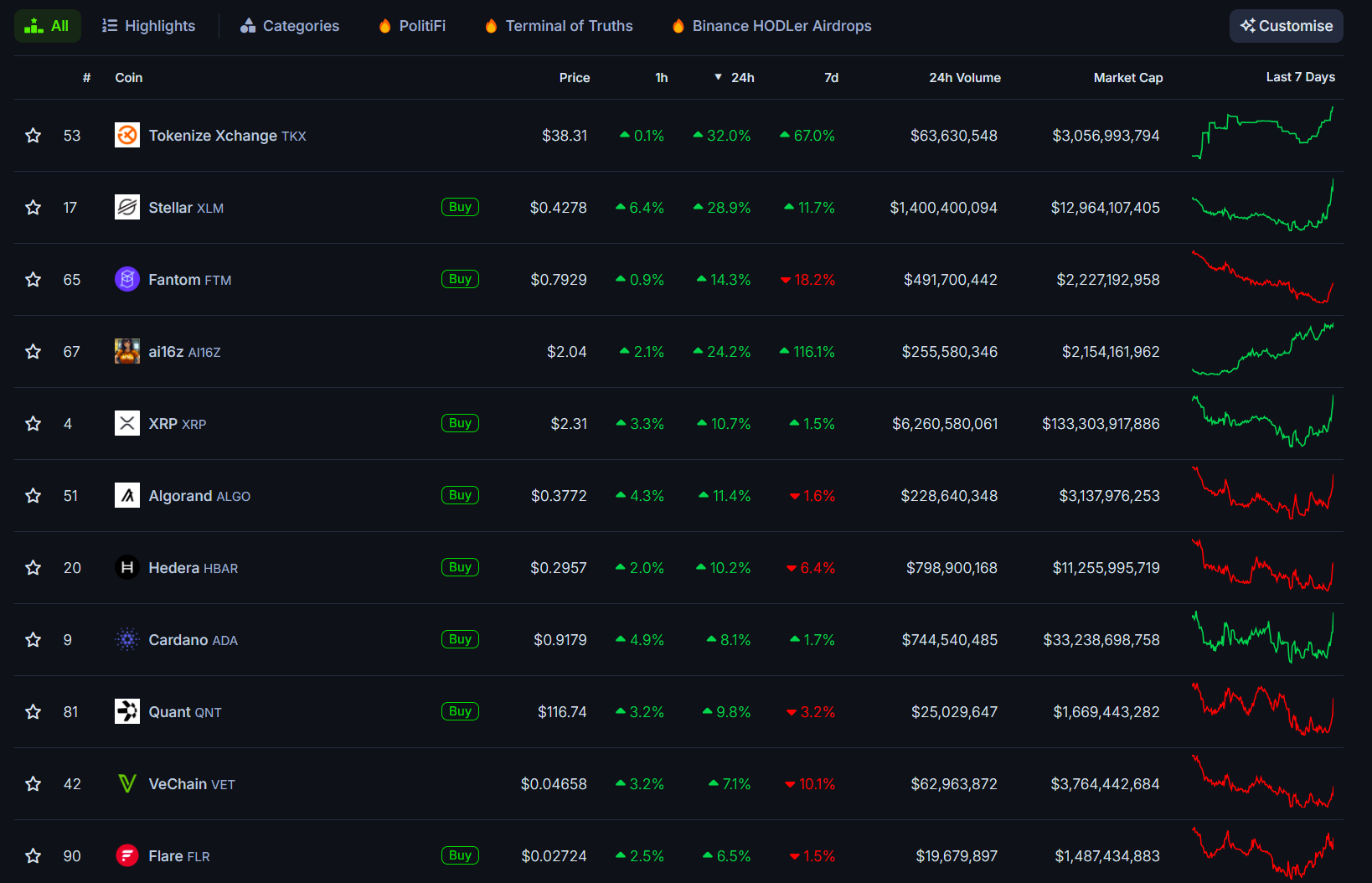

The rally comes at a time when most major crypto assets remain relatively flat. Bitcoin is currently trading around $94,000 with little movement, while other leading crypto assets such as Ethereum, Binance Coin and Solana are showing little price action.

In contrast, established altcoins including Tokenize Xchange (TKX), Stellar (XLM), Fantom (FTM) and Algorand (ALGO) posted double-digit gains over the past 24 hours. Some major crypto assets such as Hedera (HBAR) and Cardano (ADA) have seen significant gains.

The AI16Z token, the first AI coin on the Solana blockchain, is expanding its profits recently to achieve a market cap of $2 billion. Currently trading at over $2, the token has increased 21% in the last 24 hours, placing it among the top earners on a daily basis.

XRP trading volume is increasing in South Korea.

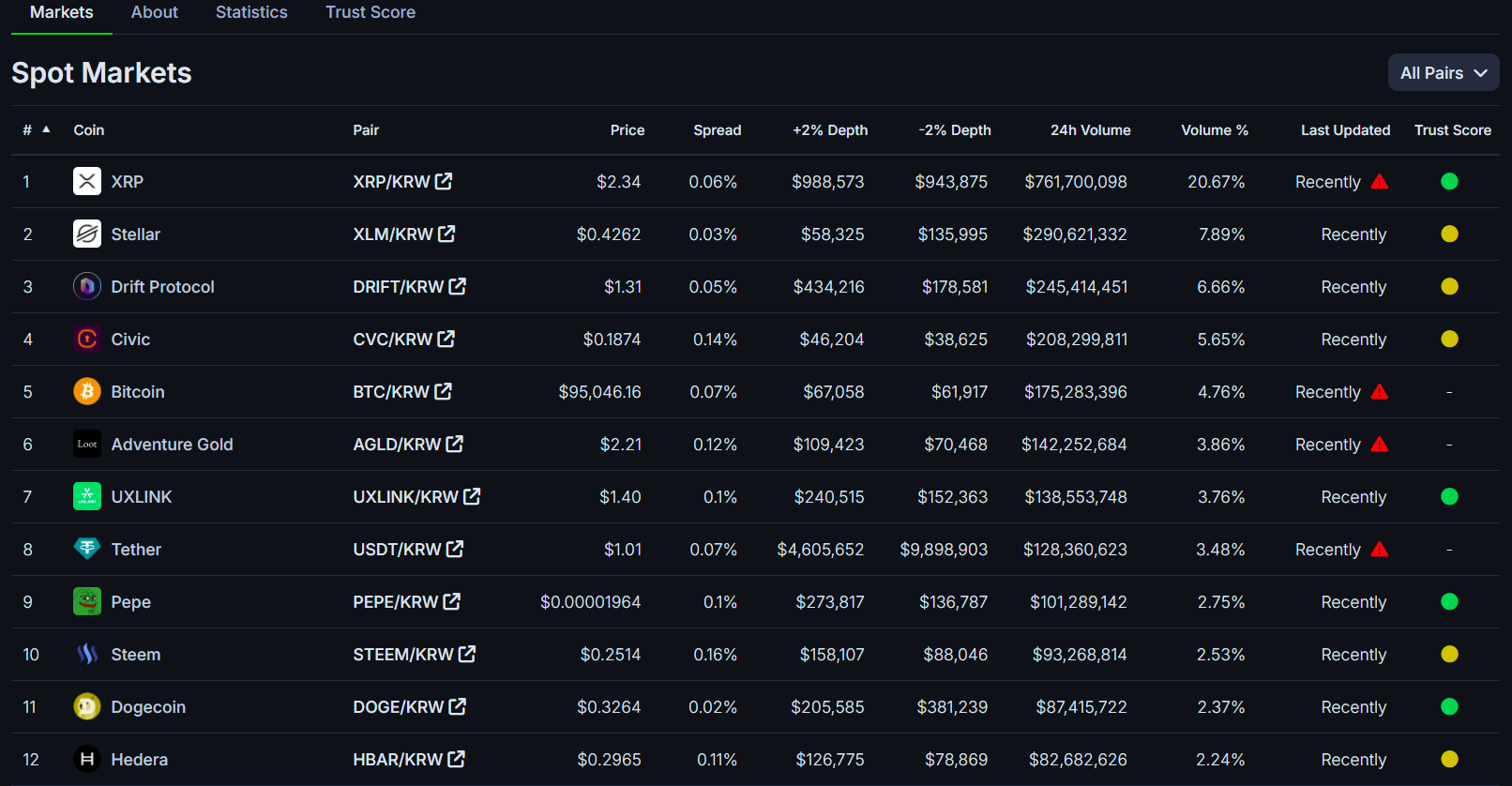

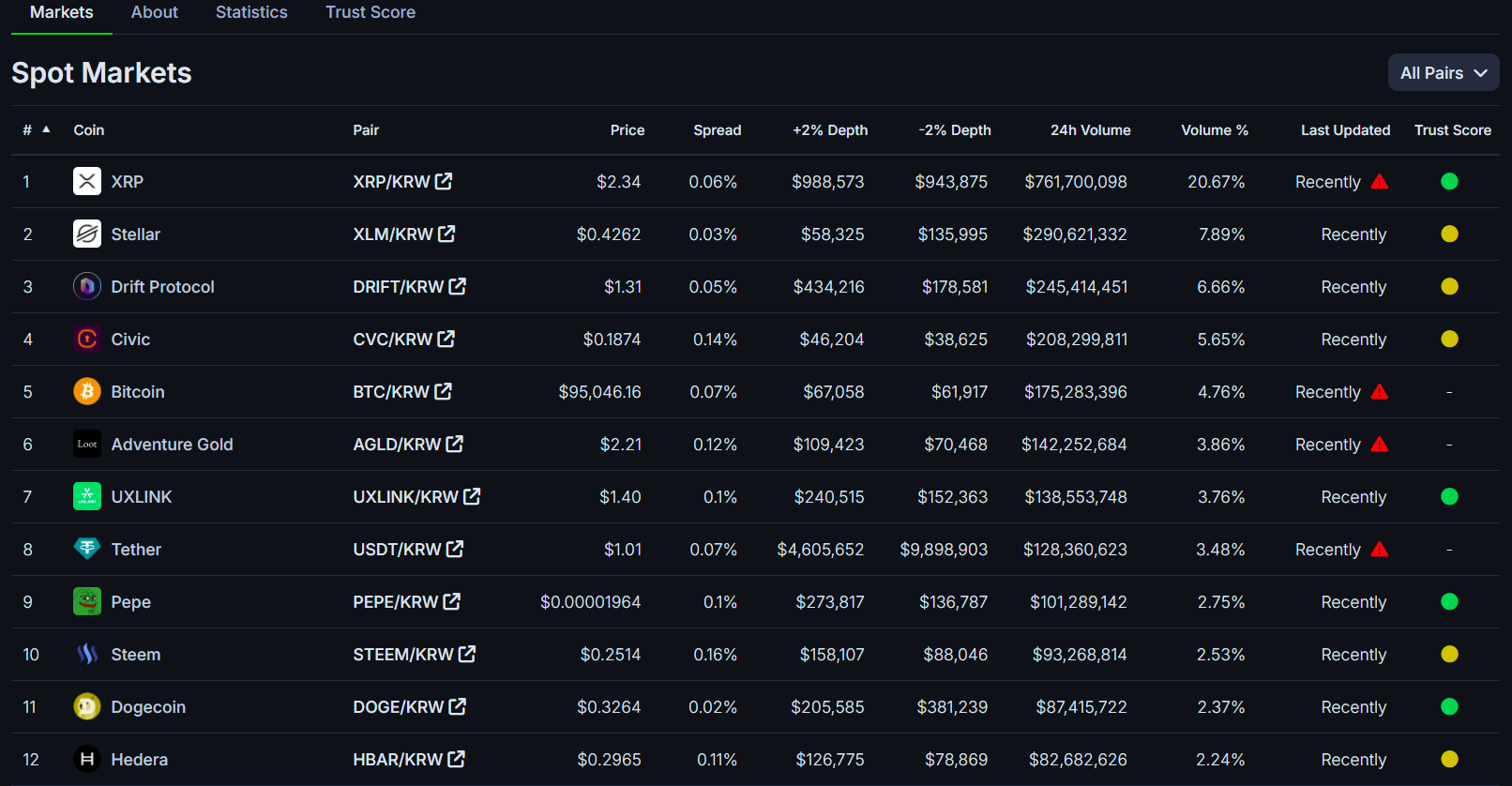

XRP trading volume in South Korea has surpassed both Bitcoin and Ethereum, the country's main exchanges.

Combined trading volume with losers on Upbit, Bitumb and Corbit exceeded $1 billion in the last 24 hours, with XRP recording $254 million on Bithum and $761 million on Upbit.

A higher transaction volume indicates more market demand for the property, which suggests that more investors are actively buying and selling.

Changes in trading volume indicate potential trends or ongoing changes. High trading volumes can also increase volatility in the market, as large orders can affect prices.

The vote comes amid political developments in South Korea, where a court issued an arrest warrant Tuesday for President Eun Suk-yeol over his December martial law ruling.

Trump's inauguration, the resignation of the chairman of the SEC more than two weeks

Trump will be inaugurated as the 47th President of the United States on January 20. On that day, SEC Chairman Gary Gensler will step down.

Trump's arrival and Gensler's departure are expected to pave the way for a shift in regulatory approach to the crypto sector, which has long faced hostility under the current administration.

For the Ripple community, these events could end a year-long legal battle between Ripple and US securities regulators, which could result in a settlement or dismissal of the case. A resolution is expected to clarify XRP's legal status and create a precedent for other crypto assets to be classified as securities by the SEC.

Additionally, as the regulatory landscape in the US matures, meaning more guidance and transparency, there is hope that one or more XRP ETFs, along with a wave of other crypto ETFs, will receive regulatory approval.

As of January 1, several fund managers—including Bitwise, Canary Capital, 21Shares, and WisdomTree—are lining up to approve the launch of their own XRP ETFs.

Any developments in the XRP ETF development or the SEC-Ripple case are expected to have a significant impact on XRP price movements.

Share this article