As bullish traders double their bets, MATIC may reach $2.

Polygon's (MATIC) price regained the $0.90 territory on Nov. 14, bringing its monthly gain to 15 percent. Analyzes of chain and derivative data identify critical bullish indicators that could shape MATIC's next major price movement.

MATIC takes the top spot as one of the top 20 crypto market earners charts for November. Here's how the Polygon community's positive response to the partnership with OKX could further drive MATIC's value.

A multilateral partnership with the OKX exchange may encourage further gains.

In the year On November 14, OKX announced the launch of X1, a new zKEVM Layer-2 network developed by Polygon CDK. Although the project is still only in Testanet, the owners of MATIC have stepped in to take advantage of the increased scalability and adoption.

The OKX statement mentions the following.

“As part of the collaboration between OKX and Polygon Labs, OKX will be a major contributor to Polygon's CDK, and will invest significant engineering resources to develop the technology stack for Ethereum burning solutions.”

Shortly after the announcement. MATIC's market price broke above $1 for the first time in four months. However, upon further investigation, on-chain data suggests that MATIC's recent price rally may be due to increased network usage.

The Cryptoquant chart below shows that the Polygon Network transaction count is currently trending higher since September 28th.

Read more: 7 must-have cryptocurrencies for your portfolio before the next bull run

The chart below clearly shows that the daily transaction count on the Polygon network has been steadily increasing this month. In the year On November 14, Polygon recorded 7,819 transactions, a 25 percent increase from last month's high of 6,229.

The transaction count metric represents the total number of confirmed transactions involving a specific cryptocurrency on a given day. Typically, a steady increase in transaction counts, as noted above, indicates growing investor interest.

The timing of the peak suggests that the OKX partnership has driven organic growth in Polygon network usage this week. Incredibly, Polygon's continued increase in trading activity has fueled a 75% price increase over the past 30 days.

Futures traders doubled their November bets.

The wholesale activity among Polygon Derivatives traders is another important reason for the increase in MATIC price. According to crypto-trading analytics tracker Coinalyse, total capital stock in the MATIC futures markets nearly doubled in November.

Read more: How to buy Polygon (MATIC) and everything you need to know

The chart below shows that MATIC's open interest decreased by $115 million on October 31st. But by mid-November, that figure had risen to more than $240 million. This shows that in the first 15 days of November, the total value of MATIC futures contracts increased by more than $125 million.

In the context of derivatives trading, open interest represents the total value of futures contracts for a particular asset. Typically, when open interest increases significantly during a rally, it indicates that many bullish traders are doubling down on their long positions.

In conclusion, increasing network usage and a 109% increase in demand this month underscores investors' confidence in continued price increases. If these trends continue, MATIC holders may see further gains in the coming days.

MATIC Price Prediction: $1.50 way back?

From a chain perspective, increasing network activity and increasing capital flows from markets are the most critical indicators. With both metrics still trending upwards, another leg up puts MATIC's value in prime position.

Read more: 14 Best Polygon (MATIC) Wallets in 2023

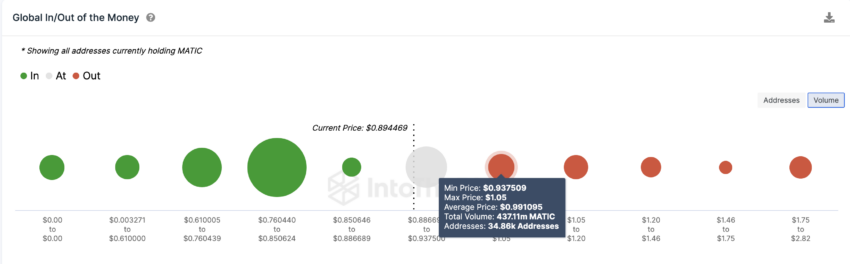

Global Out-of-the-Money (GOM) data, which breaks down current MATIC holders according to their entry value, also confirms this crash prediction.

However, it shows that the bulls must first balance the initial resistance at $0.10 to be sure of retrieving $1.50. As shown below, 34,860 holders bought 437.11 million MATIC at an average price of $0.99. If those holders exit early, they could derail MATIC's price rally.

But if the bulls can scale that resistance selling wall, the MATIC price could recover to $1.50 as predicted.

Once again, if the MATIC price drops below $0.80, the bears may overturn the bullish forecast. However, in that case, the 62,490 MATIC holders who bought 4.64 billion MATIC at a low of $0.805 could mount a wall of support. If those investors can insist on HODL, Polygon will avoid a major price reversal.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.