As profit margins shrink, Bitcoin miners tap into capital

Bitcoin miners are currently experiencing a high “capital” that pushes them to innovate for additional income.

A Bitcoin mining cap occurs when miners are forced to shut down due to unprofitability or unsustainable operating costs. This happens when the cost of mining (including electricity, hardware and operating costs) exceeds the revenue from mining the Bellwether property.

Bitcoin miners face economic pressure amid capital.

Data from CryptoQuant shows a 7.6% drop in Bitcoin mining hashrate this month, now similar to levels seen during the FTX exchange crash in December 2022. Unlike that time, today's decline follows Bitcoin's recent halving, cutting mining rewards to 3.125 BTC.

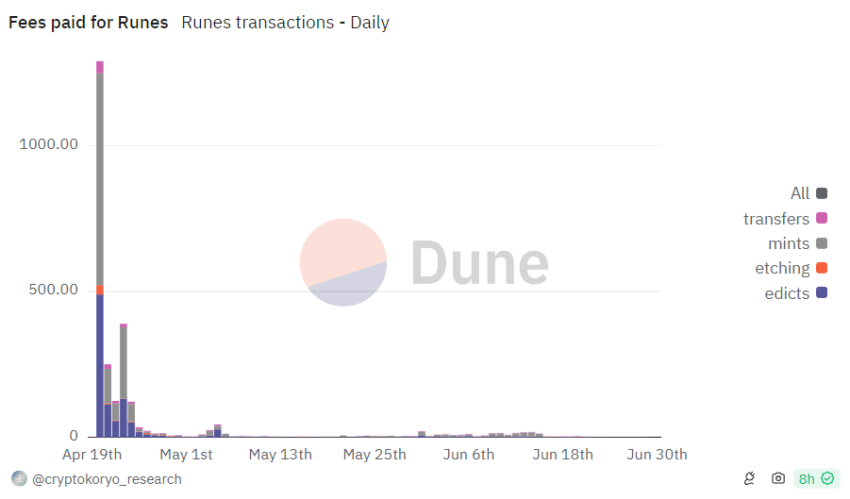

As network activity slows down, miners are struggling with reduced income from alternative sources. Initially, they benefited from the high payouts during the post-halving period of the Bitcoin-based Runes protocol craze. However, revenues declined significantly due to reduced network activity.

In the year As of June 29, daily rune transactions fell from more than 753,000 to 21,861 on April 23, a 90% decrease. As a result, total mining revenue from Run transactions fell below 2 BTC last week, down from a peak of 1000 BTC on April 20.

Read More: Making Passive Income From Crypto Mining: How To Get Started

Faced with these economic pressures, miners have ramped up sales activities this month while reducing their rigs. Last week, BeenCrypto reported that miners had mined 30,000 BTC worth an estimated $2 billion.

To further expand revenue streams, miners are increasingly turning to artificial intelligence (AI) and other proof-of-concept (PoW) assets. Companies like Core Scientific and Hut 8 have received significant funding for AI expansion. According to Matthew Siegel, head of digital research at VanEck, Stephen Byrd, head of sustainability research at Morgan Stanley, said these moves show that miners are seeing profitability in the evolving market dynamics of AI ventures.

“I respect the idea that Bitcoin mining can become more profitable. There's a game theory here… the more people get out of Bitcoin mining and into data centers, the more attractive it becomes to the rest,” Byrd was quoted as saying.

Read More: Top Cryptocurrency Mining Pools To Join 2024

On the other hand, Marathon Digital, the largest BTC mining company, has announced its entry into mining Caspa, a PoW project. As of June 25, the company said it has spent KAS 93 million, valued at $15 million.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.