As the parameters indicate corrections, the value of PEPE decreases

After listing on Coinbase, PEPE's price hit a new all-time high on November 13th. It's up 105% over the past month, though it's down nearly 10% over the past seven days. Indicators such as RSI and MVRV suggest that further corrections may occur as bullish momentum weakens.

A potential death cross within the EMA lines could push PEPE to key support at $0.0000139 or below. However, a trend reversal could see PEPE testing at $0.0000228 and a new all-time high target at $0.000030.

PEPE is not oversold yet.

The PEPE RSI has fallen from 60 to 38.8 over the past three days, indicating weakening bullish momentum. The RSI or Relative Strength Index measures price volatility on a scale of 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold levels.

The decline reflects growing selling pressure, but the current RSI suggests that PEPE is not yet oversold.

At 38.8, the PEPE RSI is at a key level, as it has not dipped below 30 since November 3rd. This suggests that if historical patterns hold, the price may stabilize soon. The recent fall does not change the fact that PEPE is the 3rd largest meme coin in the market, below DOGE and SHIB.

However, if the RSI falls below 30, it could trigger a strong bearish momentum and lead to further price corrections.

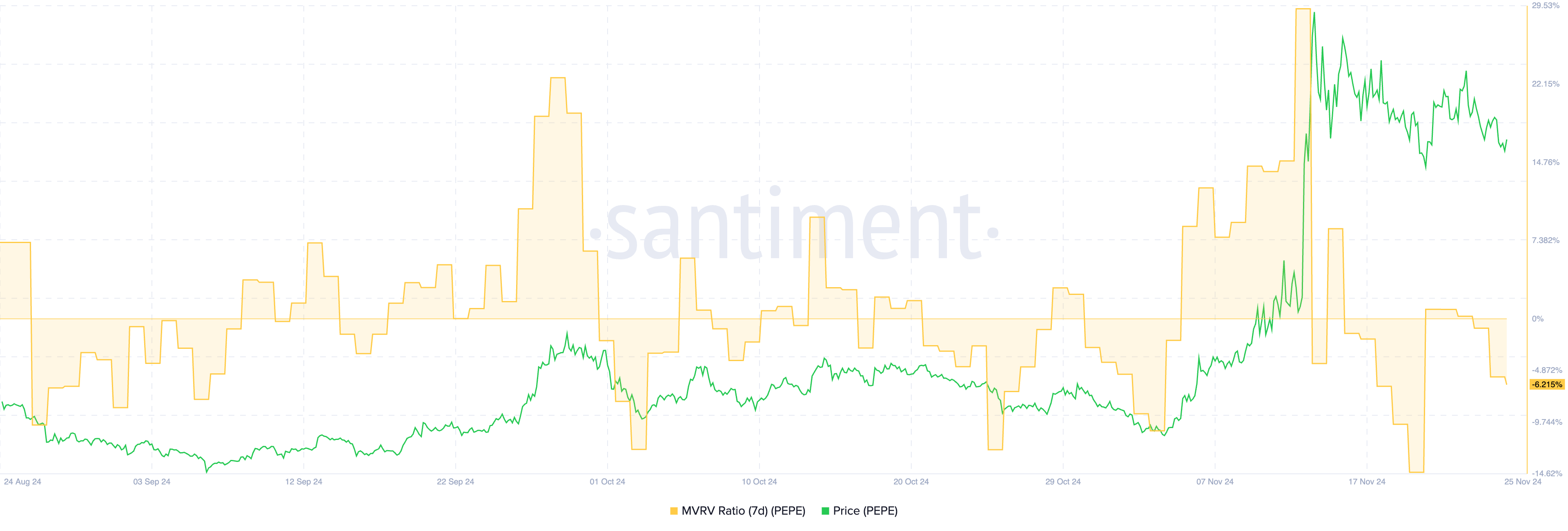

The PEPE MVRV Ratio shows that the correction is likely to continue.

PEPE's 7-day MVRV ratio is currently at -6.2%, which indicates that recent holders are on average at minimal unrealized losses. MVRV, or Market Value to Real Value Ratio, measures your holding's profit or loss on the token's market value relative to the price you paid for it.

Such negative MVRV levels suggest that owners are less likely to sell at a loss, thus reducing selling pressure.

Historically, PEPE has seen strong price recoveries with its 7-day MVRV falling below -9.7%, indicating that further correction is likely before another move higher.

This pattern suggests that while the current level of MVRV hints at a strengthening, a deeper dip creates conditions for a resurgence. If MVRV trends lower, it could set the stage for renewed inventory and a new price recovery.

PEPE Price Forecast: New All-Time Highs May Be Delayed For Now

The PEPE EMA lines show a bearish signal in the form of a death cross where the short-term EMA lines cross below the long-term.

If this pattern materializes, it could trigger further corrections. PEPE price may test support at $0.0000139 and $0.0000108. If selling pressure strengthens, PEPE could fall to $0.0000077.

On the other hand, if market confidence returns and the trend reverses, PEPE price may challenge resistances at $0.00002228 and $0.000026.

A break above these levels could push the price of PEPE to $0.000030, a new all-time high.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.