As TUSD struggles to hold onto the peg, HTX destroys backup confirmations

Share this article

Crypto exchange HTX, formerly known as Huobi, suddenly disabled its verification system today, according to Adam Cochran, managing partner at Cinemahain Ventures. Regarding this development, HTX shareholder Justin Sun has failed to hold the $1 peg for more than two weeks at the same time as his trusted TrueUSD (TUSD).

1/8

So Justin Sun HTC/Huobi have suddenly turned off their authentication system, while a few other things are happening at the same time. pic.twitter.com/eCjE9YAvwA

— Adamscochran (@adamscochran.eth) (@adamscochran) January 26, 2024

A visit to HTX's holdings earlier today showed no information about the exchange's crypto holdings. Reserve rates, wallet balances and user asset figures are all temporarily lost. The page is now back online, but the timing of this temporary outage still raises questions about the ongoing issues of stablecoin TUSD.

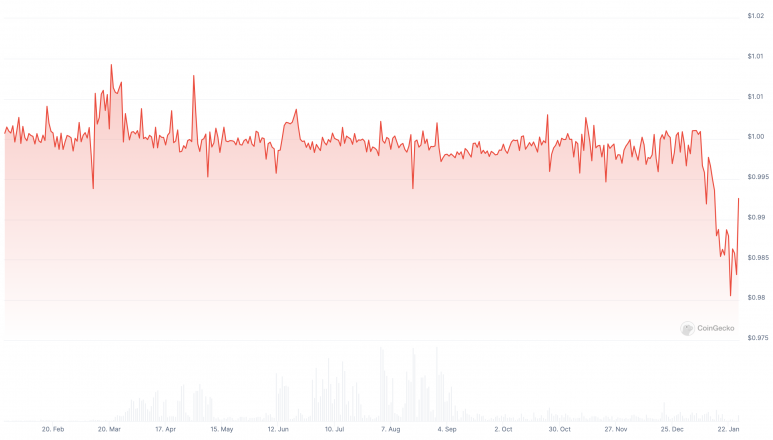

This change follows a recent investigation into TUSD's apparent lack of adequate collateral. TUSD has traded below $1 since January 7th, according to CoinGecko.

Earlier this month, TrueUSD failed to provide real-time confirmation that it had enough dollar reserves to back the stablecoin. This lack of transparency has led to speculation that TrueUSD may be under-guaranteed.

TUSD's real-time credentials stopped working as of yesterday, which means it's been reported that it hasn't been collected much. (see status description on picture)@tusdio @The_Network Any comments? pic.twitter.com/s4vsa7Gz4o

— Symbio (@NoCryptFish) January 10, 2024

There are several reports of users unable to redeem TUSD. Meanwhile, a Tron address linked to Justin Sun appears to be the only address involved in processing and burning more than $3 billion worth of TUSD tokens.

Has anyone been a lucky part of the $40M TUSD cashback from @tusdio in the last three days?

I think before I see a major Tron wallet that can move this (eventually to burn address). pic.twitter.com/6O0dw1RiD8

— TheSkyhopper (@TheSkyhopper) January 26, 2024

Last July, Archiblock founder Daniel Jayong accused Justin Sun of secretly buying TrueUSD. Court documents say Sun is buying the struggling coin issuer in negotiations with ArchBlock.

Archblock founder Justin Sun claims he was a TUSD whistleblower by law (not exactly shocking) pic.twitter.com/ybTPmSOmtk

— db (@tier10k) July 17, 2023

Following publication of this article, an HTX spokesperson confirmed to Crypto Briefing on Thursday:

“User assets are 100% protected, and user assets are also secure. There is some issue with the POR interface, which is expected to be fixed in a few hours.”

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of any information on or accessible from this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information without losing the insight – and control – of experienced crypto natives. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.