Australia’s Biggest Super Fund Allocates $27 Million to Bitcoin: Report

Key receivers

AMP has committed $27 million to Bitcoin, marking Australia's first super fund investment in the digital asset. The Bitcoin investment aims to improve returns and manage risk as part of AMP's diversification strategy.

Share this article

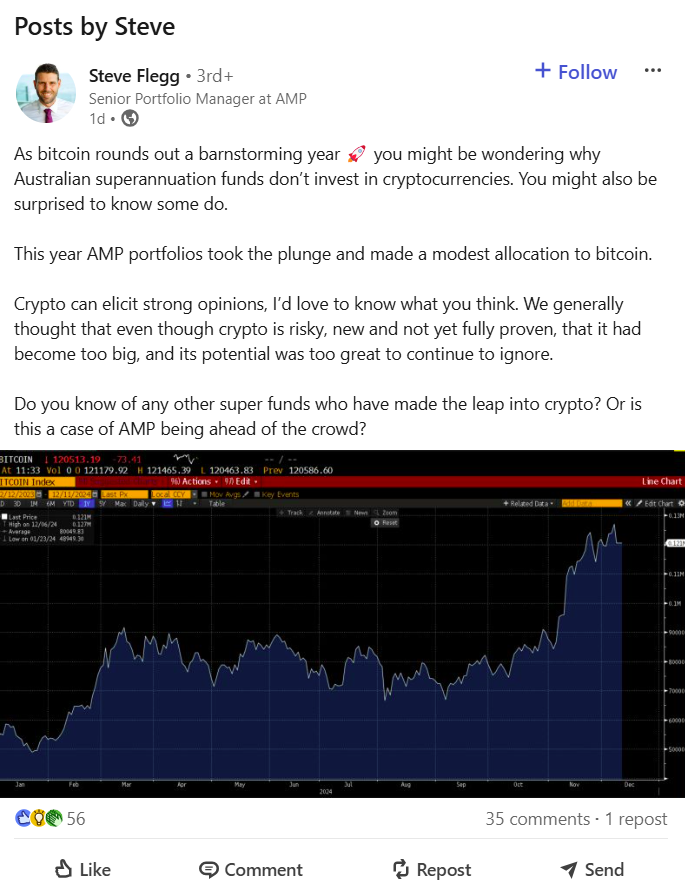

AMP has become Australia's first superannuation fund to invest in Bitcoin. The firm confirmed Thursday that it has allocated $27 million, or 0.05% of its $57 billion in assets under management, to the crypto asset, buying at prices between $60,000 and $70,000.

Word began to circulate following a LinkedIn post by Steph Flegg, AMP's senior portfolio manager, who said the company had “taken the edge off” as bitcoin ended a “stormy year”.

The wealth and pension manager's choice to add a “small, risk-controlled position” to its flexible asset allocation program was based on careful analysis and consideration by its investment team, AMP's head of portfolio management, Stuart Elliott, said in a recent interview with Super Review. .

The Bitcoin investment is part of a broader diversification strategy to improve returns and manage risk, Elliott said. As evidenced by the launch of several crypto ETFs last year, AMP is recognizing the growing trend of institutional investors entering the crypto market.

AMP's investment is a significant one for public offering super funds, University of NSW economist Richard Holden said, noting that self-managed super funds hold between $2 billion and $3 billion in crypto assets.

Caroline Bowler, CEO of Australia-based crypto exchange BTC Markets, supported the move:

“The crypto market has become too valuable to ignore. It's not just about the buzz, it's about the potential that Bitcoin holds as part of a diverse investment strategy.”

Industry-wide skepticism

Many other major funds, including Australian Super, Australian Superannuation Trust and MLC, have expressed skepticism about direct crypto investments.

Australia's largest superannuation fund, Australia Super, said it would not follow AMP's lead, but has explored blockchain investments.

The Australian Superannuation Trust, which manages $230 billion in assets, has said it has no plans to invest in crypto or Bitcoin in the near future.

Like Australia Super and the Australian Superannuation Trust, MLC is not currently investing in crypto, but is open to the possibility in the future. Dan Farmer, MLC's chief investment officer, described crypto investments as “not yet, more than ever.”

Share this article