Avalanche (AVAX) Under Pressure: Continuation of Long Downtrend?

Avalanche (AVAX), the smart contract blockchain token, has been swinging towards low price levels for almost a month. As a result, traders in the derivatives market will shift from the previous bullish thesis to a bearish bias.

AVAX had an impressive performance in 2023 and the first quarter of 2024. But recently, the token seems to have lost its chance.

The Bulls are running away from the Avalanche.

AVAX is trading at $31.53. However, long/short ratio traders expect the price to decline despite a 7-day decline of 8.66%. Evidence of this sentiment is reflected in the long/short ratio.

The long/short ratio measures traders' valuation of a cryptocurrency. Values of this indicator greater than 1 indicate that there are more long positions than short positions. Conversely, a long/short ratio below 1 indicates increased bearish speculation.

A market participant who expects the price of a token to increase when filling the bid on a contract is long. Short, on the other hand, means a trader is betting on a decline in prices.

According to derivatives data portal Coinglass, AVAX's Long/Short Ratio was 0.79. This will strengthen the understanding of the market.

Read more: 11 Best Avalanche Wallets to Consider in 2024

In addition to the ratio, open interest adjusts to potential depreciation. Open interest refers to the price of outstanding contracts in the market.

This indicator decreases or increases depending on the net position. Unlike the long/short ratio, open interest does not indicate whether there are too many longs or too many shorts. Instead, an increase in open interest refers to liquidity inflows and open contracts.

However, the decrease indicates an increase in closed positions and an increase in cash flow. As of this writing, AVAX's open interest was $211.64 million. On June 7, when the price of AVAX was $35, open interest was very high.

For the price of the signal, the reduction may provide an increase in open demand as opposed to the upward strength that may confirm the downtrend.

AVAX Price Prediction: A long way from Rally

Meanwhile, the AVAX market structure on the daily chart suggests a possible collapse. The Exponential Moving Average (EMA) is an important indicator that confirms this bias.

EMA measures the direction of a trend and reflects how prices may change over a period of time. On the AVAX/USD daily chart, the 20 EMA (blue) from April 13 crossed below the 50 EMA (yellow).

This position is called the Cross of Death and is a bearish trend. It occurs when the long EMA crosses above the short EMA. The opposite is a golden cross, which is formed when the short EMA crosses above the long EMA.

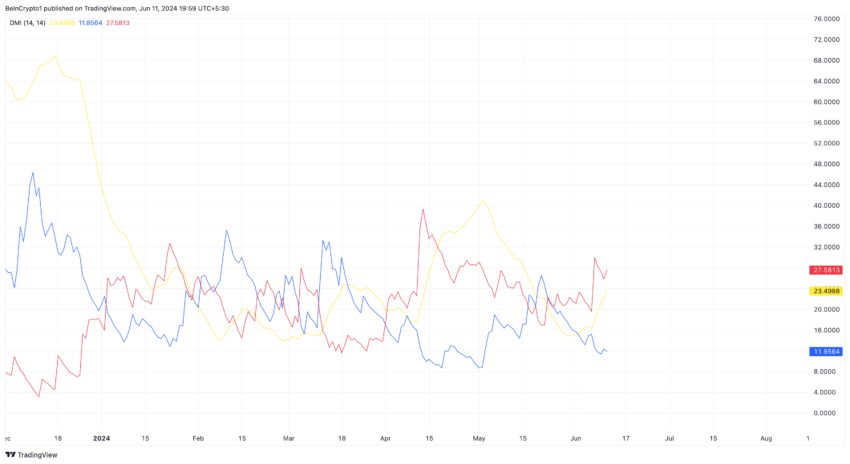

This position puts AVAX at risk of falling to $29.38. Additionally, the Directional Movement Index (DMI) supports a potential bearish trend.

As the table below shows, -DMI (red) was 27.58, +DMI (blue) was 11.85. DMI measures both intensity and direction. Therefore, the difference between +/- DMI points to a downward trend for AVAX.

Also, the Average Directional Index (ADX) is trending up. ADX (yellow) shows the strength of the direction. If the ADX is sharp, it means that the direction has strength behind the movement.

However, a low DMI reading means that the directional strength is weak. In the case of AVAX, it was the former.

Read more: How to buy Avalanche (AVAX) with a credit card: a step-by-step guide

Therefore, the price may drop below 30 dollars in a short period of time. However, if the broader market starts to recover, the prediction may be futile and void, as AVAX may follow the directions of other altcoins.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.