Bank of Canada reviews DeFi innovation and challenges in financial markets

The Bank of Canada has published a staff analysis note reflecting on the growth of decentralized finance (DeFi).

The staff memo, released on October 17, outlines the cryptocurrency market's growth rates, benefits, challenges facing traditional finance, risks, and the potential impact of regulations on financial markets.

According to the report, crypto assets were originally developed as a blockchain-based payment system before branching out into new areas of financial services.

To achieve its decentralized goals, it uses disruptive smart contracts with third parties to settle multiple transactions, a service that eventually grew to a $2.9 trillion market cap before the main platform collapsed and regulatory hurdles drove down prices.

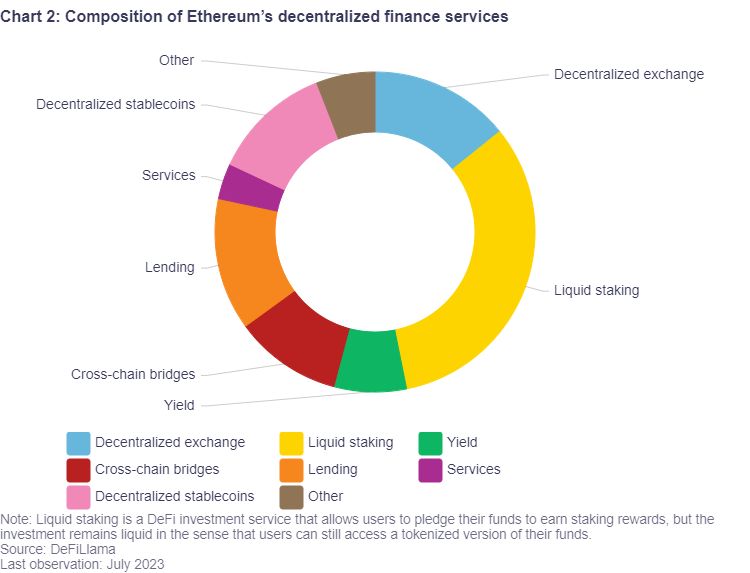

A whole new area has been developed with the asset class, alongside the new risks in the current market, from useless tokens, decentralized stablecoins and leading services.

A whole new area has been developed with the asset class, alongside the new risks in the current market, from useless tokens, decentralized stablecoins and leading services.

Bank of Canada points out the benefits

One advantage of the ecosystem described by the bank is that the integration of smart contracts will make it easier for many companies to create services.

This is due to the open source nature of their code allowing developers to collaborate and build on other networks.

The bank cited service offerings, competition and transparency as factors that make the ecosystem more attractive than traditional financial products.

Committed to ending financial monopolies, cross-border payments for most services allow payments between countries, and with increasing functionality, users can enjoy seamless experiences without struggling across multiple platforms.

DeFi can also reduce misunderstandings in financial markets that face limited and opaque transactions with new facilities on different chains. In addition, the market will bring transparency through the use of blockchain technology, as it will cut out potentially corrupt traditional intermediaries and place real powers in the hands of customers.

Market risks and regulations

While decentralized finance has many advantages, it also poses a number of risks to global financial markets, including limited liquidity, high concentration, and unregulated centralization.

Only tokenized assets can be recorded on the blockchain and interact with smart contracts. However, few real-world assets have been identified so far, resulting in a self-referencing system focused primarily on speculative crypto businesses. Its contribution to the real world economy is negligible.

In the case of centralized systems penetrating the space, even though the sector claims to be decentralised, certain players remain highly centralized which, if not managed properly, poses risks to stakeholders.

This comes from the complexity of managing private keys and other services to release the popularity of centralized exchanges. The fall of FTX in November is a classic example of uncontrolled centralized players opening up risks in the sector.

The bank suggests adequate regulations across all channels to block all activities of bad actors in the industry, including how they interact with traditional finance.

Recently, the Canadian Association of Securities Regulators clarified its stablecoin regulation, which describes the process of issuing and trading securities without being captured in the securities website.