Binance Will Expand Its Dominance on the Spot Market in 2023: CoinGecko

Share this article

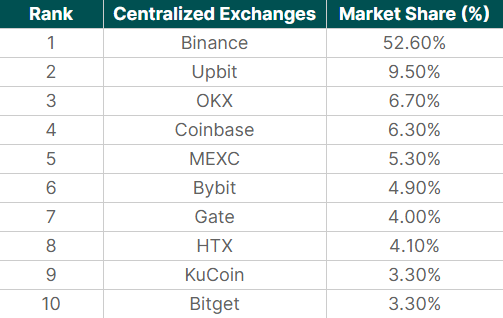

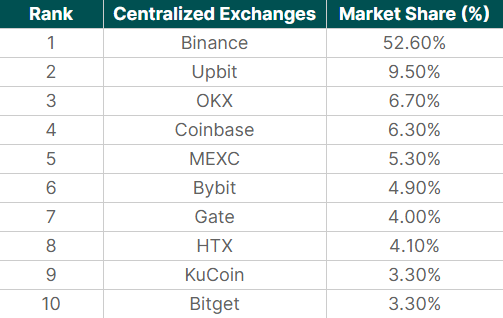

Centralized exchange Binance was responsible for $3.8 trillion in spot transaction volume, with a 52.6% dominance of the centralized currency market by 2023, according to a January 30 report by CoinGecko. Year-on-year market share growth has reached 4 percent.

By December 2023, Binance had a record trading volume of over $427 billion and 3% of its monthly market share. Analyzing the month-to-month period, the exchange showed a 37.5% increase in trading volume, reaching a dominance of 43.7% in the last month of 2023.

Despite the regulatory turmoil the company faced last year, Binance has gained momentum. The exchange is at the center of a landmark settlement with the US Department of Justice (DOJ) and the Commodity Futures Trading Commission (CFTC), agreeing to a $4.3 billion fine to settle allegations of financial misconduct.

This season saw one of the most influential people in crypto, Changpeng Zhao (CZ), step down as CEO of the company.

Upbit in 2010 It has taken the opportunity to increase its market share by 2023, with a sales volume of $687 billion by 2023 and a dominant year-on-year growth of 2.2%. Last year's Q4 was particularly fruitful for Upbit, with transaction volume rising 93.5% over the quarter to $238.2 billion.

A significant driver of Upbit's success, according to a CoinGecko report, can be attributed to the ‘premium for kimchi', a phenomenon based on high domestic demand for the cryptocurrency in South Korea, which has led to a high price for the currency.

In the year OKX reports that by 2023, OKX will hold a 6.7% market share with $485.9 billion in transaction volume and a 1% growth in market dominance. The last quarter was particularly popular for OKX, which saw a 152% increase in trading volume quarter-on-quarter to $177.9 billion.

The exchange showed a consistent upward trend in market share, starting the year at 5.1% and closing at 8.9%. Although it was temporarily overtaken by HTX in the third quarter, OKX not only managed to regain its position, but also outperformed HTX's growth.

In the last quarter of 2023, MEXC was among the top 10 centralized exchanges with the most significant revenue, with a growth of 204%, which traded more than $90 billion. Bybit and KuCoin followed closely behind, growing 162% and 161% respectively.

In particular, KuCoin made a significant comeback by securing ninth place at the end of December with a market share of 3.3%, after briefly dropping out of the top 10 in the third quarter.

Share this article

The information on or included in this website is obtained from independent sources that we believe to be accurate and reliable, but we make no representations or warranties as to the timeliness, completeness or accuracy of information obtained through this website. . Decentralized Media, Inc. Not an investment advisor. We do not provide personalized investment advice or other financial advice. The information on this website is subject to change without notice. Some or all of the information on this website may be out of date, or may be incomplete or incorrect. We may, but are not obligated to, update any outdated, incomplete or inaccurate information.

Crypto Briefing may include articles with AI-generated content created by Crypto Briefing's own proprietary AI platform. We use AI as a tool to deliver fast, useful and actionable information. All AI-added content is carefully reviewed, for accuracy, by our editors and writers, and we always draw from multiple primary and secondary sources to create our stories and articles.

You should not make an investment decision in an ICO, IEO or other investment based on the information on this website and you should never interpret or rely on any information on this website as investment advice. If you are seeking investment advice on an ICO, IEO or other investment, we strongly recommend that you consult a licensed investment advisor or other qualified financial professional. We do not receive compensation in any form for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities or commodities.

See full terms and conditions.