Bitcoin 3-Year High, Ethereum Slips: CoinGecko

CoinGecko's Q3 Crypto Industry Report determined that the overall market was down 1.0%. Bitcoin enjoys a 3-year high for market dominance, and Ethereum is slipping in several dimensions.

A number of minor concerns need to be addressed, but the quarter is generally positive for crypto.

Bitcoin in global markets

CoinGecko's report revealed several interesting market trends. At first glance, Bitcoin is doing well and has more than 53 percent of the total crypto market share. Moreover, as of writing, the dominance of Bitcoin stands at more than 58%.

Since this bull was formed in April 2021, this shows Bitcoin's dominance over other crypto assets.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

However, CoinGecko raised a number of points that seemed less naive. The overall market value of all crypto assets declined slightly during this period, and even Bitcoin underperformed traditional values such as gold and several Treasury bonds. British, Japanese and US Treasury bonds have all beaten Bitcoin since early August.

Global government policies, especially those of these countries, had a significant impact in this quarter. US rate cuts and potential tax cuts in Japan have been a particular boon for Bitcoin.

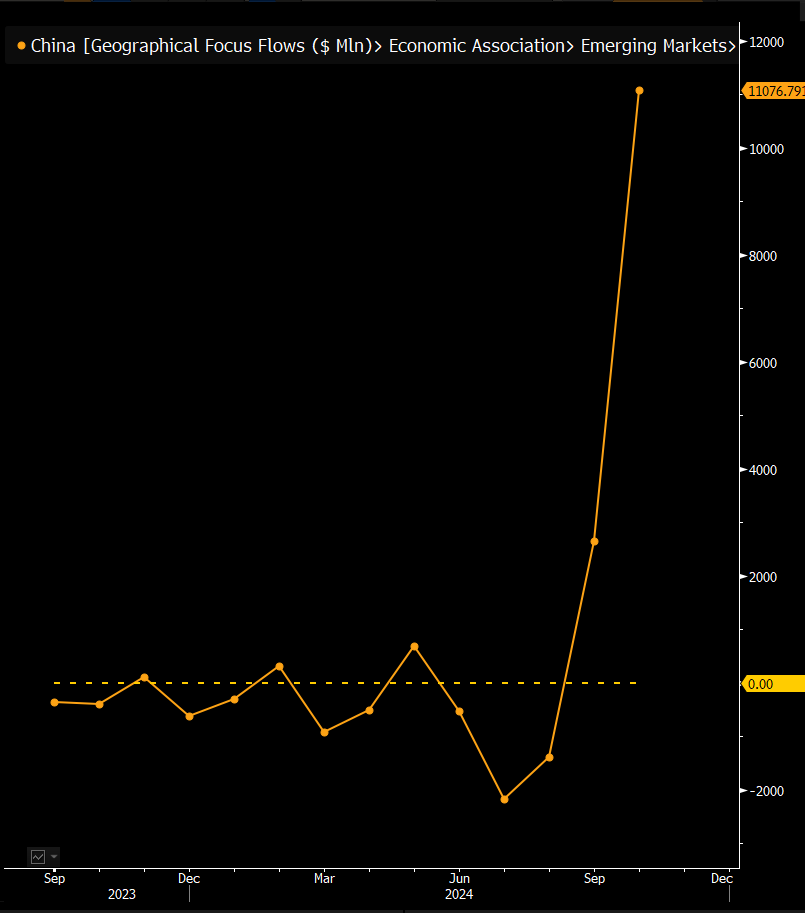

Provocative announcements in China also helped buy the entire crypto market. CoinGecko has not reviewed Chinese Treasury bonds, but analyst Eric Balchunas noted the ETF's strong performance:

“Year of the Bull: China's ETFs' Total October Inflows Now Up to $11 Billion. What a chart. A $90 billion asset purchase by the government will do that…” Balchunas said in a Monday post.

In short, Bitcoin is taking advantage of the crypto market, but this is not a victory. The big market is reeling, and global economic policies have brought this decentralized money to its biggest win.

Although Bitcoin prices remained flat in Q3, US Spot Bitcoin ETFs experienced higher net inflows…in Q3 compared to Q2. The inflow of income increased AUM by 13.2%, the report said.

Is Ethereum covered?

Ethereum (ETH) has lost some of its market share to Bitcoin, but this is not the only development that CoinGecko is focused on. Ethereum Layer-2 (L2) transactions rose 17.2 percent this quarter, but nearly half came from the base. This is Ethereum L2's recent success, and was responsible for 42% of ETH L2 transactions.

Read more: How to Create a Token on Base Blockchain: No Code Guide

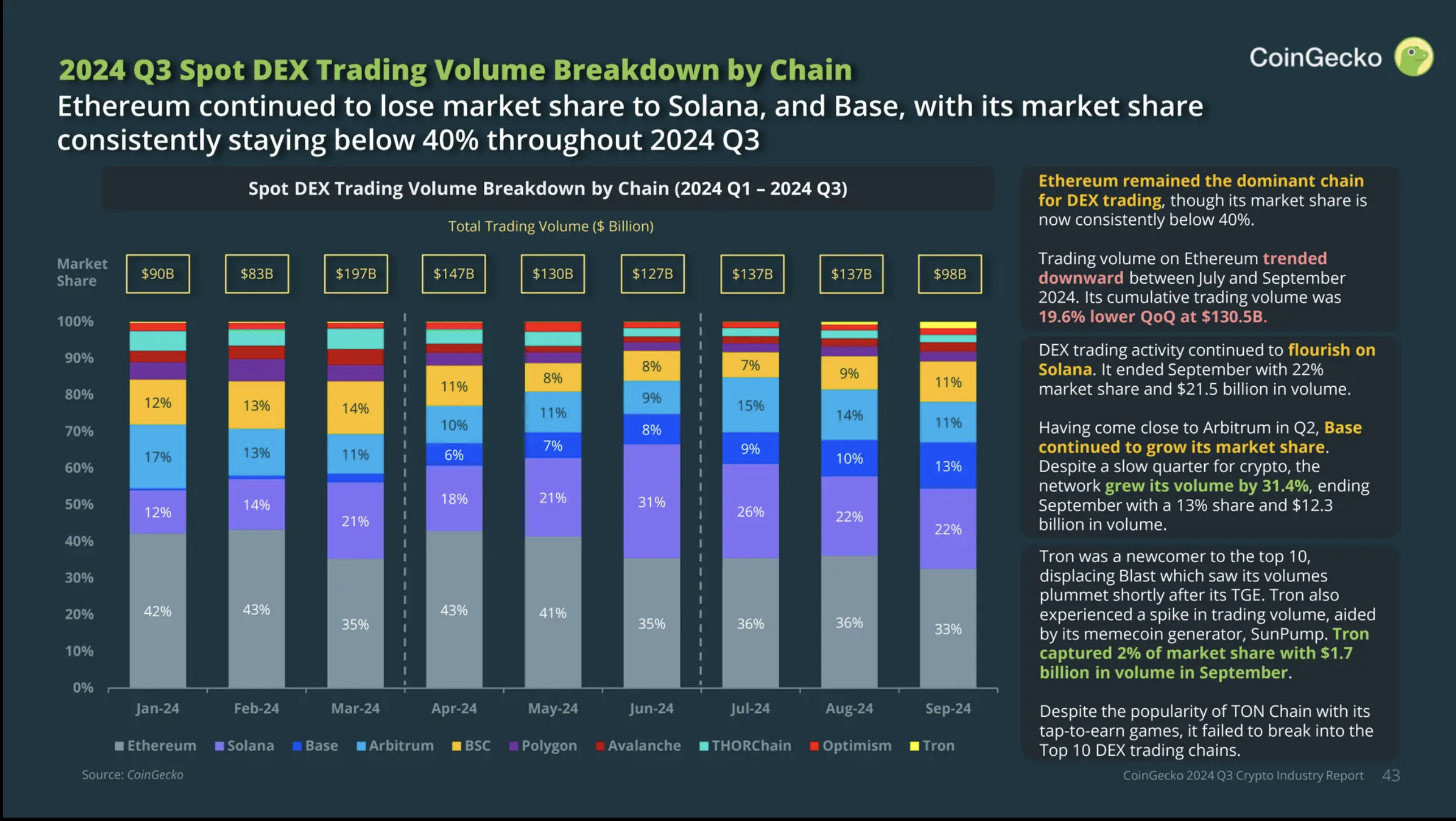

Base is consuming Ethereum on decentralized exchange (DEX) trading, while ETH is declining as it grows. As CoinGecko has already noticed the technical benefits of this chain, Solana has taken bites out of its ETH share.

“In Q3 2024, Ethereum was the dominant chain for DEX trading, although its market share is now consistently below 40%. DEX trading activity continues to grow on Solana, fueled by many fun coins. Meanwhile, despite a slow quarter for the base crypto market; It continued to grow its market share in Q3,” CoinGecko said.

Ultimately, neither Bitcoin nor Ethereum can claim a fully successful quarter. The crypto market has slowed slightly in Q3 2024, but it is still a worrying sign. Bitcoin's successes and failures seem tied to many other factors, and Ethereum faces real competition.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.