Bitcoin and Ethereum options expire – what to expect

Today, more than $10 billion worth of Bitcoin (BTC) and Ethereum (ETH) options expire.

Market watchers pay particular attention to this phenomenon as it can affect short-term trends in the number of contracts and their fair value. Examining call-to-call ratios and peak pain points can provide traders with insights into potential market directions.

Bitcoin and Ethereum options expire today

The notional value of BTC options expiring today is $9.47 billion. According to Deribit data, these 98,309 expired Bitcoin options have a call ratio of 0.84. This ratio shows the spread of buying options (calls) over selling options (puts).

The data shows that the maximum pain point for these expiration options is $80,000. In crypto options trading, the biggest pain point is the price at which most contracts expire worthless. Here the property incurs the maximum financial loss of the holders.

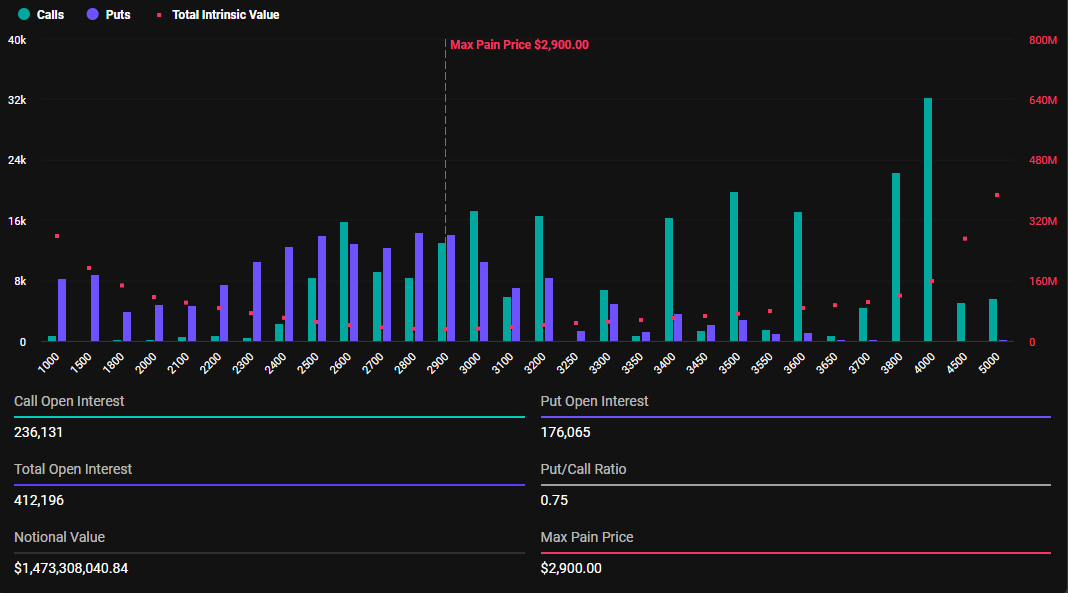

In addition to Bitcoin options, 412,116 Ethereum options contracts are due to expire today. These expiring options have a notional value of $1.47 billion and a call ratio of 0.75. The maximum pain point is $2,900.

The current market values of Bitcoin and Ethereum are above their respective peak pain points. BTC is trading at $96,353, while ETH is sitting at $3,573. This means that if the options expire at these levels, it generally represents a loss for option holders.

Options traders' results may vary depending on the specific strike price and position they hold. To accurately assess the potential profit or loss from expiration, traders must consider their entire option position against current market conditions.

Insights on BTC and ETH options expiring today

Analysts at options trading tool Greeks.live present an interesting investor perspective that shows the need for a comprehensive review before reaching a conclusion.

“We had an 11% return on BTC and people are saying the end is near. It was less than 10 days when the same people were asking back to buy,” he wrote.

Greek.Live CEO and founder Jeff Liang said the options are set to be held until they expire at 8:00 UTC on Friday.

Although the spread is significant, the discount volatility is equal to the recent 1-month historical volatility, so the price is not overvalued. A 5% spot price increase can reduce the spread. I'm ready to hold on until it's over. I bought call options last night, and the market made some moves this morning,” Liang said.

Meanwhile, crypto markets are secretly optimistic. Bibit said in a statement to BeCrypto that optimistic investors may be waiting for a more crypto-friendly SEC chairman after Gary Gensler's resignation.

Against this backdrop, Bybit commented on the current market outlook, citing a correction in Bitcoin prices and noting that expired ETH options indicate some bullish sentiment.

“BTC's decline from the $100,000 mark has moderated ATM volatility, with short-term options falling below 60%, reflecting a pattern seen after the US election. Low perceived volatility explains the drop. While open demand for calls remained unchanged, demand for short options stalled this week. ETH options show slightly higher sentiment than BTC options. Markets have recalibrated after the election peak, but call options remain at the forefront of both trading volumes and open interest,” Bybit added.

ATM IV refers to the volatility of an option contract where the strike price is equal to the current market price of the asset. Analysts and traders often use this specific type of IV (implied volatility) to gauge market sentiment and exchange prospects.

Therefore, traders are advised to be careful, because historically, the expiration of options often leads to short-term volatility in the market. Weekends are also critical as they are often characterized by high volatility due to low trading volumes.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.