Bitcoin as an ETF And the pressure of the marginal fluids is influencing

Bitcoin ETF reinforces the “imminent” BTC price decline, where the flow and liquidity of the criminals revolves. Marginal liquidity accelerates Solloff as key support levels are broken. The correlation with technology stocks added.

After recent weeks, it is coming under heavy pressure, the market is suffering from disease demand, severe ECPP. And the forced flow weakens the wave and creates a high pressure.

Menstrual periods are counted as entry months, and traders start a fast-sliding temporary regime or a deep cycle reset.

E.T.P.P.P.P.

Since the October high above $56,000, the Bikocon slide has been steady and steady.

In the year From the peak in October, the writer has a value of 800 billion dollars, which is disturbing when the levels seen in the spring are broken.

ETFS, once a stabilizing force for Bitcoin (BTC), are now driving more weakness.

The Blorrock IEBEBET EABET ETE record sold by the runaway sale sent the largest monthly redemption on record, leaving the mine with $520 million.

This reversal is changing in the sentiment of institutions and has become the main source of downward pressure.

A recent Nidig Research ETDF puffs, switching, switching, corporate treasury strategies are slowing down the demand engine that supported Bitcoin earlier this year.

Greg Pepig says that Nidig's current cycle is that the market is currently in a state of panic.

This shift is being offset by a strong sell-off in the market as the demand for food expands.

A key part of this change is in the Stundcoin market, which sometimes loses significant value after bankruptcy events.

In addition, digital asset treasuries, once active Bitcoin buyers, will drag down the killers who sell assets or share assets.

These activities have contributed to the stability of liquidity in the crypto sector.

Bitcoin price

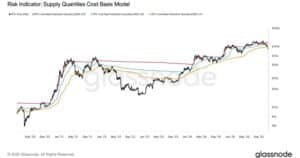

From a technical point of view, bitcoin has entered the territory of a trendline and a swinging hammer candlestick is printed.

The cut that was earlier in the year and last week's SELLOFFESS are now eyes.

The top-sponsored vacation can create conditions for short-term recovery, which is more than $94,000 and $95,000.

However, that set-up has been able to withstand strong market pressure.

Bitcoin smokes another complexity of the integrated relationship with risk.

The correlation between Bitcoin and NASADAQ 100 is repeated close to 9.96.

Bitcoin follows when tech stocks fall, and the recent uproar over the AI bubble has been a serious concern for both markets.

Bitcoin slips to multi-month lows, indicating that dominance is moving away from BTC and risk-adverse options.

The market is also pointing to the volatility that comes from margin liquidity.

Leverance position, especially the constant future expectations, have raised the recent activities.

If Bitcoin fell from below $87,000 to above $97,000, more than $900 million was wiped out, taking a lot of damage.

In particular, performance toys have become a recurring theme with each leg lowered.

In addition, oxidation indicators, including Relative strength index (RSI) and moving average local indicator (MACD), The ratio of the previous hammers that sell quickly.

A drop below the recent likes could close the door to the 76,000 territory that Bitcoin (BTC) had cut during the recent market turmoil associated with ref fears.