Bitcoin (BTC) price analysis gives good signals

Over the weekend, the price of Bitcoin (BTC) hovered between $54,424 and $58,215. However, as the new week begins, the coin offers a surprising revelation on the chain, which may influence its next direction.

To put it in perspective, this situation has historically been critical to BTC's recovery. Will it be the same this time?

Bitcoin is oversold, triggering multiple auctions

The benchmark in question is the NVT Golden Cross. NVT stands for Network Value to Transaction. According to the revised NVT ratio index, the indicator measures if Bitcoin reaches the bottom or the top.

If the value of this indicator is 2.20 or higher, it means that the coin has hit the upside, and a decline is inevitable. As shown in the image below, this happened in December 2023, March 2024 and most recently, May.

Relatively speaking, if the NVT Golden Cross is below -1.60, it means that BTC is close or has hit the bottom.

Currently, the gauge is at -1.39, which could be a bearish sign. This selling pressure can be linked to Mt Gox's recent BTC activity.

Apart from this, the many transfers made by the German government played a role. However, as it stands now, the coin may be on the road to recovery, as a takeover could signal a resurgence.

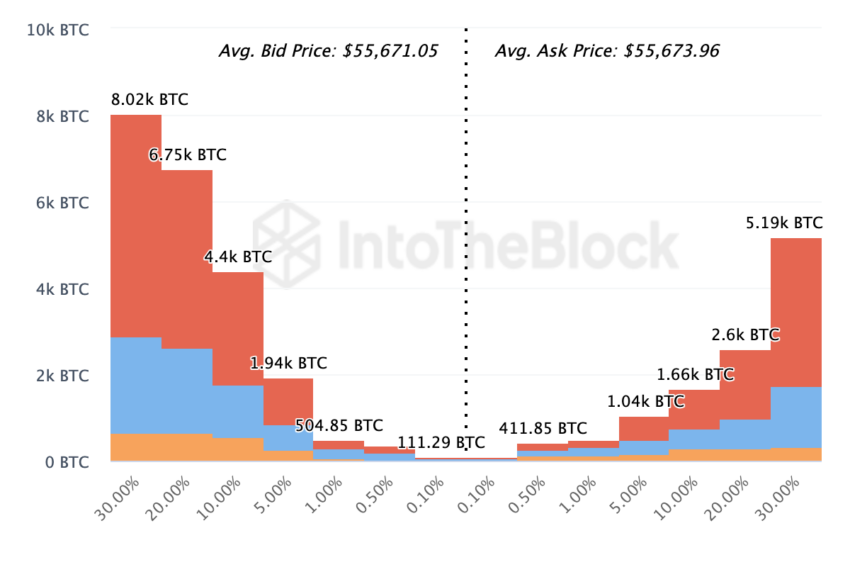

Furthermore, market participants seem to be queuing up to buy BTC at the current discount rate. BeInCrypto discovered this after researching the depth of the exchange's on-chain market.

Read more: How to buy Bitcoin (BTC) on eToro: a step-by-step guide

This measure looks at the movements on the order books of the top 20 exchanges. The depth of the exchange chain market, which is divided into two parts, considers the bid (buy) and ask (sell) units.

According to IntoTheBlock, participants bid an average of 55,671 for 22,075 BTC. However, the total amount of BTC released is 11,514 BTC at an average of $55,673.

Given the high buy rate, Bitcoin's price may recover some of its recent losses, avoiding another fall.

BTC Price Prediction: No more breakouts.

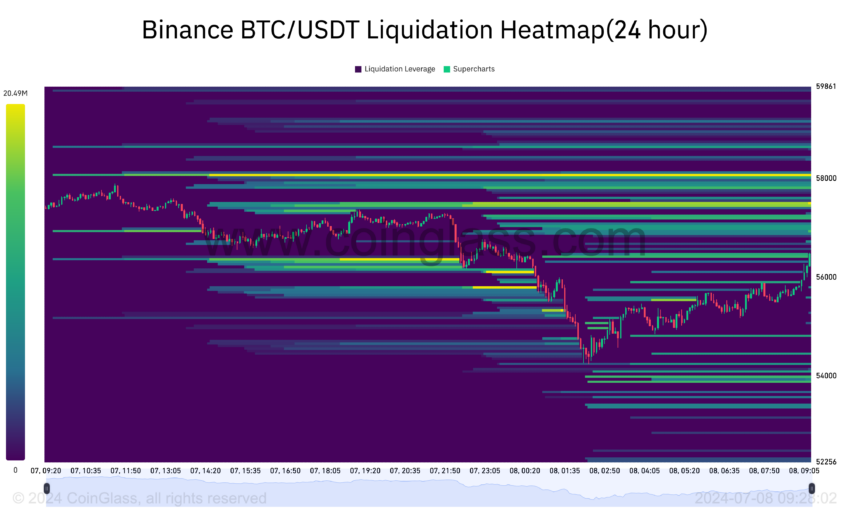

At press time, Bitcoin is trading at $56,752. However, Liquidity's heat map suggests that prices may rise in the short term.

A Liquids Heatmap uses color variations to measure the volume of buys and sells in a market. Cool colors like purple indicate a low level of activity. But when you see colors like green or yellow, it means that the liquidity is focused on the price level.

By analyzing the heat map, one can identify areas of interest, resistance and support levels.

According to Coinglass, there is significant liquidity at $57,516 and another at $58,037. This high level of liquidity can attract Bitcoin price increases in these regions.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

The Relative Strength Index (RSI), which measures momentum, supports this potential. The daily BTC/USD chart is at 34.61.

When the indicator reading is below 30.00 it is oversold. When it is above 70.00, it is overbought. Therefore, the RSI position indicates that Bitcoin has left the oversold territory and is looking for a significant recovery.

Going through the Fibonacci Retracements areas that place support and resistance points, BTC could retest $58.251 if it crosses $57,016.

Meanwhile, RektCapital, an anonymous analyst at X, also commented on Bitcoin's price action. According to him, he may have left a side business when the coin collection was closed.

“Bitcoin is about to make its first weekly candle, closing below the low of the retracement range for the first time in more than four months,” Rect Capital posted.

However, the coin is still trading below the 20-day exponential moving average (EMA), which tracks price changes to determine the strength or weakness of a trend.

If the price of Bitcoin is above the 20-day EMA, this indicates a strong bullish trend. However, as long as the coin does not break below the threshold, it risks a return to $55,019.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.