Bitcoin (BTC) Short Holders: $55,000 Defense?

An accelerated bull market is often associated with an increasing flow of new investors. Short-term holders of Bitcoin (STH) – as the analysis on the chain calls them – join the market during the rising bull market. Driven by the desire to make a quick profit, they do not hold assets for a long time.

However, if Bitcoin's price corrects, as it did last week's price action, short-term holders will quickly lose ground. However, their characteristics and market presence are critical to maintaining a healthy beef market.

What is the value of short-term holders of Bitcoin?

It is important to monitor the behavior of short-term holders of Bitcoin due to its historical correlation with the price of BTC. The STH category includes addresses that hold their BTC for less than 155 days. After exceeding this arbitrary threshold, addresses become long-term caches (LTHs). They hold assets for a long time and do not want to sell on impulse.

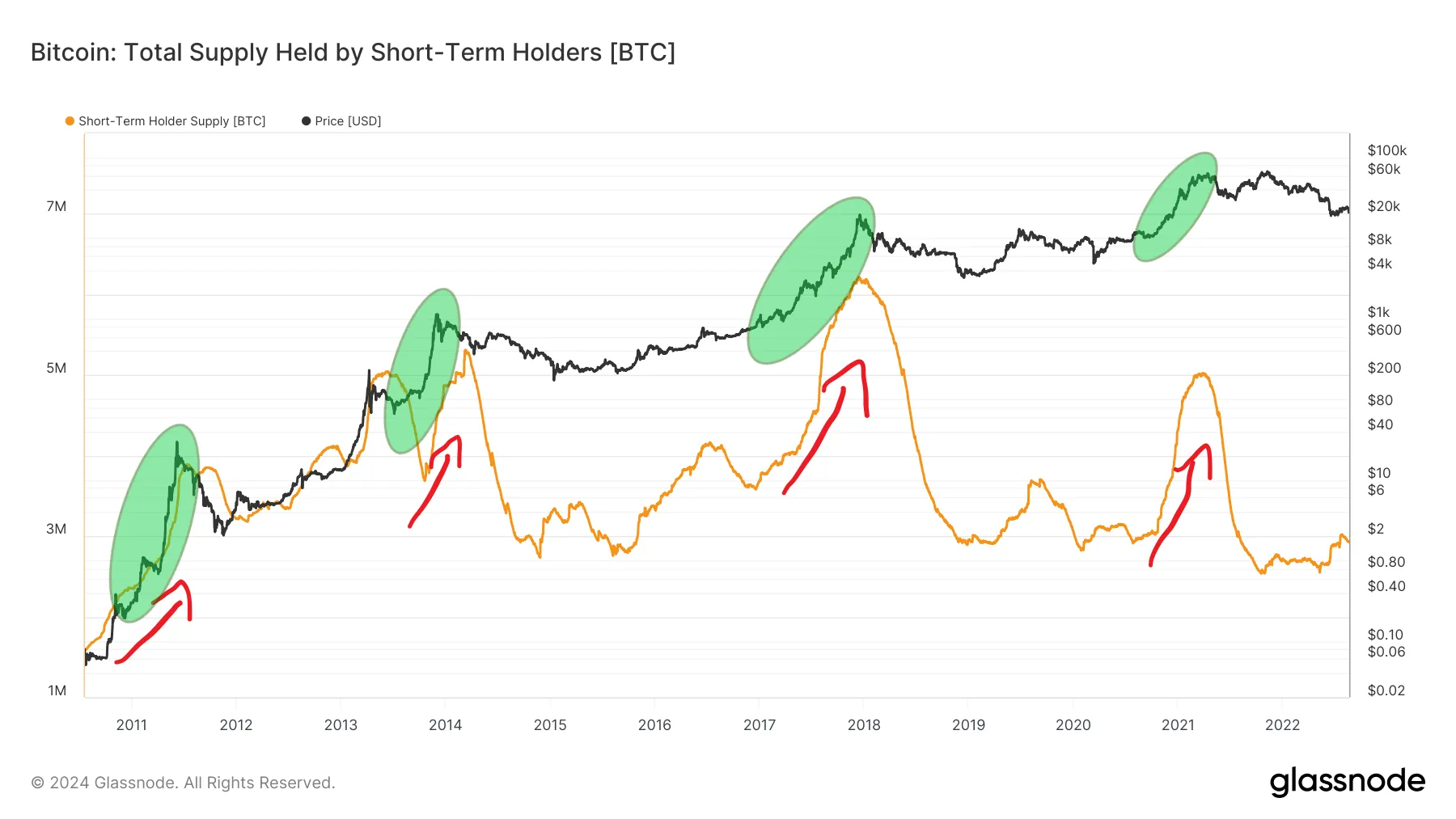

Naturally, the increase in the percentage of BTC supply held by STHs is inversely proportional to the percentage held by LTHs. Interestingly, LTH's long-term supply chart is inversely related to the price of Bitcoin. This is especially evident at the end of successive cycles. The more Bitcoin is sold by long-term holders (red areas), the higher the BTC price (green areas).

Therefore, the supply in the hands of STH is usually directly proportional to the price of BTC. New, inexperienced market participants buy when BTC increases (red arrows).

Since the cryptocurrency has already increased (green areas), they are confident that it will continue. This is still a growing circle of new investors and traders looking to join the bull market movement. Therefore, it is important to follow what short-term owners are doing on the chain.

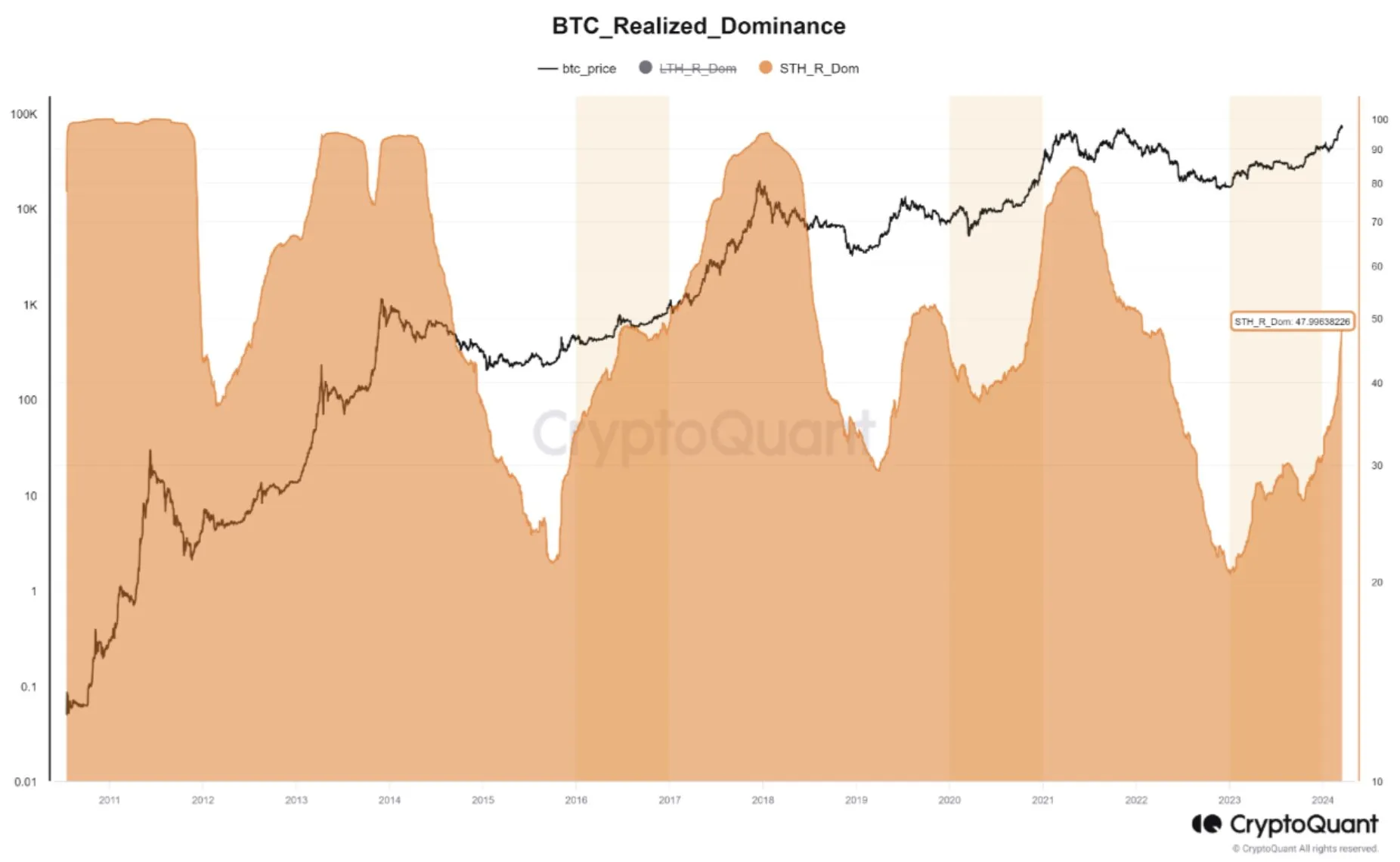

Short-term holders will receive approximately 50% of their BTC Realized Cap

In a recent article, analyst firm CryptoQuant noted that nearly 50% of Bitcoin's realized capitalization is in the hands of short-term holders. A special increase in this indicator can be seen in the last 30 days when the enthusiasm and speed of STH purchases increases.

“This event, along with a very high level of bullishness among short-term holders, indicates a significant amount of capital in the market in the coming weeks and months.” – Added on-chain analysts.

However, on the other hand, another CryptoQuant analyst wrote that the pace of selling of assets held by LTHD does not yet indicate the lateness of the cycle. In other words, there is a lot of potential in the current cycle to buy STH and increase the price of BTC.

“However, we have not yet seen it enter this phase late in the cycle, although occasional corrections are common, partly due to the current market conditions being heavily leveraged,” he said.

Key support at $55,000

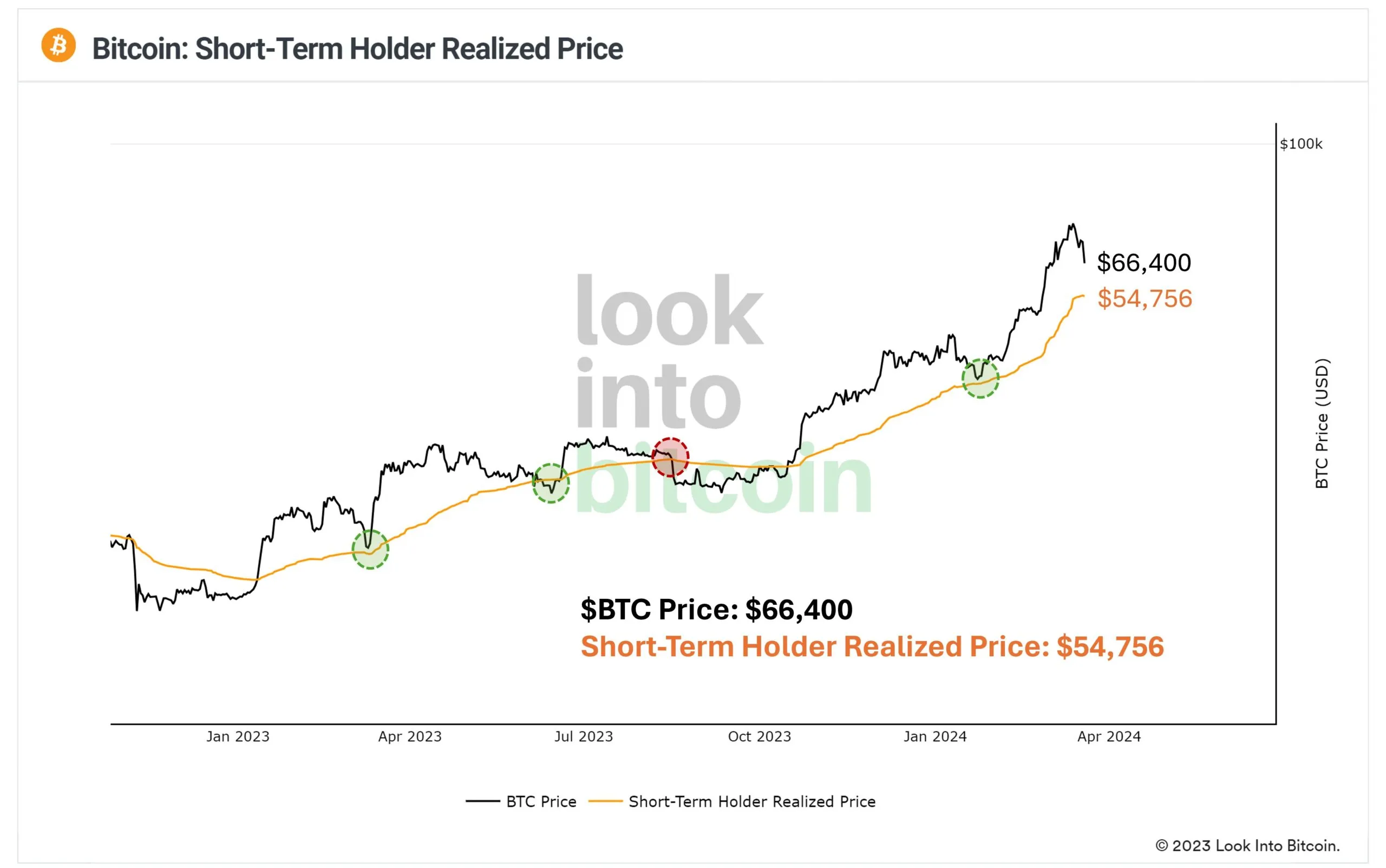

Finally, the famous cryptocurrency market analyst @PositiveCrypto published his views on STH behavior in X today. It also provides a chart of the guaranteed value of short-term holders.

In the ongoing bull market, the curve has already given support to the price of Bitcoin three times (green areas). At the same time, he emphasized that once the price of BTC fell below this support, it led to a deep correction in the market.

The analyst predicts that if Bitcoin's continued correction leads to a re-realized STH price area, Bitcoin will reach around $55,000. Measured from the current all-time high (ATH) of $73,777, this would be about a 25% decline.

However, even such a deep correction does not disrupt the long-term bull market structure. Only the loss of this support and a deep decline could trigger a medium-term bear market, which could dominate the upcoming halving environment.

Click here for BeInCrypto's latest crypto market analysis.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be construed as financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions. Please note that our terms and conditions, privacy policies and disclaimers have been updated.