Bitcoin Call Call Ratio 1.0: Bearish Signs Ahead?

Crypto markets witness $3.42 billion in Bitcoin and Ethereum options contracts expire today. Especially as markets wait for Bitcoin to hit $100,000, the massive expiration could have a short-term price impact.

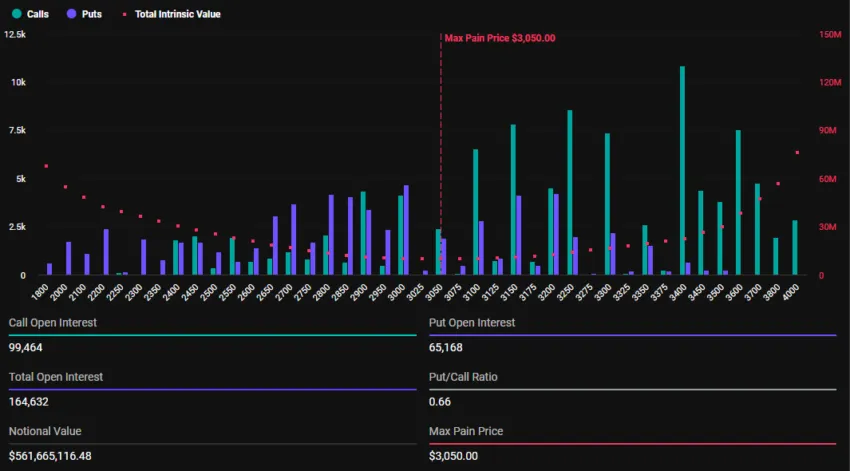

With Bitcoin options valued at $2.86 billion and Ethereum at $561.66 million, traders favor volatility.

Unlike Ethereum, traders bet on the price return of Bitcoin.

Bitcoin (BTC) and Ethereum (ETH) contracts expiring today saw a significant increase compared to last week.. According to Deribit data, 28,905 Bitcoin options contracts ended Friday at a 1.09 to call ratio and a maximum pain point of $86,000.

On the other hand, 164,687 Ethereum contracts expire today with a call to call ratio of 0.66 and a maximum pain point of $3,050.

Bitcoin's call-to-call ratio has remained above 1, however, indicating a generally subdued sentiment BTC's whales and Long term owners fueling recent growth. In comparison, Ethereum peers have a call ratio of 0.66, reflecting the overall market outlook.

The put to call ratio indicates market sentiment. Options represent bets on a price decline, while call options represent bets on a price rise.

If this ratio is more than 1, it indicates that there is no optimism in the market, many traders will reduce the price. On the other hand, a call ratio of less than 1 indicates optimism in the market and many traders are betting on a rise in prices.

Bitcoin call-to-call ratio, implications for BTC

As the options expire, traders are decreasing the value of BTC and increasing the value of ETH. According to Max Payne theory in options trading, BTC and ETH can each pull to their maximum pain points (strike price) of $86,000 and $3,050 respectively. Here, the vast majority of contracts – both calls and puts – become worthless.

Price pressure on both assets will ease, especially after Derbit completes contracts at 08:00 UTC today. At the time of writing, BTC was trading at $98,876, while ETH was trading at $3,389. Meanwhile, in line with the call ratios, Greece.Live analysts predict an extended move northward in ETH and say BTC is in a correction.

“8% of the positions expired this week, the big rally in Ethereum led to a huge increase in the ETH main term options IV. [implied volatility]While BTC main term options IV has remained relatively stable. The market sentiment remains extremely optimistic at this point,” Greeks.Live analysts said.

While analysts say Bitcoin is at risk of a correction, the overall market rally has ruled out this potential pullback. They attribute the positive sentiment in the market to significant capital inflows into ETFs (exchange-traded funds), particularly BlackRock's IBIT options, which have recently begun to trade strongly against the bull market in the space.

However, with today's high volume of expirations, traders should anticipate fluctuations in the price of Bitcoin and Ethereum that may shape their short-term trend.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This newsletter aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with experts before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.