Bitcoin closes in on major breakout as 200-day moving average nears

Key receivers

Bitcoin's 200-day MA approach may signal a new bullish trend. Low liquidity indicates cautious trading and limited downward pressure.

Share this article

Bitcoin is trying to break above its 200-day moving average (MA), which has been sitting at around $64,000 for the past five consecutive days. Historically, a break above the 200-day MA signals further upside, serving as a key indicator of long-term market sentiment.

Bitcoin is up over 5% since the Federal Reserve's rate cut announcement, reaching 63.5k and nearing the critical 200-day moving average of $64k.

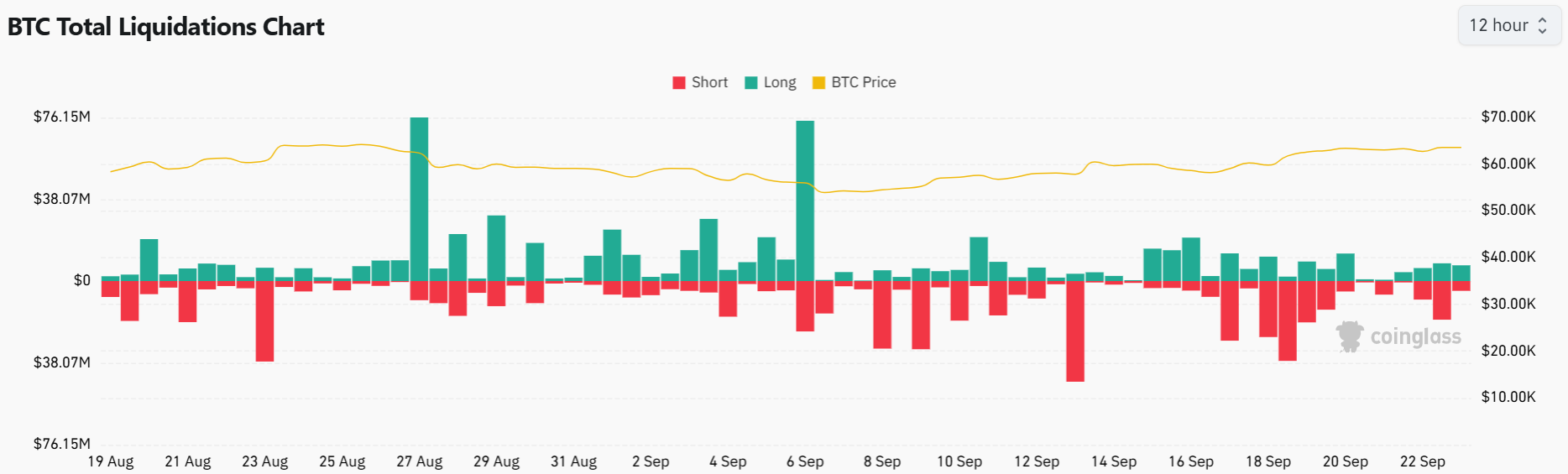

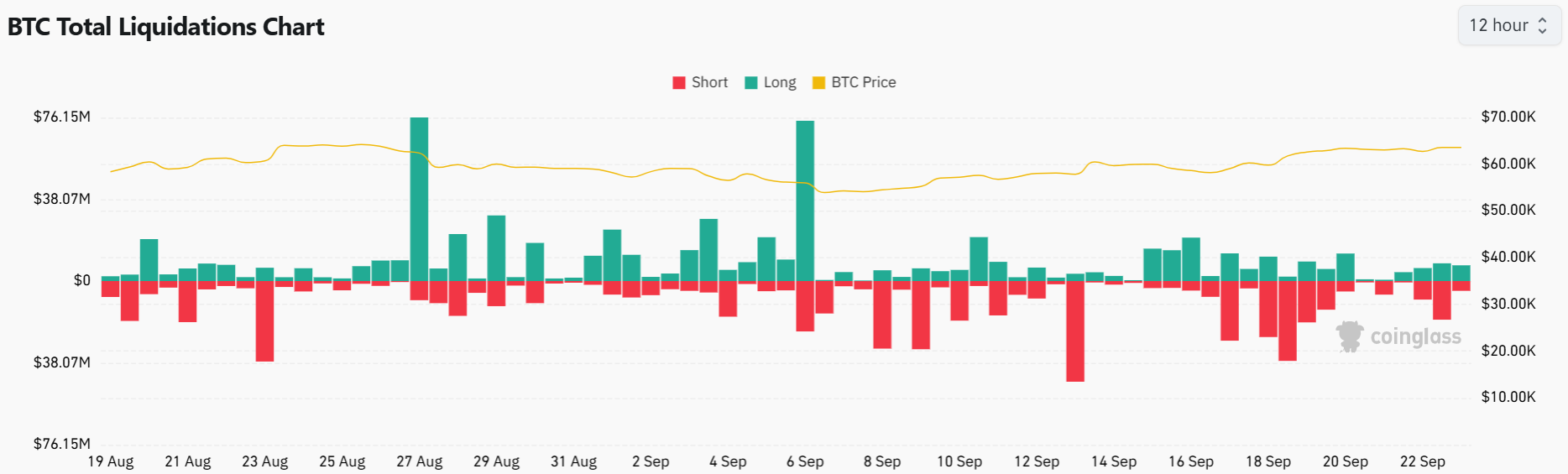

As Bitcoin hovers near its 200-day MA, CoinGlass reports $7 million in long liquidity and $5 million in short liquidity. Low liquidity levels indicate cautious trading and limited downward pressure, indicating bullish momentum.

In October 2023, Bitcoin crossed its 200-day MA, which was then around $28,000. That crash was sparked by anticipation of Bitcoin ETF adoption in the U.S., ultimately driving a powerful rally that saw bitcoin reach a peak above $70,000 in March.

At this point, a number of factors align again to support fragmentation. With the approval of trading options for BlackRock's Bitcoin ETF and growing institutional interest in the crypto, many believe Bitcoin could soon return to its post-ETF announcement price range of $64,000 to $74,000. A sustained push above the 200-day MA could signal the start of a new uptrend, attracting more investors.

Despite some sideways trading moves in the past six months, Bitcoin has delivered long-term returns. Over the past year, the token has risen an impressive 142%, far outperforming traditional asset classes such as the S&P 500 (+32%) and the Dow Jones Index (+24%). Compared to high-profile stocks like Apple (+31%) and Tesla (-1%), Bitcoin remains an attractive investment for those looking for growth potential.

Share this article