Bitcoin Dodips Below $87k: A Week’s Gains Are Entered In One Candle

Bitcoin dropped below $87,000 a week for a one-week gain in one session.

The rapid rally was less than $ 400 million in 60 minutes and pushed the global million dollar to push by 4% to $ 3.04 trillion. Businesses and institutional investors quickly put pressure on prices as they did business

Sponsored Sponsored

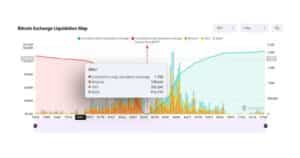

Market volatility produces huge liquidity

Liquids rise in the numbered areas reflecting the sliding speed. Market data has flowed $400 million in one hour. This highlights the dangers for traders of rapid losses during strong price movements.

The amount of business turnover of investors was more than 110 billion dollars. Bitcoin's dominance stood at 57.1%, Emerum at 11.3%, according to Kombok data.

Cubasia's letter highlights the thin weekend liquidity and the rest of the environment, “This Crypto bear market is still in nature. The analyst fell more than 4000 dollars in minutes without news. This one domino-effect is filled with mass liquidation in the areas where it was hit.

Other analysts have warned that the price patterns of ancient bikinis resemble those of earlier menstrual cycles. In the year Following a break above $90,000 on November 20, it held at $91,208.85 on November 28 and was supported at $90,000 for six days.

Korbot Instructions Current Price Action April 2024 If only to drop from $57,000 to $67,000, this pattern suggests that further sideways movement or another correction is possible.

Another analyst warned The risk of “off” exposure can happen if Bitcoin fallsRoughed the $80,000 support level.

Sponsored Sponsored

“Bitcoin is not a good open to start the week! It successfully moved from 20.00 to close to 40.00. This <48 KC

Technical analysis also shows critical support zones. Should be sold, prices can slide much more. A drop to $48,000 at current levels would trigger a staggering 45%, but such a move would require sustained bank sentiment.

He took out the narrative forms of property rotation

Some analysts see Bitcoin Shellofs as a Bitcoin Shelloffse in asset allocation. They move as traditional safety-related vehicles like precious metals. This indicates that some investors are risk averse.

This argument shows that capital flows from digital resources to “hard money” alternatives. For example, Silver Brain rose even as he fell. Some analysts see this as a sign of changing investment preferences.

“#Bitccoin is so regulated in a single week, #silly by <ግትርነት ሀብቶች> It is not on. Driving High Money, Digital Risk → Financial Dimensions” – Macro Fields

This concept is fiercely debated. Bitcoin has been restarted again and again from the bottom of the rally. Despite their volatility, it still dominates the market at 57.1% and still flows through many of its digital assets.

Meanwhile, it settled below $87,000 on the first day of December. At the time of writing, Bitcoin is at $87,200-$87,400, with market participants looking closely at the $87,000 support level.