Bitcoin dropped below $62,000 when Iran launched a missile attack on Israel

Key receivers

Bitcoin falls below $62K as Middle East tensions rise. Market volatility will continue as geopolitical and economic uncertainty continues.

Share this article

The price of Bitcoin dropped below $62,000 on Tuesday afternoon following Iran's missile attack on Israel. At the time of the report, BTC was trading at around $62,200, down 1.4% in the last 24 hours, as the conflict intensified, creating uncertainty in the global market.

Traders who were waiting for the mass start of “Uptober” have lost hope as both crypto and stock markets fell.

Following Iran's large-scale missile attack on Israel today, Bitcoin experienced a sharp sell-off that pushed the mark below $61,000. Although the price has recovered to around $62,000, the ongoing conflict between Israel and Iran continues to create uncertainty.

Analysts warn that Bitcoin may face further downward pressure and may retest the key support level of $60,000 if the situation worsens.

The sell-off in Bitcoin and other crypto assets was driven mainly by reports of an escalation in the Middle East. Iran recently launched a missile attack targeting major Israeli cities, including Tel Aviv, following Israel's threat to retaliate against Hezbollah forces. The Israel Defense Forces confirmed that all Israeli civilians were ordered into bomb shelters at the time of the attack.

Adding to the tension, US President Joe Biden and Vice President Kamala Harris are reported to have ordered US military forces in the Middle East to help defend Israel in the White House Situation Room.

Bitcoin's price fell quickly as investors fled speculative assets. At press time, Bitcoin has recovered slightly but is down roughly 2% over the past 24 hours. The volatility reflected broader market uncertainty caused by the conflict, with investors seeking safe-haven assets such as gold, which rose more than 1.2% to a record high.

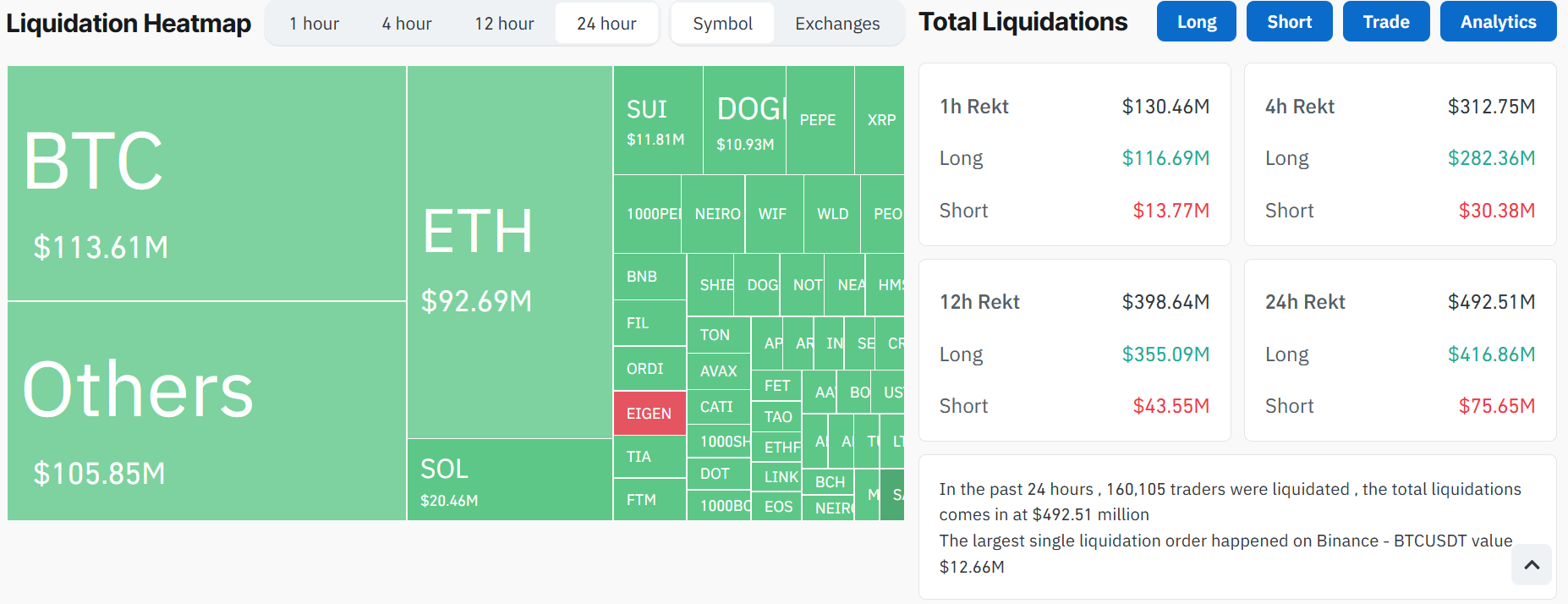

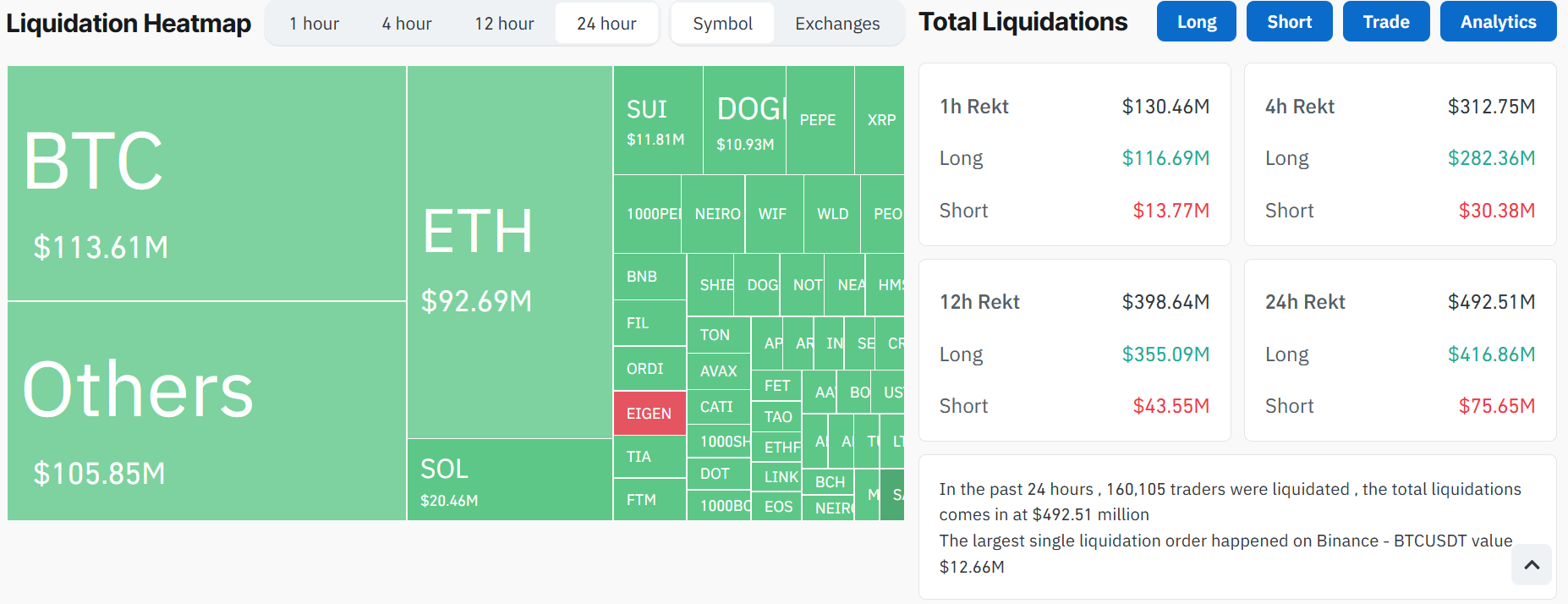

In addition to geopolitical concerns, traders were profit-booking ahead of the upcoming FOMC. Data from CoinGlass shows high flows from major tokens such as Bitcoin, Ethereum and Solana.

More than $481 million in liquidations were recorded, adding to sales pressure. Ethereum saw more than $92 million worth of liquidity, while $113 million worth of Bitcoin positions were wiped out, marking the largest liquidity event since early September.

Bitcoin's recent sales mirrors the same decline seen in April and July, when tensions in the Middle East sent crypto assets plummeting. As the conflict continues and market volatility continues, it is highly likely that Bitcoin will test lower support levels such as $60,000.

October is traditionally a strong month for Bitcoin, earning the nickname “Uptober” for its consistent positive returns. However, with geopolitical tensions and key macroeconomic events such as the FOMC meeting, market volatility is likely to continue.

Share this article