Bitcoin ETF revenues exceeded $555 million as demand began to grow

Spot Bitcoin ETFs in the US posted record net inflows of more than $555 million on Monday.

This marks the highest net inflow since June 5, indicating a strong resurgence of investor interest in Bitcoin. At the same time, the price of Bitcoin also increased.

Bitcoin has surpassed $66,000

According to data from Coinglass, as of October 14, the Everywhere Bitcoin ETF recorded $555.90 million in revenue. Additionally, the total trading volume of Bitcoin ETFs reached $2.78 billion, the highest since August 25.

On the other hand, the price of Bitcoin has increased by more than 6.3% on the day, after the price correction earlier in October, it came back above $66,000. However, as of writing, the price of Bitcoin is hovering around $65,500.

Read more: What is a Bitcoin ETF?

Farside data shows that most Bitcoin ETFs saw positive net inflows during Monday's trading session, with the exception of Wisdomtree's BTCW, which had zero net inflows. Fidelity's FBTC led the buying activity with $239.3 million, followed by Bitwise's BITB with $100.2 million. Even Greyscale's GBTC, which often faces selling offsets, recorded $37.8 million in buying.

As the US election draws to a close, positive sentiment is increasing

According to a Bloomberg analysis, the recent Bitcoin price rally was driven by investors' hopes that the newly elected president will help strengthen the crypto industry with improved regulatory policies. Presidential candidate Trump has promised to replace SEC chairman Gary Gensler, candidate Kalama Harris has promised to support a regulatory framework for cryptocurrencies.

However, BlackRock CEO Lawrence Fink said the outcome of the election may not have a significant impact on the sector.

“Well, first of all, I'm not sure whether either president or another candidate will make a difference. I believe the use of digital assets will become more and more real in the world. The discussions we have with institutions around the world, discussions about how they should think about digital assets, what kind of asset allocation there should be. I mean, we believe that Bitcoin is an asset class in itself. – Laurence Fink said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

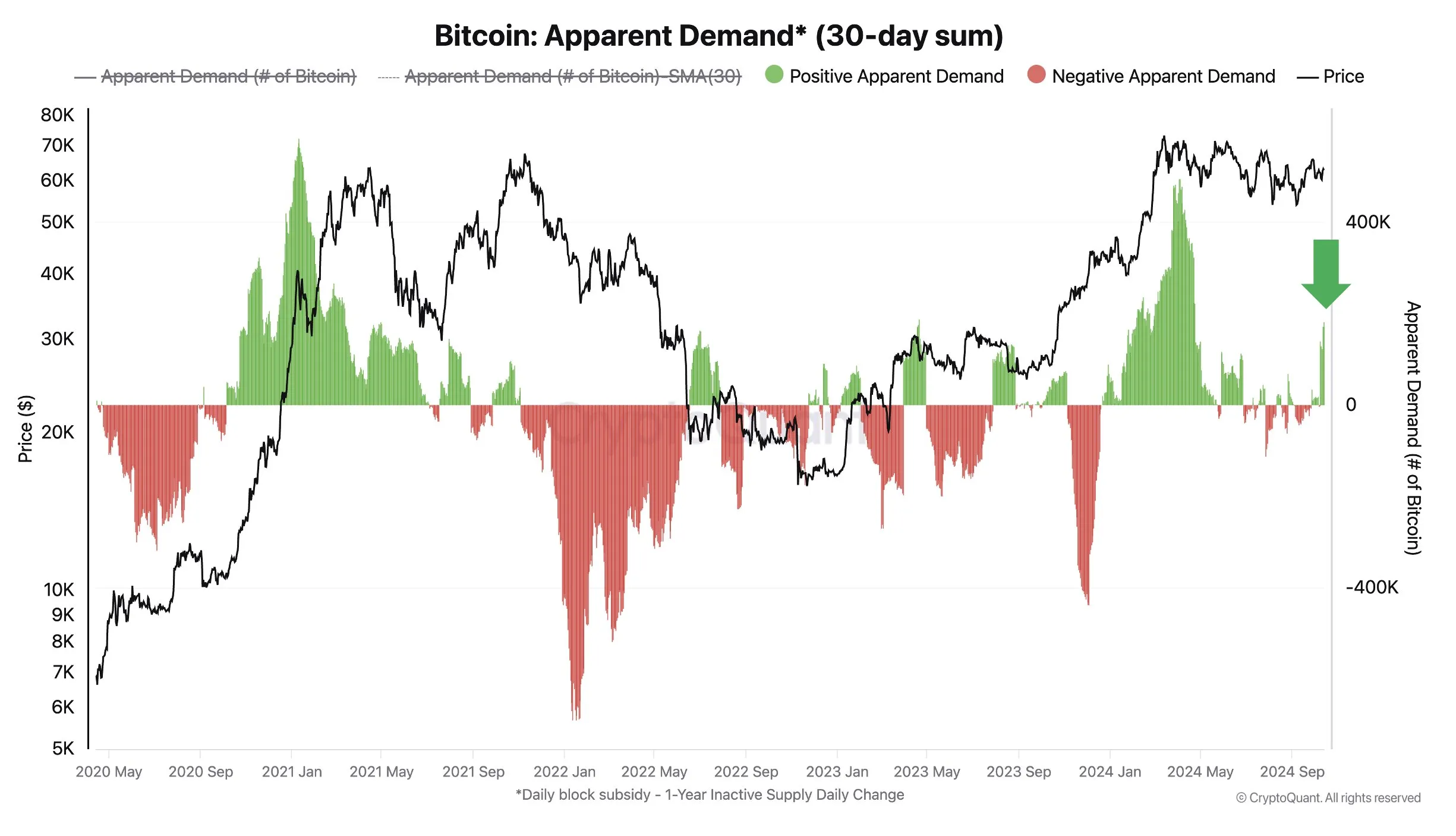

CryptoQuant's Bitcoin Clear Demand Indicator shows that Bitcoin demand is making a strong comeback. This metric measures investor interest by comparing newly minted bitcoins and the supply that has been inactive for more than a year.

The chart shows that the last major increase in Bitcoin's apparent demand was in early 2024, when the price of Bitcoin increased from $40,000 to $72,000.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policies and disclaimers have been updated.