Bitcoin ETFs 111% Increase in Global BTC Millionaires

The number of Bitcoin (BTC) millionaires has increased by 111% this year, largely due to the rise of crypto exchange-traded funds (ETFs).

The approval of the Spot Bitcoin ETF, followed by Ethereum (ETH) ETFs, has attracted institutional players to crypto, creating a new wave of interest beyond retail investors.

Bitcoin ETFs Fuel Rise in BTC Millionaires

According to a study by Henley & Partners, there are currently 85,400 Bitcoin millionaires worldwide, which represents an increase of 111% in one year. As these financial instruments have cemented Bitcoin's status as “digital gold,” the report attributes the rise of crypto elites to the influence of ETFs.

“The total market value of crypto assets now stands at an astounding $2.3 trillion, an 89 percent increase from the $1.2 trillion recorded in the organization's inaugural report last year. The number of crypto centi-millionaires (those with crypto holdings of $100 million or more) grew by 79% to 325, expanding significantly, and even the rare group of crypto-billionaires saw a 27% increase. to 28 globally,” said a quote from the report.

Read more: How to buy Bitcoin (BTC) and everything you need to know

Beyond Bitcoin, Ethereum is gaining attention, with 172,300 people worldwide holding more than $1 million in crypto assets. The report shows a 95% increase in ETH millionaires since last year's inaugural findings, cementing Ethereum's role as a cornerstone of the market.

Wealthmaster founder Lark Davis praised blockchain for serving as the foundation for many projects and strengthening its importance in the crypto ecosystem.

“Most of what's being built in crypto is built on top of Ethereum, based on Ethereum, or they bring the money back to Ethereum,” Davis said.

Dominique Volek, head of the private client group at Henley & Partners, told Solana et.f. These financial instruments herald a new era of crypto adoption, where digital assets increasingly connect with traditional finance (TradFi) and global mobility.

Bitcoin confirms its digital gold standard

Meanwhile, institutional interest in crypto markets continues to grow. The introduction of Bitcoin and Ethereum ETFs led to retail and institutional interest, and the resulting buying pressure contributed to the rise in the value of cryptocurrencies.

After the January authorization, Bitcoin reached a new all-time high above $73,000, while Ethereum briefly touched the psychological level of $4,000. According to BeCrypto, demand remains strong, with total crypto investments reaching $533 million last week. Bitcoin led the way in revenue with $543 million, while Ethereum faced a decline, partly due to Grayscale customer redemptions.

However, the increasing flow of capital into crypto investment products has highlighted the increasing recognition of digital assets, further strengthening the status of Bitcoin as a legitimate investment.

Reflecting this demand, Bitcoin ETFs saw net gains of $200.4 million on Monday, marking the eighth straight day of positive gains. In contrast, Ethereum ETFs experienced net outflows totaling $13.2 million.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

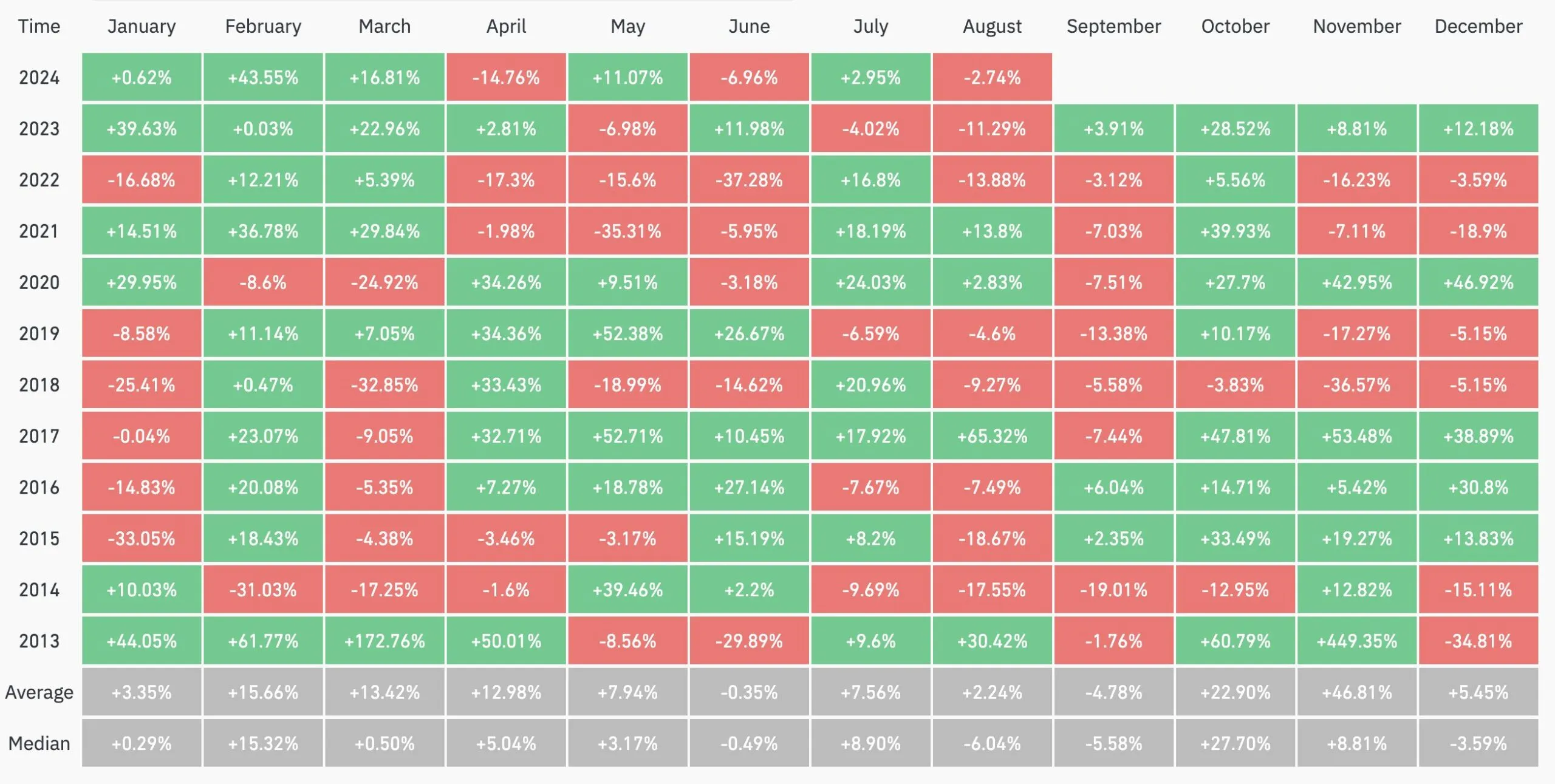

As this trend contributes to Bitcoin's recent price increase and analysts' speculation of a possible bull market, it is important to note that September has historically been Bitcoin's worst performing month.

According to data from BeInCrypto, Bitcoin is trading at $62,235, down 2.42% from the opening of Tuesday's session.

Disclaimer

Adhering to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news report aims to provide accurate and up-to-date information. However, readers are advised to independently verify facts and consult with professionals before making any decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.